- 1 Tesla and Ford became top gainers in the automotive sector.

- 2 Both the companies have agreed on a deal to use Tesla Superchargers.

Automotive sector is getting greener every passing day and stock prices in the industry appear to follow the path. While Tesla (NASDAQ: TSLA) grew by almost 5%, others including Toyota (NYSE: TM), Ferrari (NYSE: RACE), Stellantis (NYSE: STLA) and more gained on an average of 1%. Ford Motor Company (NYSE: F) became the top gainer considering F stock rose over 6% yesterday.

Ford Leads the Pickup Segment

Companies are slowly turning to electric vehicles (EVs) to meet the rising demand. NBC reported that Ford and Tesla have agreed on a partnership to use Tesla Superchargers which were exclusive to the company’s native vehicles only. The collaboration allows Ford Motor Company access to 12,000 of them. While Tesla is on top of the EV market, Ford is behind them with 61,575 sales. However, the Michigan-based automotive manufacturer is ahead in the pickup vehicle segment.

Elon Musk, Tesla CEO, may visit China to meet important government officials, according to Reuters. The country is currently the second-biggest market for the company. Production of Model 3 is reportedly reduced in their Shanghai arm. There might be a couple of reasons including potential introduction of a new EV or sufficient vehicle supply in the region.

According to South China Morning Post, a Hong Kong-based English language newspaper, HK is working on a hydrogen extraction program for heavy transport fuel. China is among the fastest growing EV markets globally. The newspaper also mentioned that declining battery costs may boost EV adoption to replace internal combustion engine vehicles.

F Stock Price Action

F stock closed at $12.09 yesterday, giving some fruitful returns to investors. However, the price was consistently moving in downtrend since April 2023 while a major crash happened during February. The value, according to gann fan, may seek support around $13 and resistance near $14.5. Data from TradingView show 123.258 Million buyers bought the company shares on Monday.

MA cross highlights 9-day moving average is below 21-day moving average, pointing towards a potential decline. Woodies CCI is indicating the same considering it has entered the overbought zone. Moving average convergence divergence shows buyer dominance has began rising.

Lithium Scarcity May Pose a Threat in Future

Lithium is an important market for EVs considering the companies have increasingly started to use lithium-ion batteries in vehicles. The metal is becoming among the most important commodities globally. According to the United States Geological Survey (USGS), 88 million tons of lithium is available for mining globally. Additionally, 80% of mined lithium is used for batteries only.

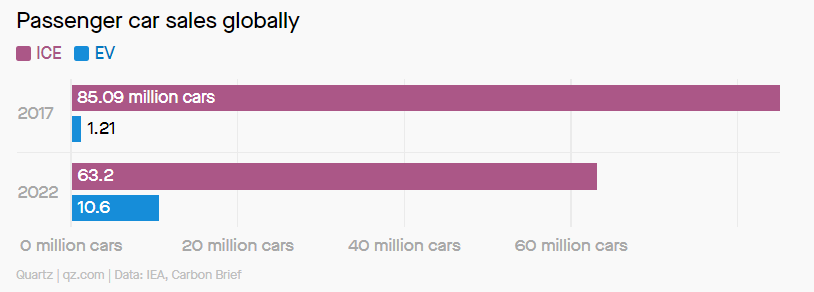

A New York-based news publication, Quartz, says that 1 in 7 cars are now an EV based on data provided by the International Energy Agency (IEA). Additionally, sales of traditional vehicles have plunged by a quarter, a direct consequence of rising demand in EVs. Last year, global electric vehicle sales went up by 60%.

However, Lithium-ion batteries are expensive which may pose a threat to the industry in future. Scientists believe that sodium-ion batteries may become a possible replacement in forthcoming years.

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational purposes only and do not establish financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Anurag is working as a fundamental writer for The Coin Republic since 2021. He likes to exercise his curious muscles and research deep into a topic. Though he covers various aspects of the crypto industry, he is quite passionate about the Web3, NFTs, Gaming, and Metaverse, and envisions them as the future of the (digital) economy. A reader & writer at heart, he calls himself an “average guitar player” and a fun footballer.

Home

Home News

News