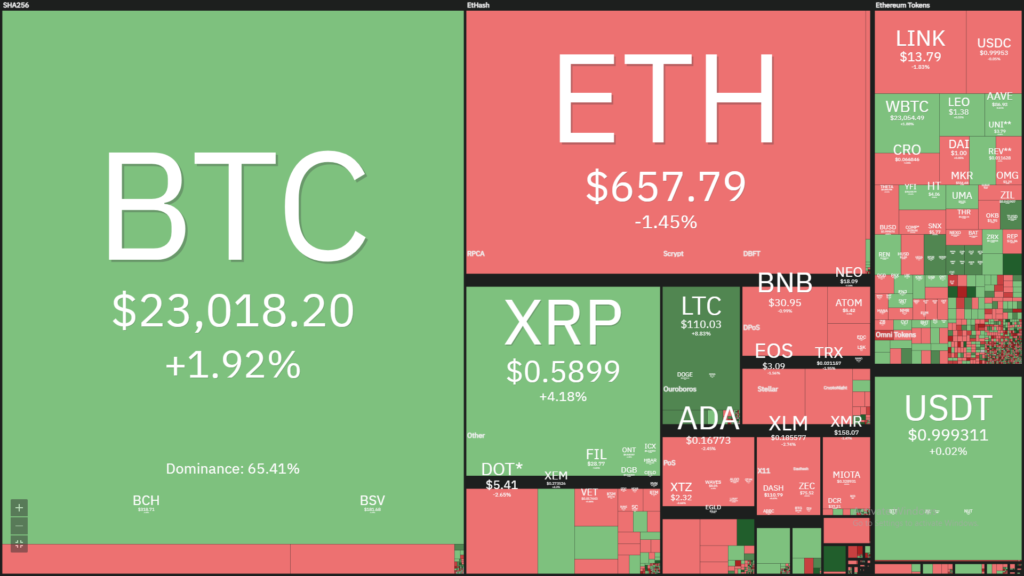

- The overall market conditions looked to sustained the bullish sentiments as BTC attempted to develop sustainability above the $23K mark and Ethereum avoiding any sort of negative divergence in the levels

- The total market capitalization of the cryptoverse has reached $653.18B resulting in an increase of 3.36% over the day

- The total volume traded of the market in the last 24 hours stands at $261.41B resulting in an increase of 23.73% over the day

- The dominance of the crypto king has reached 65.52% resulting in an increase of 0.51% over the day

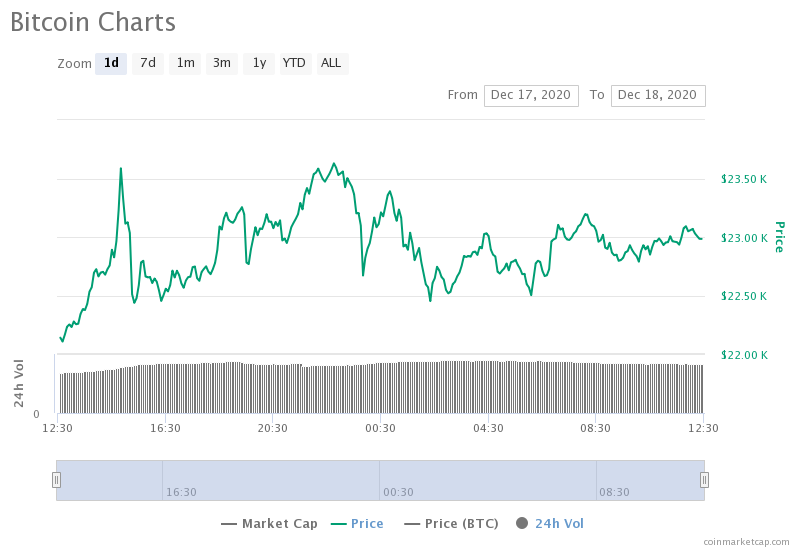

BTC/USD

Bitcoin price levels were able to maintain the constant positive sentiment in the overall market conditions on Friday’s market session. However, the price stability above the bullish mark of $23K is yet to be confirmed as investors might get doubtful for BTC having price corrections in the upcoming trading sessions after having an overheated bullish rally of 28.00% over the week. The CMP is placed at $22,874.55 with an overall gain of 3.46% over the day bringing the market capitalization to $424,767,285,911 with the 24-hour volume traded of $66,159,504,452.

