- The recent $6 local top stands 60% below the $15 high reached on May 12.

- Leaves the investors with little to cheer about

- Traders are uncomfortable using leverage for bullish positions

Retail traders may have opted out of EOS. However, derivatives data reveals that pro traders are maintaining bullish perspectives in the short term.

EOS started surging in May, encouraged by a $10-billion funding round to build an EOS-based crypto exchange platform called Bullish by Block. One, a blockchain software firm. The EOSIO Company revealed that it had raised the capital from Peter Thiel and Mike Novogratz and hedge fund managers Alan Howard and Louis Bacon.

The bullish news cannot lift the investors’ sentiments, and the recent $6 local top stands 60% below the $15 high reached on May 12. It leaves the investors with little to cheer about. Presently retail traders are uncomfortable using leverage for bullish positions, and professional traders have been neutral-to-optimistic since mid-July.

Experts also refer to the May 2 report commissioned by Block. which suggested an increase in the inflation rate from 1% to somewhere between 1.2% and 3.8%. The new issuance rate is required to increase financial incentives for voters and block producers.

EOS is losing its momentum due to a lack of deliveries and partnerships

EOS is losing its momentum due to a lack of deliveries and partnerships. The price tanked to its bottom at $3.04 on June 22. The bearish trend ended on June 23, as the little-known “Bullish” exchange said it would be going public on the New York Stock Exchange via a special-purpose acquisition company, or SPAC.

The trend turned bullish after the exchange released its private alpha version on July 27 and promised a full launch later in 2021. Additional sops like spot trading, margin trading, and liquidity pools will also be provided.

EOS announced free access to live pricing data

On Thursday, the biggest announcement was made when EOS announced free access to live pricing data using real-time market information provided by AlgoTrader. The Swiss-based startup has many features that include multiple assets from various exchanges and can create synthetic instruments, derivatives, and stablecoins.

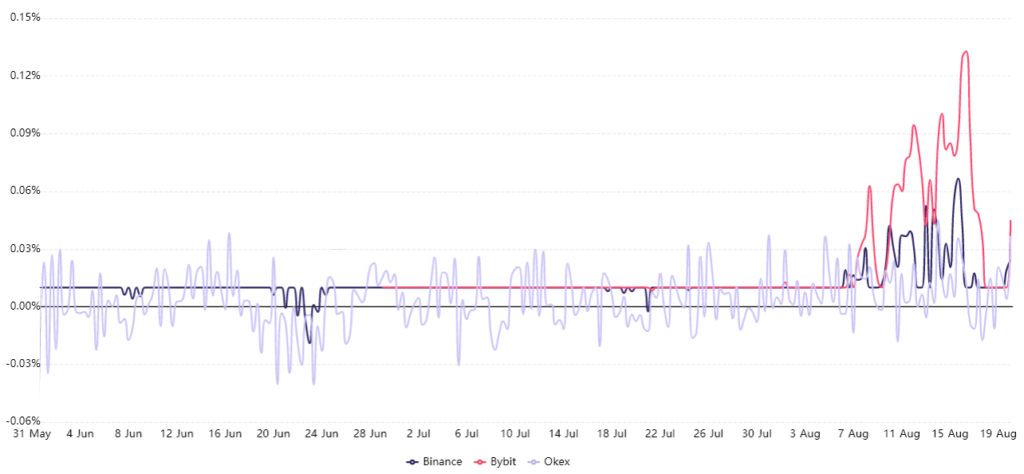

To best gauge the trading sentiments, if they are bullish as EOS’ price holds the $5 support, one should analyze the perpetual contracts futures data. It is one of the most reliable tools of the retail traders’ because its price usually perfectly tracks the regular spot markets. There is also no need to manually roll over contracts nearing expiry as required on quarterly futures.

In any future contract, the trade longs (buyers) and trade shorts (sellers) are at par all the time. However, their leverage varies. Hence exchanges will charge whichever side is using more leverage at a funding rate to balance their risk, and this fee is paid to the opposing side. On the other hand, the neutral markets exhibit a 0%–0.03% positive funding rate, equivalent to 0.6% per week, indicating that longs are the ones paying it.

Data revealed that the sentiments were positive and building up from Aug. 8. The positive sentiments lasted less than ten days. The positive funding rate shows that longs (buyers) were paying the fees, but the movement seems reactive to the price increase and faded as EOS failed to breach the $6 resistance.

Andrew is a blockchain developer who developed his interest in cryptocurrencies while pursuing his post-graduation major in blockchain development. He is a keen observer of details and shares his passion for writing, along with coding. His backend knowledge about blockchain helps him give a unique perspective to his writing skills, and a reliable craft at explaining the concepts such as blockchain programming, languages and token minting. He also frequently shares technical details and performance indicators of ICOs and IDOs.

Home

Home News

News