- 1 In 2023, Boeing Stock is trading within a range, hoping to rally.

- 2 The company recently acquired a U.S. Navy Contract and might need help with a Chinese Jet manufacturer.

Boeing Co. (BA Stock) rallied around 19% YTD, and wobbling in a range, Its CEO said that COMAC’s C919 jet could threaten its duopoly with Airbus. Recently the company secured a $200 Million modification contract for the U.S. Navy. The contract revolves around maintaining full-rate production for F/A – 18E/F aircraft, expected to be completed by June 2025.

The Boeing Company (B.A. stock) – Commercial Evaluation

For long, the aerospace industry witnessed the duopoly of Boeing and Airbus. Still, it was recently challenged by Commercial Aviation Corp of China (COMAC), the Chinese manufacturer that successfully launched domestically produced C919 narrowbody jet. Company’s CEO Dave Calhoun speculates that this feat foreshadows the demise of the duopoly.

However, he predicted that COMAC would have to work hard to meet the demand of China alone, and it would take time for it to emerge as a global competitor in the airline business. The two crashes of 737 MAX in 2018 and 2019, killing 346 people, caused a stir in the industry, creating a lousy name for the company.

Moreover, B.A. stock is returning to normal as it rallied over 60% in the last seven months. At press time, B.A. ‘s share price was $207.96 with a jump of 1.10%; previous close and open were at $205.70 and 206.46, respectively. Price gained 49.34% in the last 52 weeks, with an average volume of 5.81 Million shares; the market cap sits firmly at $125.107 Billion.

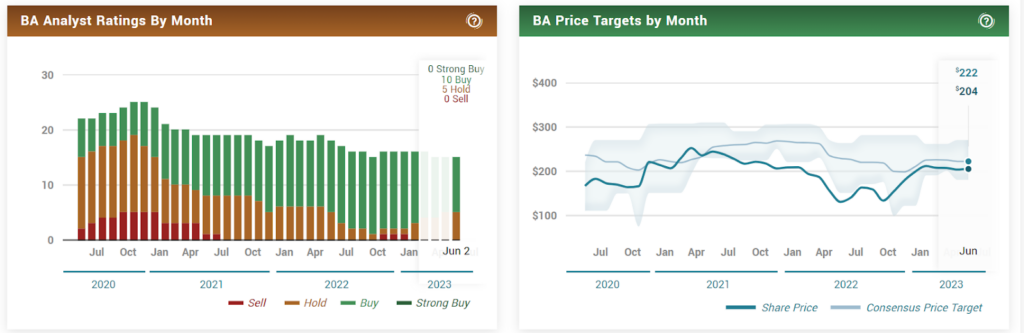

Analysts provided a 2.63 rating for moderate buy, placing the price target at $221.60 with a 6.6% upside.

The aviation company released its last earnings on April 26, 2023, with reported revenue of $17.921 Billion, while it was estimated to be $17.516 Billion. The surprise in the equation equals $404.843 Million, with a jump of 2.31%.

The quarterly changes in revenue are an increase of 28.09% to $17.92 Billion; however, the trailing twelve-month (ttm) revenue is reported to be $70.54 Billion. Also, the revenue per share is $117.98, and the year-on-year (YoY) quarterly revenue growth is 28.10%. Similarly, the net income hiked by 66.04% to minus $414.0 Million, the net profit margin swelled by 73.48% to negative 2.31, and the profit margin dropped by 5.86%.

Earnings per share jumped 53.82% to negative $1.27 quarterly, while the basic EPS is minus $6.92. Price to-sales ratio is 1.76. Total cash in hand at the end of the recent quarter is $14.77 Billion, while debt is $55.39 Billion. EBITDA is reported to be $2.04 Billion.

The Boeing Company (BA Stock) – Candle Exploration

In 2023, B.A. ‘s share price has been moving within a narrow range between $195.97 and $214.16. If the price breaks the range from the top, it could try to enter the supply zone. The strength is the northbound trajectory of EEMA indicates price action. However, the RSI of 50.44 shows neutrality.

If the price goes south, it would first encounter EMA before meeting immediate support at $186.52. If there is a breakdown, the price could drop to S1 or stretch to S2. The breaking of the range shall foreshadow the future of the B.A. share price.

Disclaimer:

The views and opinions stated by the author, or any people named in this article, are for informational purposes only and do not establish financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Andrew is a blockchain developer who developed his interest in cryptocurrencies while pursuing his post-graduation major in blockchain development. He is a keen observer of details and shares his passion for writing, along with coding. His backend knowledge about blockchain helps him give a unique perspective to his writing skills, and a reliable craft at explaining the concepts such as blockchain programming, languages and token minting. He also frequently shares technical details and performance indicators of ICOs and IDOs.

Home

Home News

News