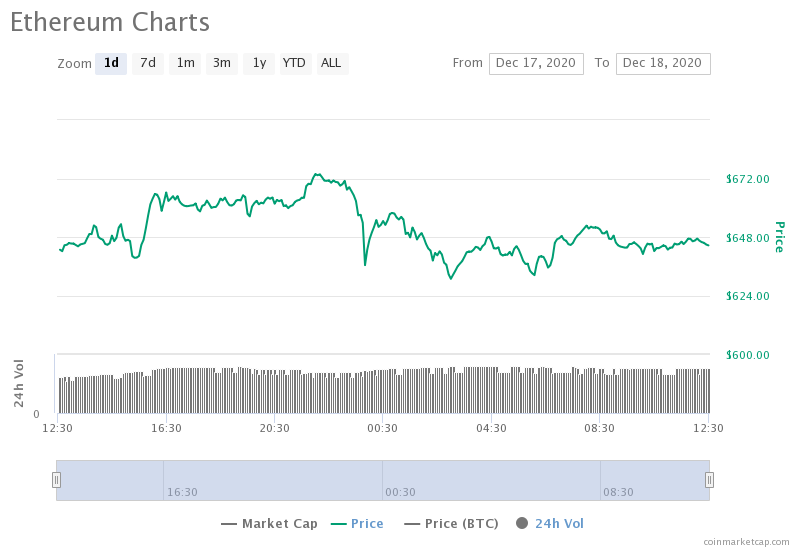

ETH/USD

Ethereum faced negative reversals from its new year-to-date high which is placed around $670. The CMP is placed at $642.56 with a marginal loss of -0.24% bringing the market capitalization to $73,209,807,949 with a 24-hour volume traded of $24,126,429,477. The ETH/BTC pair is also performing negative with a loss of -3.44% bringing the current level to 0.02808883 BTC. We may expect the current retracement to go down to its previous year-to-date high around $630 from where little support is looking to build-up for the crypto asset.

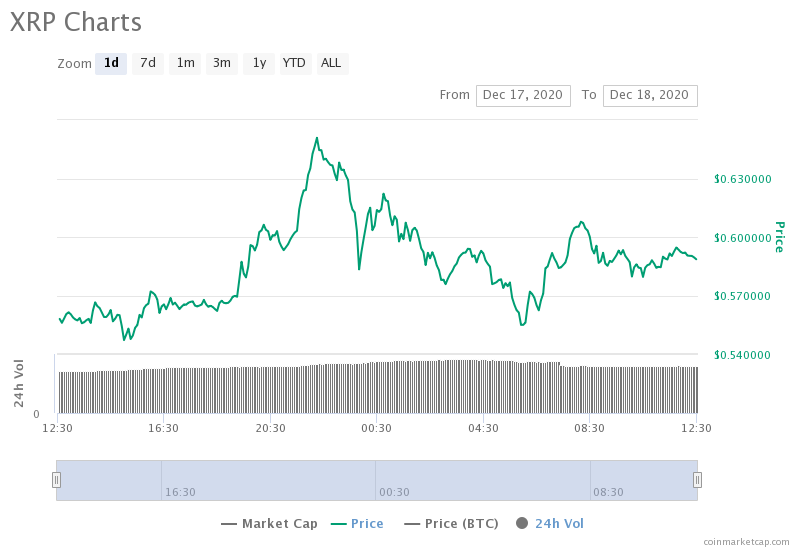

XRP/USD

XRP price levels were unable to maintain stability above the crucial bullish mark of $0.60 resulting in minor retracements during the current market session. However, the crypto asset remained positive with an overall gain of 5.89% bringing the CMP to $0.589524 with the market capitalization to $26,747,660,092 with the 24-hour volume traded of $19,170,833,053. The XRP/BTC pair has turned positive with a gain of 1.66% bringing the current level to 0.00002571 BTC. If the magnitude of the retracement gets increases in the upcoming trading sessions, the levels will have support placed at $0.52.

LINK/USD

Chainlink price levels targetted for a positive breakout above the major resistance mark of $14.00 on Friday’s market session. The CMP is placed at $13.67 with an overall gain of 1.77% adding the weekly gain to 15.61%. The market capitalization is at $5,417,022,860 with the 24-hour volume traded of $1,898,134,771. The LINK/BTC pair continued to trend negative with a loss of -2.29% bringing the current level down to 0.00059363 BTC. However, the LINK/ETH pair has turned positive with a gain of 1.56% bringing the current level to 0.02121018 ETH indicating that it may provide support to the current bullish rally of the crypto asset.

