- 1 The over-all price performance of JPM stock shows a bullish outlook.

- 2 This weekend trading performance by the stock added nearly $3 in its trading price.

The JPMorgan Chase & Co (NYSE: JPM) stock price has experienced overall bullish sentiments showing the buyers’ confidence This U.S. finance stock has gained the confidence among the investors which led towards its upside price surge.

JPM Stock Price Analysis

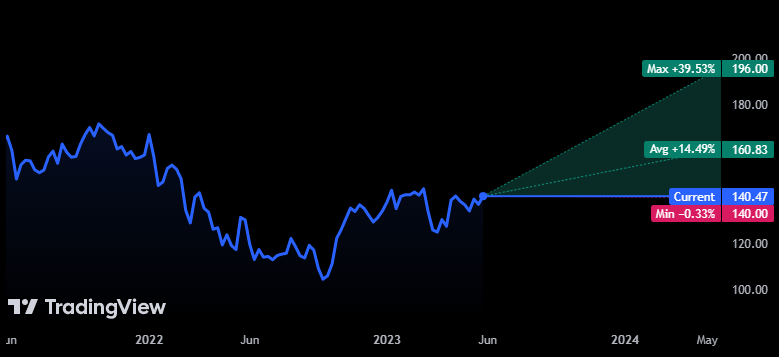

On June 2nd, Friday’s trading session, JPM stock closed at the price of $140.47, with more than 2% of price gain. The stock opened at the price of $139.56, gave high at $141.48, while dropping to the low of $139.34.

The 52-week high that the stock has noted is $144.34 and the low was at $101.28. As per the recent week price performance, the stock rose 3.46%, while year-to-date (YTD) price surge is $3.87%. Notably, the small price gain in this finance stock has benefited its price surge.

As seen in the above price chart, the price of JPMorgan stock surpassed its 20-days EMA with the dominance of active bulls in the market. The stock price follows its path in the price range of $140.00 as seen in the above chart. Earlier in the previous week, the stock price also showed similar performance but experienced the bear’s dominance, after which the price started sliding down, which regained in this week.

Notably, in Mid-April JPMorgan Chase has reported its Q1 2023 earnings and revenue report. With a quite good trading volume, its price has started rising upside. The RSI also showed an upsurge as seen in the above chart.

The price target set by analysts has a maximum estimate at $196.00, while the minimum estimate is at $140.00. Meanwhile the price target is set at $160.83, which is over 14% up from its recent closing price.

The Financial Reports of JPMorgan Chase

The market cap of JPMorgan Chase is nearly $410.49 Billion, and the total revenue for the first quarter of this year is $56.26 Billion. It is 19.17% higher compared to the previous quarter., while the net income of Q1 23 is 12.55 Billion. Its dividends are paid quarterly and the next dividend per share is expected to be $1.00 As of now, the Dividend Yield (TTM)% is 2.91%.

The EPS for the last quarter are $4.10 whereas the estimation was $3.41 which accounts for 20.09% surprise. The New York-based company reported that its revenue for the same period amounts to $38.35 Billion despite the estimated figure of $36.12 Billion. However, the estimated EPS for the next quarter are $3.96, and revenue is expected to reach $38.78 Billion.

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational ideas only and do not establish financial, investment, or other advice. Investing in or trading crypto or stock comes with a risk of financial loss.

With a background in journalism, Ritika Sharma has worked with many reputed media firms focusing on general news such as politics and crime. She joined The Coin Republic as a reporter for crypto, and found a great passion for cryptocurrency, Web3, NFTs and other digital assets. She spends a lot of time researching and delving deeper into these concepts around the clock, and is a strong advocate for women in STEM.

Home

Home News

News