- DeFi crypto has grown by leaps and bounds as it is an open, transparent and composable source network for the financial world

- Its decentralised function has a huge following with regulators still scampering everywhere to regulate it in some form or the other

- The recent volatility in DeFi crypto market is attributable to the various activities carried out with smart contracts, DApps and protocols on blockchain network

Decentralised Finance (DeFI) is a term that a lot of people must have heard by now, given the popularity of cryptocurrencies these days. The innovation of a public ledger in a blockchain that is digitally accessible from across the world is quite similar to the birth of cloud storage systems in 2006.The latter’s invention led to ease of accessing documents from any part of the world while giving startups ample storage space for their needs.

DeFi is quite similar in the sense that it not only provides a platform to trade cryptocurrency but consists of several decentralised applications (DApps) which help users trade, lend and borrow digitally. It removes the need of middlemen like banks as they have the potential to tokenize every physical object present in an organisation. It would not be surprising to see a firm borrow money after tokenizing their inventory and putting it up as a collateral on a blockchain network.

Financial well-being with DeFi

Ethereum is the most famous DeFi platform for enthusiasts to trade, save, invest, borrow in exchange for various products. Users have started to tokenize their art work and sell it on the blockchain network with ease. DeFi crypto could be used as collateral to take a loan or earn interest as passive income. The financial well-being of the investor remains with the individual/organisation. Activities on the platform are pseudonymous and the markets are open 24 X 7.

Unlike Bitcoin, anyone can invest index funds, schedule payments and indulge in activities like borrowing and lending. Moreover, it empowers the use of digital tokens backed by fiat currency also known as stablecoins. Coins like USDC and DAI have provided stability to savings of many households in terms of volatility and prevent them from economic downturns.

Activities fueling volatility in digital currencies

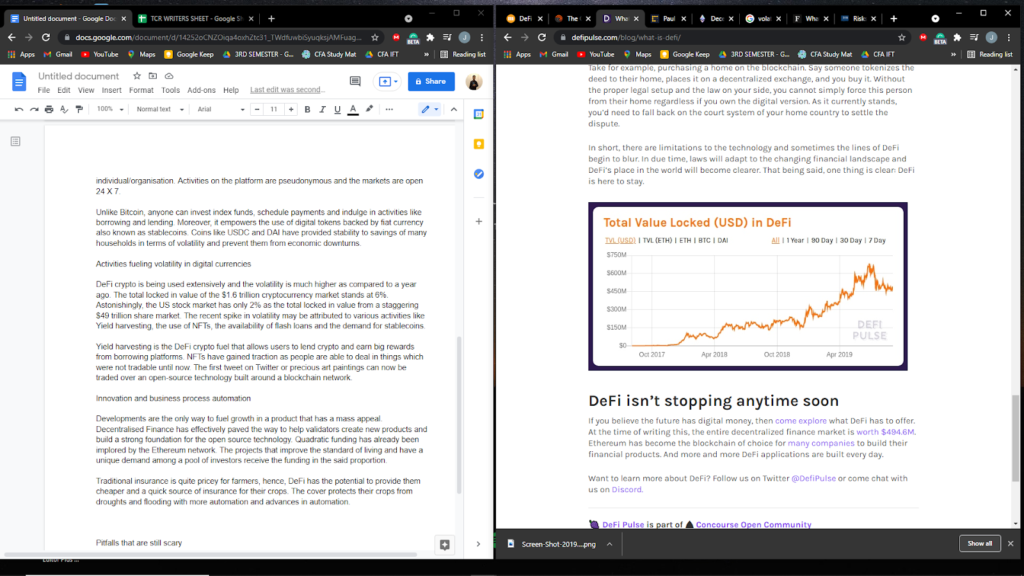

DeFi crypto is being used extensively and the volatility is much higher as compared to a year ago. The total locked in value of the $1.6 trillion cryptocurrency market stands at 6%. Astonishingly, the US stock market has only 2% as the total locked in value from a staggering $49 trillion share market. The recent spike in volatility may be attributed to various activities like Yield harvesting, the use of NFTs, the availability of flash loans and the demand for stablecoins.

Yield harvesting is the DeFi crypto fuel that allows users to lend crypto and earn big rewards from borrowing platforms. NFTs have gained traction as people are able to deal in things which were not tradable until now. The first tweet on Twitter or precious art paintings can now be traded over an open-source technology built around a blockchain network.

Innovation and business process automation

Developments are the only way to fuel growth in a product that has a mass appeal. Decentralised Finance has effectively paved the way to help validators create new products and build a strong foundation for the open source technology. Quadratic funding has already been implored by the Ethereum network. The projects that improve the standard of living and have a unique demand among a pool of investors receive the funding in the said proportion.

Traditional insurance is quite pricey for farmers, hence, DeFi has the potential to provide them cheaper and a quick source of insurance for their crops. The cover protects their crops from droughts and flooding with more automation and advances in automation.

The above graph is proof that investors have started to like decentralised finance to the extent that they are ready to lock up a part of their investment within a blockchain network. The recent DeFi crypto selloff has hurt the market sentiment but investors have placed their trust, money and time in blockchain networks. Furthermore, there are several decentralised exchanges that provide 100 times leverage to boost returns.

DeFi accounts for 40% of the ether that moved in the decentralised network co-founded by Vitalik Buterin. The world’s second most famous cryptocurrency network has all the factors in it to boost user experience and the use of DeFi crypto.

Pitfalls that are still scary

Given its uniqueness, investors must factor in the pitfalls of such a technological innovation. The network is devoid of consumer protection and hackers still pose a serious threat. Private key requirements are long and encryption is a herculean task for many validators. Regulatory clampdowns in numerous countries have left the industry in doldrums combined with a high gas price for Ethereum.

Lastly, investors run the risk of losing their funds to attacks carried out by disgruntled parties’. The loss of an admin key to an unknown person is bound to take away all your funds within a short span of time. There is no doubt that DeFi can leave a profound effect on our lives but it also runs a lot of risks that need to be weighed upon. DeFi crypto is still relatively new for many and investors should not invest more than they can afford to lose.

Andrew is a blockchain developer who developed his interest in cryptocurrencies while pursuing his post-graduation major in blockchain development. He is a keen observer of details and shares his passion for writing, along with coding. His backend knowledge about blockchain helps him give a unique perspective to his writing skills, and a reliable craft at explaining the concepts such as blockchain programming, languages and token minting. He also frequently shares technical details and performance indicators of ICOs and IDOs.

Home

Home News

News