- A PwC report on crypto hedge funds elucidated that the US, the UK and Hong Kong are home to most of the hedge fund managers

- 47% hedge funds used third party research data to implement strategies for better results

- Efficient governance policies increased multifold as investors in the crypto space grew at the same pace

Cryptocurrency hedge funds have shown that investors are taking a liking towards digital assets. They want to risk their investment for phenomenal returns leading to a change in their expectations. The total assets under management stood at $42.8 million for such hedge funds and this staggering figure also ensured that the performance numbers were also great.

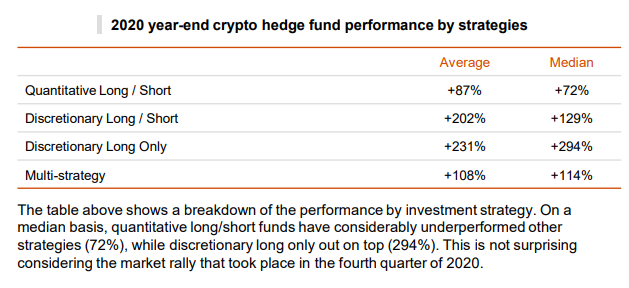

The discretionary long-only strategy returned +294% in the previous year even as the Bitcoin crash tried to dampen the spirit of investors.

Numbers have shown growth

A PwC’s report on the cryptocurrency hedge fund ecosystem has proven fruitful as it showed that strategies like quantitative, discretionary long-only, discretionary long/short and multi-strategy have outperformed. Arbitrage, low latency trading, and market making strategies have thrived well during the pandemic. The average ticket size of investors stood at $1.1 million while the median remained stable at $0.4 million. The respondents in the analysis had a median performance of 184%. However, none of the funds could outperform the Bitcoin rally.

Managers work on objectives and goals of particular funds and cannot keep taking risks. They are bound by investment objectives of investors, while management fees are not enough for a fund to sustain business operations. Fund managers have sought various streams of revenue that will benefit the fund and investors at large.

Post crash changes

The activities dealt in by cryptocurrency hedge funds were reduced considerably in 2020, which were mainly borrowing, lending and staking. The percentage of crypto hedge funds involved in staking was 41.6% in 2020 which was 42.0% in 2019. Moreover, 60% of the respondents agreed that they have not undergone significant changes in the form of risk management policies after the Bitcoin crash in 2020.

Funds took lesser short positions which is also a fact that the market outlook remains positive for most part of the financial year. Furthermore, fund managers spoke about the risk management policies in place that prevented losses while only a few changed management techniques and counterparty risk measures.

Steve Anderson is an Australian crypto enthusiast. He is a specialist in management and trading for over 5 years. Steve has worked as a crypto trader, he loves learning about decentralisation, understanding the true potential of the blockchain.

Home

Home News

News