- 1 XOM Stock Surged 2.30% despite being negative in the weekly trading session.

- 2 ExxonMobil reported less revenue in Q1 2023 compared to estimated figures.

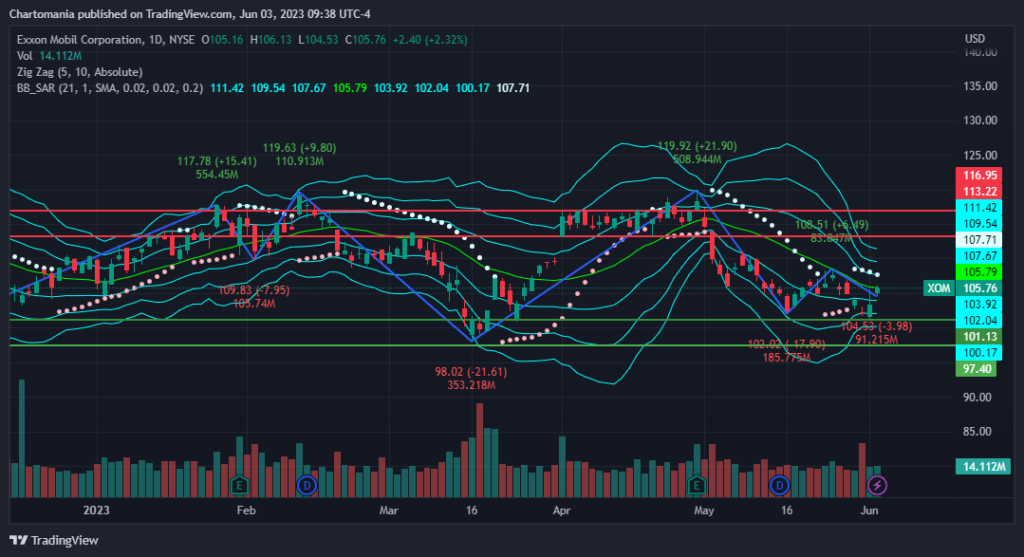

On the June 2, 2023 trading session, XOM Stock surged more than 2.30% and closed at $105.76. In the same trading session, the company’s stock opened trading at $105.16, and after hitting a high of $106.13 and a low of $104.53, it closed 2.32% up compared to June 1 trading prices.

On the June 2, 2023 trading session, XOM Stock surged more than 2.30% and closed at $105.76. In the same trading session, the company’s stock opened trading at $105.16, and after hitting a high of $106.13 and a low of $104.53, it closed 2.32% up compared to June 1 trading prices.

In the last three trading sessions, XOM Stock recorded an impressive hike. It is important to note that the trading prices of XOM Stock downgraded around 3.04% in monthly trading and 3.90% in quarterly trading sessions.

As per indicators, it might be a good time to buy or hold XOM stock. Technical indicators do not suggest purchase or sale; it suggests a neutral opinion. Analysts’ price target for one year is $127.10.

Earning and Revenue of ExxonMobil

In the last few quarters, ExxonMobil Corporation reported more revenue than the estimate, excluding Q2 2022. Similarly, in Q1 2023, the company’s reported revenue was $86.56 Billion, 1.07% more than the estimated figures.

Earning Per Share surged by around 8.86% in Q1 2023 and has shown constant growth in the last few quarters. The overall market capitalization of ExxonMobil at press time was $427.58 Billion.

TradingView says more than 99% of ExxonMobil shares are free-floating, and 0.19% are closely held. From the total revenue, the company’s gross profit is 26%, net income is 14%, and the remaining is EBITDA and EBIT.

ExxonMobil generates the majority of revenue from the Energy sector by selling their products in no U.S regions, and 29% of income is from the United States and surrounding areas.

ExxonMobil majorly exports its products to Singapore, France, Italy, Australia, Canada, the United States, Belgium, and a few regions. In 2022 company’s revenue dropped by 2.88% and reported $12.26 Billion less revenue than estimated figures.

Exxon Mobil acquired Jurong Aromatic Corporation for more than $2 Billion, XTO Energy for $41 Billion, Celtic Exploration Ltd. for $2.64 Billion, InterOil Corporation for $2.5 Billion, and MPM Lubricants for an undisclosed sum on December 14, 2009.

The oil and gas company has invested heavily in Brazil and will continue to explore options to grow and expand in the South American nation.

Major competitors of Exxon Mobil in the global market include Shell, Saudi Aramco, PetroChina, Chevron, China Petroleum & Chemical Corporation, etc.

Major subsidiaries of Exxon Mobil are XTO Energy, Tengizchevroil, Imperial Oil, Esso Public Company Limited, SeaRiver Maritime, Aera Energy, and Exxon Neftegas.

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational ideas only and do not establish financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Andrew is a blockchain developer who developed his interest in cryptocurrencies while pursuing his post-graduation major in blockchain development. He is a keen observer of details and shares his passion for writing, along with coding. His backend knowledge about blockchain helps him give a unique perspective to his writing skills, and a reliable craft at explaining the concepts such as blockchain programming, languages and token minting. He also frequently shares technical details and performance indicators of ICOs and IDOs.

Home

Home News

News