BCH/USD

Bitcoin Cash price levels were able to maintain sustainability above the crucial mark of $300 on Friday’s market session. The CMP is placed at $314.03 with a gain of 1.81% adding the weekly overall gain to 15.87%. The market capitalization is at $5,419,269,341 with a 24-hour volume traded of $5,847,294,833. The BCH/BTC pair is trending negative with a loss of -2.53% bringing the current level down to 0.01363726. On the upper side, the price levels will be facing major resistance at $320 and $330 respectively.

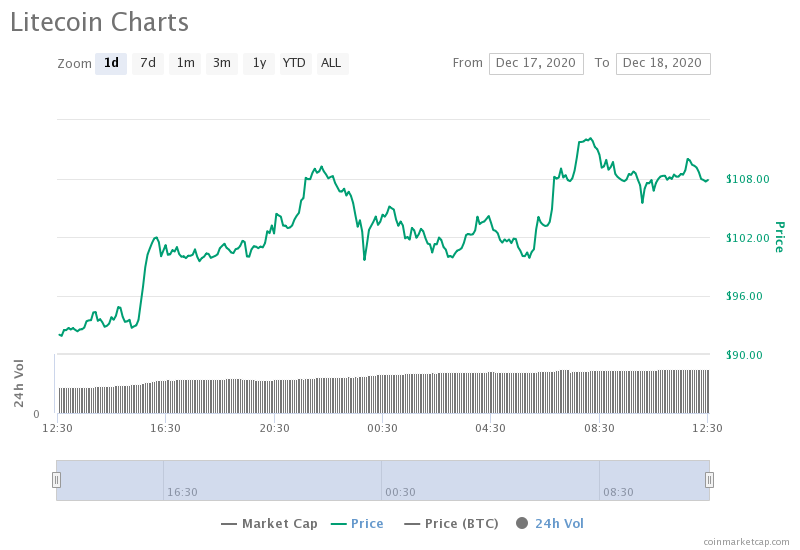

LTC/USD

Litecoin continued its overheated bullish rally on Friday’s market session by adding the weekly overall gain to 52.46%. The CMP is placed at $108.36 with an overall gain of 17.68% over the day bringing the market capitalization to $7,191,192,850 with the 24-hour volume traded of $12,117,990,704. The LTC/BTC pair is also performing significantly positively with a gain of 13.63% bringing the current level to 0.00472708 BTC. However, LTC is still down by 75% from its December 2017 levels which were around $375.

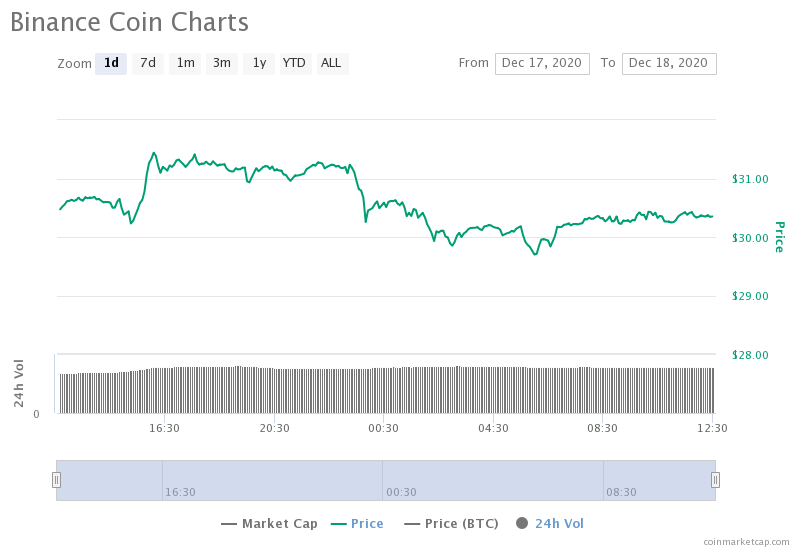

BNB/USD

Binance coin price levels looked for sustainability above the resistance level of $30.00 on Friday’s market session. The CMP is placed at $30.61 with a gain of 0.37% over the day adding the weekly gain to 12.79%. The market capitalization is at $4,420,353,882 with a 24-hour volume traded of $472,775,335. The BNB/BTC pair is still performing negative with a loss of -3.36% bringing the current level down to 0.00133203 BTC. BNB will be facing major resistance at $33 and $35 respectively.

