- Since the starting of the year, XRP has been moving between the price band of $0.20 and $0.30.

- XRP has been making failed attempts to cross the major hurdle of $0.30

- Currently, it is on the downside with -2.03% loss in today’s market.

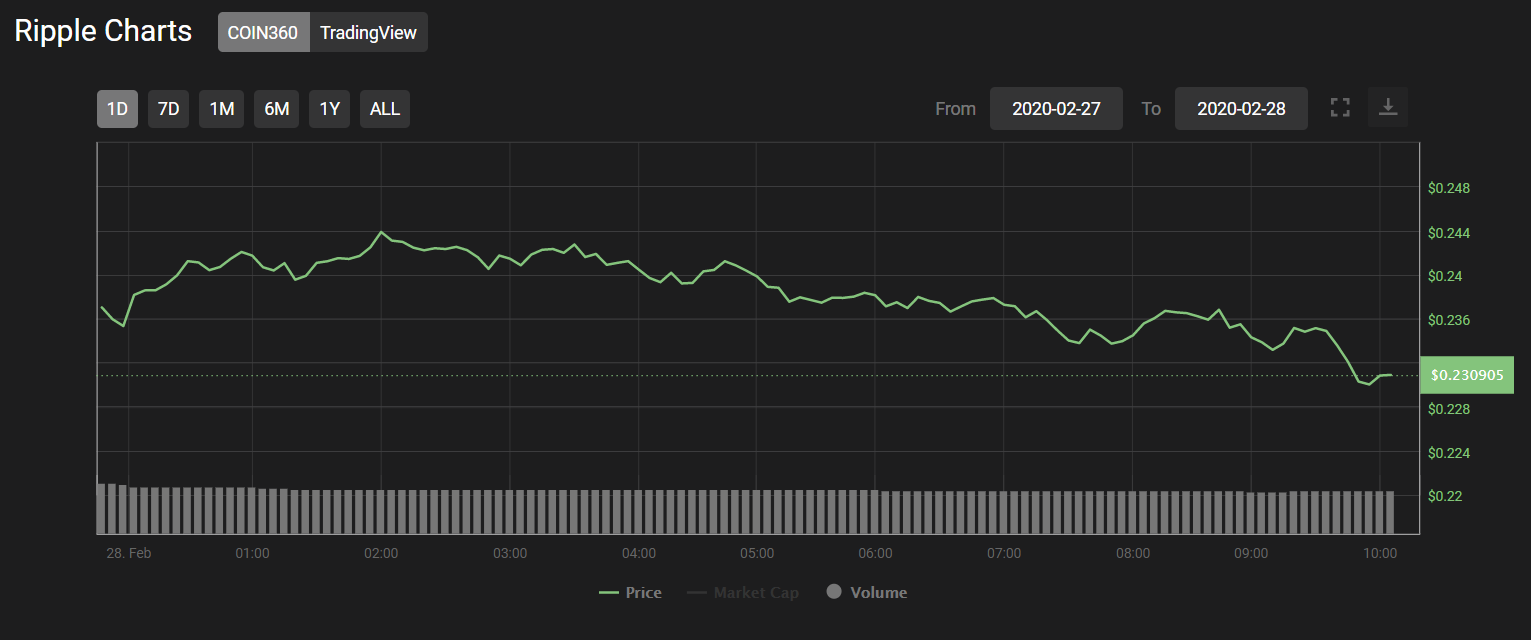

Ripple hasn’t shown any big movements in today’s market. It started off with a price level of $0.23 and went to the day-high of $0.25. The current price of the third-largest crypto assets in the world is around $0.231419 with -1.84% overall loss. The market capitalization is of $10,104,457,686 and the 24h volume traded is $605,448,402.

The main concern for XRP is the pricing consolidation between the price of $0.20 and $0.30. It will be for two months now that XRP will be struggling to break that mark and sustain that. Also, the pricing pullback has generated a new resistance of $0.25 which is testing XRP bulls.

If the buyers helped the cryptoasset to move above $0.27, it can be acted as an additional support level for XRP bulls aiming to break the major mark of $0.30.

FUNDAMENTAL ASPECT

The current downfall can be the result of the fundamental new about a class-action lawsuit filed by a one time investor Bradley Sostack and several customers who believe that ripple is failing as security and also failed to register itself properly. They also believed that the executives of the XRP community are misleading and showed false currency to their customers and are engaged in a false advertisement at the same time.

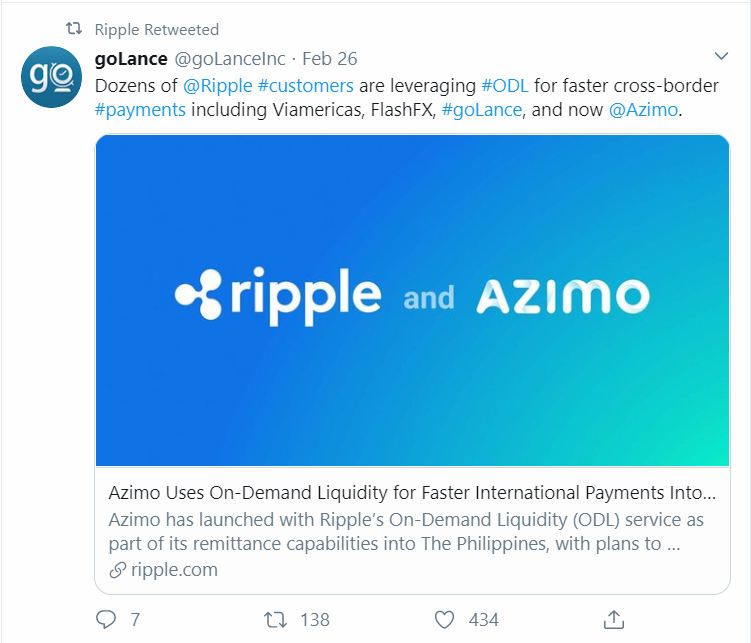

However, on the bright side, ripple recently announced a partnership with the money transfer giant AMIZO to cryptocurrencies into the cross-border money transfer business. Ripple, until now, has partnered with over 300 companies for the purpose of network integration.

This also helped Ripple to enter the top 100 clubs of cross border payment companies which includes companies like UBS and PayPal.

TECHNICAL ASPECT

The technical graph reflects on the cyclic movement of XRP in this month which justifies the situation of price consolidation for the crypto assets. At the top of the cyclic pattern, XRP reached the level of $0.29 with a hope to break the major level of $0.30 but failed miserably. It faced heavy price corrections afterward and went down to yesterday’s low level of $0.22.

For ripple price analysis, technical indicators and oscillators suggest that XRP bulls still have potential from here to build up positive momentum in the market. Both RSI and CCI have shown positive divergence from the oversold region which favors XRP bulls. MACD levels also indicate bullish movement due to the bullish cross made in the bearish zone.

Resistance Level: $0.27 and $0.29

Support Level: $0.21 and $0.20

Mr. Pratik chadhokar is an Indian Forex, Cryptocurrencies and Financial Market Advisor and analyst with a background in IT and Financial market Strategist. He specialises in market strategies and technical analysis and has spent over a year as a financial markets contributor and observer. He possesses strong technical analytical skills and is well known for his entertaining and informative analysis of the Financial markets.

Home

Home News

News