- 1 Glassnode has recently shared its data-driven analysis that included information about Bitcoin Miners.

- 2 The data is based on the current conditions in the crypto market.

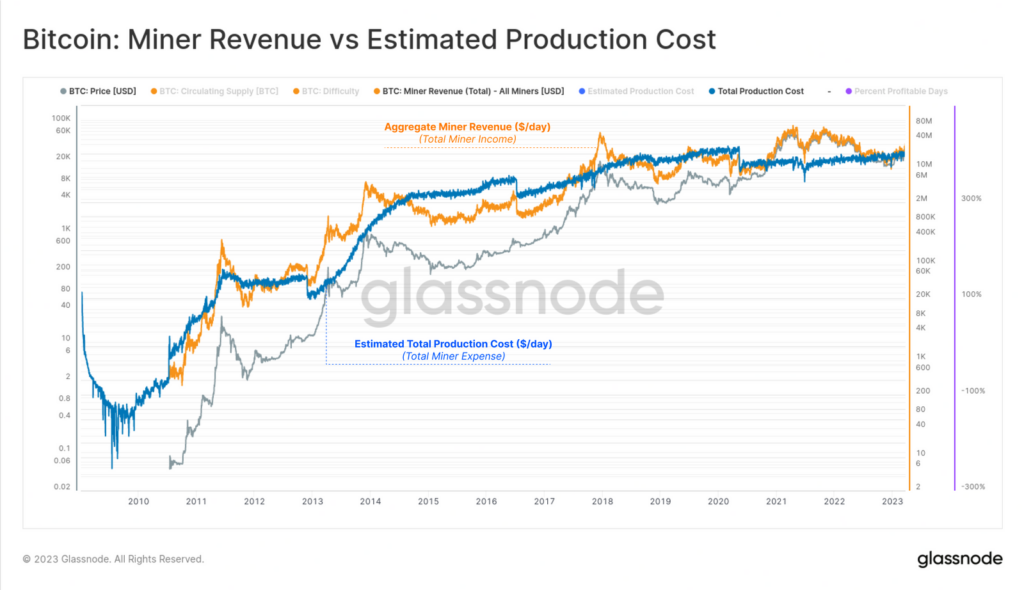

Glassnode, the on-chain and financial data provider for digital assets, has recently shared a tweet mentioning Bitcoin (BTC) Miners. It added, “The current market conditions remain profitable for Bitcoin Miners.” It generates a combined $24.1 Million in revenue from the block subsidy and transaction fees. Meanwhile, as noted, the estimated production cost is $19.1 Million, which results in a net profit of plus $5 Million.

As per the insights sourced from Glassnode, if the value of the revenue-to-cost ratio is more than 100%, then this indicates a profitable mining industry. While if the ratio is above 350%, then it is observed as “near bull market peaks.”

Inversely, if the value of the ratio is less than 100%, then this indicates an “unprofitable mining industry.” In contrast, the revenues fall to just 30% to 50% of the estimated production cost near bear market lows.

The BTC miner has generated $48.8 Billion in revenue since Bitcoin began openly trading in 2010. Although the miners have expended an estimated $35.8 Billion in production, this culminates in a net surplus of over $13.0 Billion across the mining industry and an all-time profit margin of 37%.

Are Bitcoin Miners Forced to Liquidate BTC?

A crypto-services provider, Matrixport, also said in a report on June 2nd, Friday that the BTC price is experiencing selling pressure at the $28,000 price level, and miners may be responsible. As per the report, the BTC miners are being forced to liquidate any new inventory produced as the profit margins have compressed in recent weeks.

Moreover, as the report includes, the mining process has become quite competitive and often profitable as there is a continuous rise in the BTC miner’s difficulty. Meanwhile, mining difficulty is a parameter set by the BTC protocol for regulating the average time between blocks. Notably, earlier this week, the mining difficulty reached its all-time high.

The Head of Research, Markus Thielen, has added in their research that “at the current input cost and potential output revenue expectations, most of the machines produced before 2022 appear to be unprofitable.” Based on this note, Thielen counters that the miners are forced to sell their inventory at the current level instead of holding on till prices increase.”

Moreover, Thielen added, “There is now significant upside convexity for miners as profitability could increase fourfold if bitcoin prices increase by 10% plus.”

Moreover, the price of BTC is currently trading at $27,186.19 with a 24-hour trading volume of $11.96 Billion. BTC is up 0.27% in the last 24 hours, with a current market cap of $527.18 Billion. The last 24-hour price performance of BTC was noted low at $26,898.00 while the high was at $27,303.86, as per the data sourced from CoinMarketCap. However, last 1-month price performance of BTC noted an over 5% decline in its price.

With a background in journalism, Ritika Sharma has worked with many reputed media firms focusing on general news such as politics and crime. She joined The Coin Republic as a reporter for crypto, and found a great passion for cryptocurrency, Web3, NFTs and other digital assets. She spends a lot of time researching and delving deeper into these concepts around the clock, and is a strong advocate for women in STEM.

Home

Home News

News