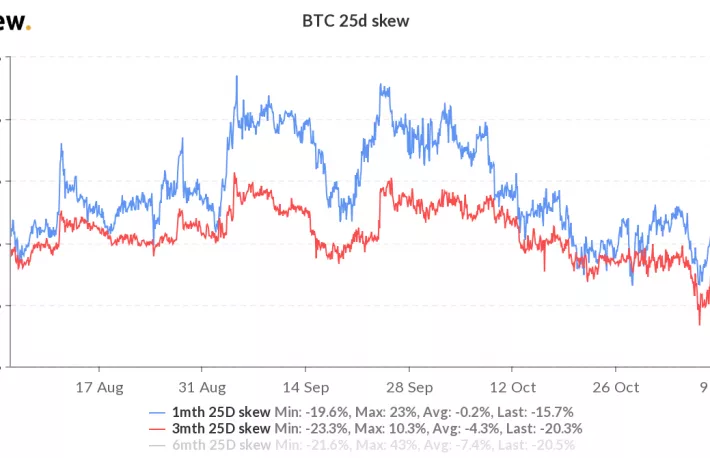

- According to Skew’s data it is overtaking the net demand for put options known as bearish bets

- If we observe the negative one-month skew, it doesn’t seem like the bulls are even considering the possibility of a temporary pullback

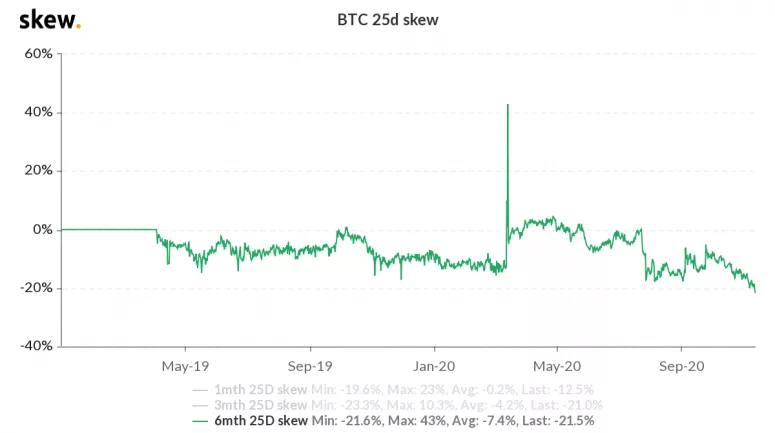

Recently in Bitcoin’s options market, bullish sentiment has been observed on the records that the digital currencies are rallying to 3 years high. According to Skew’s data, earlier on Thursday, the spread among the prices due to the put options and close options that will run out in six-months had declined to an all-time low of -21.6%.

Bullish bets are outstripping the bearish bets

According to Skew’s data, we observed that the net demand for call options, also known as the bullish bet, is overtaking the net demand for put options known as bearish bets. However, as per the current sign, we can expect a strong bullish move in the market. According to Vishal Shah, the founder of Alpha5, a derivatives exchange, and an options trader, some topside is being predicted in the options market.

However, the price of Bitcoin is also crossing its level that was observed three years before. According to several analysts, they expect a consolidation on the recent gains before the price will rally towards $20,000 by December.

Confidence of investors in cryptocurrencies

If we read the six-month put-call skew data, it is observed that over the past 22 months, the skew mainly remained below zero, and this sign indicates the investor’s confidence in the long-term anticipation. According to Sui Chung, CEO of CF Benchmarks, we might observe the inclining bulls to be at an all-time high, although the Bitcoin options market will remain bullish. As bitcoin’s price is around $16,000, a possible spike could be observed in a bullish mood from the new market participants.

Effects of Bullish and Bearish sentiments

According to Shah, while the sentiments are not always a concern, high movements can return to a mean, as the bullish and bearish views mark the significant market’s tops or bottoms. Since the record high of December 2017 at $20,000, Bitcoin’s price is still short at $4,000, though the options market seems to reach the top. With that, the return of bullish bias to its previous state doesn’t seem to be affecting the spot market, as the options market of Bitcoin is still small.

According to Chung, if the call premium gets sky-high, the bull’s bias might correct. However, it isn’t far away to give spreads for puts, and the scenario could play out if the price of Bitcoin rally’s to a new high.

If we observe the negative one-month skew, it doesn’t seem like the bulls are even considering the possibility of a temporary pullback. Bitcoin’s powerful smash above the high of June 2019, at $13,800 per Bitcoin, has created a way towards the previous record.

Join The Coin Republic’s Telegram Channel for more information related to CRYPTOCURRENCY NEWS and predication.

Steve Anderson is an Australian crypto enthusiast. He is a specialist in management and trading for over 5 years. Steve has worked as a crypto trader, he loves learning about decentralisation, understanding the true potential of the blockchain.

Home

Home News

News