- 1 Cisco Systems Inc’s stock price declined nearly 1% in its recent trading session.

- 2 The stock price lost $0.50, while the activeness of bears in the market dropped its price.

Cisco Systems Inc (NASDAQ: CSCO) Cisco Stock showed bear dominance in the market, as they pulled the stock price down. However, this stock’s one-month and year-to-date (YTD) price is showing bullish sentiments. The company reported its Q3 2023 earnings and revenue on May 17th with a good trading volume. Compared to its quarterly report’s trading price, the recent closing price showed an upsurge.

Cisco Stock Price Analysis

On May 31st, the Cisco stock price closed at $49.67 with a 1% of decline in its trading price. The stock opened at $49.91, rose to $50.02, and fell at $49.60. The stock price previously showed a bullish outlook, but the recent one-day price performance showed bearishness in its price. The RSI of CSCO stock was traveling towards the overbought zone, but bear dominance turned its price downside.

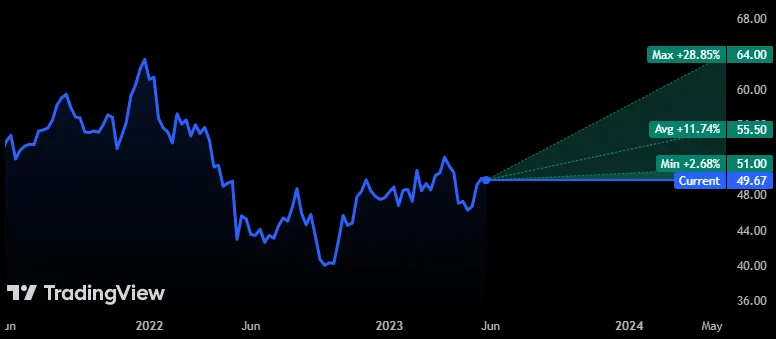

As shown in the above price chart, the price may indicate that it is still up from its 200-day moving average following the bearish trend. The recent day’s performance was totally under the control of active bears in the market with a good trading volume. This trading volume was almost similar to the trading volume of the stock price that it experienced in its third-quarter results. However, at that time the bulls won the race currently controlled by bears.

The price forecast set by analysts is having a maximum estimate of $64.00 with a minimum estimate of $51.00. However, the price target is $55.50, over 11% from its recent closing price.

The Financial Fundamentals of Cisco Systems Inc

Cisco Systems Inc is based in the U.K. and works on designing, manufacturing, and selling Internet Protocol-based networking products and services. These products and services are linked with the communications and information technology industry.

The company has a market cap of $202.408 Billion, and the total revenue for Q3 2023 is $14.57 Billion. The revenue is 7.20% higher than the previous quarter while the net income of Q3 23 is $3.21 Billion. The earnings for the same period are $1.00 whereas the estimation was $0.97, accounting for a 2.83% surprise. Its revenue for the same period amounts to $14.57 Billion, despite the estimated figure of $14.40 Billion.

The estimated earnings for the next quarter are $1.06, and revenue is expected to reach $15.05 Billion. Moreover, Cisco Systems dividends are paid quarterly and the next dividend per share is expected to be $0.39.

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational ideas only and do not establish financial, investment, or other advice. Investing in or trading crypto or stock comes with a risk of financial loss.

Nancy J. Allen is a crypto enthusiast, with a major in macroeconomics and minor in business statistics. She believes that cryptocurrencies inspire people to be their own banks, and step aside from traditional monetary exchange systems. She is also intrigued by blockchain technology and its functioning. She frequently researches, and posts content on the top altcoins, their theoretical working principles and technical price predictions.

Home

Home News

News