Pandora Protocol bridges real-world assets to an Open finance ecosystem. It induces liquidity in the NFT ecosystem for both real-world and digital assets.

New York, April 30, 2021 – Pandora Finance has announced its official launch this week. Pandora is a new project dedicated to connecting digital and real-world assets in a way not seen before. By creating liquidity enabled NFTs (non-fungible tokens) to tokenize offline assets, then powering these with Pandora technology, huge volumes of real-world assets will become available to trade on-chain. Not only will this open the door to frictionless trade and liquidity to currently locked asset classes, but the very nature of liquid NFT technology will enable decentralized, secure data augmentation.

Overview

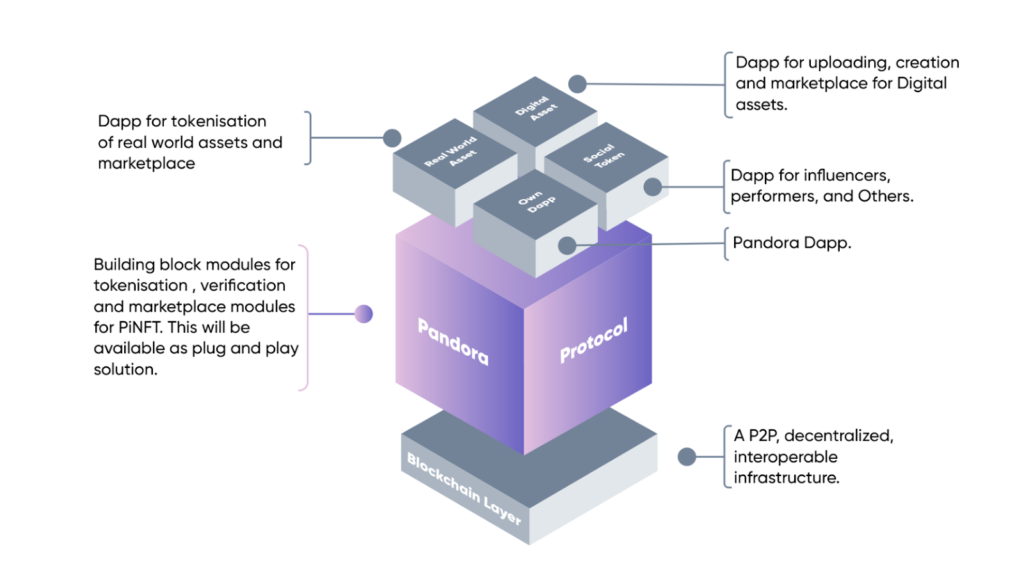

Pandora Protocol is a hybrid Open Finance solution for problems faced by both traditional finance, and decentralised finance. By creating a bridge between real-world and on-chain assets, this protocol allows for the tokenization of illiquid assets – meaning they can be found, traded and owned in a secure, decentralized way.

NFTs have been increasingly popular over the last 12 months; however, the lack of liquidity has been a growing concern for many. Pandora’s middleware solution induces liquidity in the NFT ecosystem for any NFT platform; this can come in the form of tokenized real-world assets, through to digital asset NFT’s. This is where Pandora offers significant advantages over other marketplace enablement technologies. Instead of competing with other NFT platforms for liquidity, they are helping other platforms grow just by inducing liquidity into them.

It is this technology which sits at the heart of Pandora protocol’s future value. Imagine being able to have a marketplace where both digitally native and real-world assets could find liquidity, accurate pricing data while also continually being updated with relevant, exact on-chain data. This would add significant utility and purpose to the NFT space, and allow them to be swapped, traded or borrowed.

According to Pandora CEO Puskhar Vohra:

“We see NFT as a much bigger marketplace than the DeFi ecosystem, but the existing nature of NFT makes it illiquid. The goal of the Pandora protocol is to bring liquidity to the NFT ecosystem. We provide a liquid infrastructure protocol where any asset can be tokenized in liquid form and can be further traded as a swap, lend, borrow or derivative trade.”

Potential use cases of Pandora

Pandora provides both a middleware solution for minting liquidity enabled NFTs, alongside offering Dapp developers the ability to leverage Pandora to provide liquidity to their own users’ NFTs. This represents a significant breakthrough in the potential use cases for NFTs:

- Digital marketplace: Allowing offline assets to be tokenized and updated in real time with value metrics and data. This allows for the loaning, swapping and trading of any conceivable type of asset on a cross chain platform.

- Real-world asset marketplace: Tokenizing real-world assets into NFT and inducing liquidity to generate yield out of it is the primary use-case of Pandora.

- Social Skill: Tokenizing social skill into NFT and trading it in an open marketplace is unique and innovative in itself. Using Pandora SDK these use-cases can be easily spun out.

- Real-world augmentation: Pandora allows NFTs to be minted in real-world locations where users can compete for them in real-life. Think Pokémon GO, but at scale; and with on-chain functionality

There are already a number of products leaning into the above use cases. Technologies such as Kylyx, Box and Kalel have already begun building on Pandora.

To find out more, or join the growing Pandora community.

About Pandora

Pandora creates a bridge between on-chain and real-world assets to form an open finance ecosystem. This protocol allows for the tokenization of illiquid assets, meaning they can be found, traded, borrowed and owned in a secure, decentralized way. Pandora provides both a middleware solution for minting liquidity enabled NFTs, alongside offering Dapp developers the ability to leverage Pandora to provide liquidity to their own users’ NFTs.

Home

Home News

News