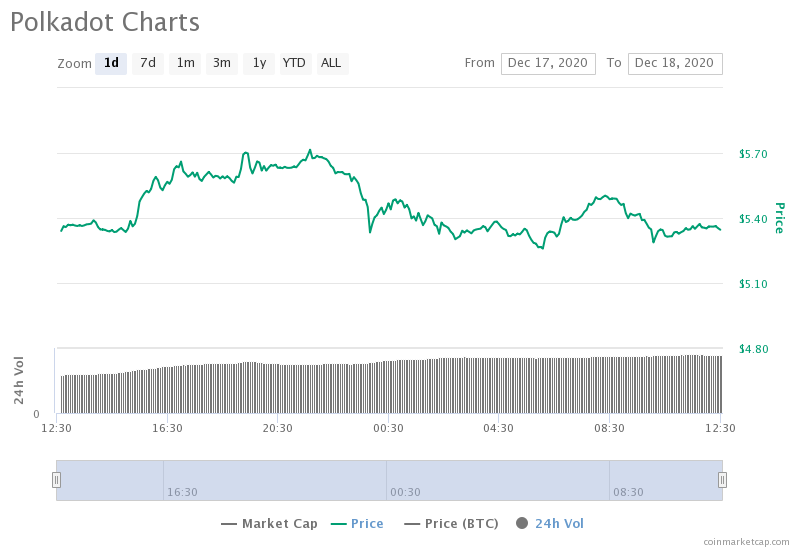

DOT/USD

Polkadot price levels were again unsuccessful in maintaining stability above the bullish mark of $6.00 resulting in negative reversals. The CMP is placed at $5.35 with a marginal loss of 0.30% keeping the weekly overall gain to 15.03%. The market capitalization is at $4,755,554,401 with a 24-hour volume traded of $893,407,910. The DOT/BTC pair continues to trend negative with a loss of -3.775 bringing the current level to 0.0002387 BTC. DOT will be having major support placed at $4.80 and $4.50 respectively.

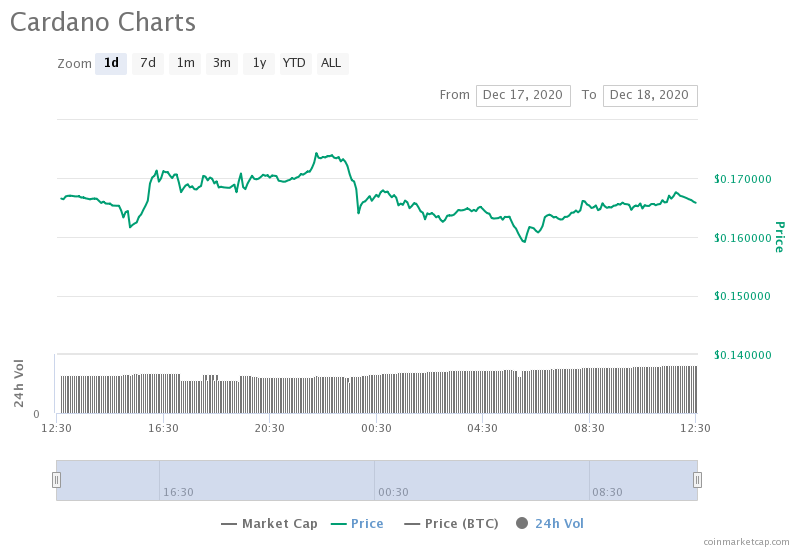

ADA/USD

ADA price levels were also unable to maintain sustainability above the crucial resistance mark of $0.17 resulting in minor retracements for the day. The CMP is placed at $0.167582 with a marginal gain of 0.32% adding the weekly gain to 21.52%. The market capitalization is at $5,206,753,783 with a 24-hour volume traded of $1,325,791,750. The ADA/BTC pair continues to trend negative with a loss of -3.14% bringing the current level to 0.00000728 BTC.

BSV/USD

Bitcoin SV looked vulnerable for a negative breakout below the major resistance level of $180.00 again on Friday’s market session. The CMP is placed at $181.82 with a marginal gain of 0.98% bringing the market capitalization to $3,380,557,608 with the 24-hour volume traded of $775,372,854. The BSV/BTC pair is still performing negative with a loss of -2.96% bringing the current level to 0.00786048 BTC. A negative breakout below the resistance level can again consolidate the current bullish momentum of the crypto asset.

Mr. Pratik chadhokar is an Indian Forex, Cryptocurrencies and Financial Market Advisor and analyst with a background in IT and Financial market Strategist. He specialises in market strategies and technical analysis and has spent over a year as a financial markets contributor and observer. He possesses strong technical analytical skills and is well known for his entertaining and informative analysis of the Financial markets.

Home

Home News

News