- Classic Ethereum seriously trading below its value

- Ethereum blockchain transactions are 35 billion dollars daily

- Ethereum exchange transactions annually are 12 times of PayPal transactions

Cryptocurrencies have captured the interest of investors, and an example is Ethereum has surged nearly 1,100% over the past 12 months. When the crypto world is in turmoil, popular crypto KOL Lark Davis feels that Ethereum (ETH) is seriously undervalued. He also gives statistics to prove his point. The market is in a bearish phase, but Lark feels that classic ethereum, at its current market capitalization and the possible price, is seriously trading below its value. Lark added that ethereum is traditional and other cryptocurrencies are just waiting to explode.

At present, Ethereum was trading at $1,991.43 with a market cap of 235 billion dollars. In comparison with the Ethereum blockchain, Paypal has a market capitalization of 340 Billion. Thus, it is 100 billion more than classic ethereum.

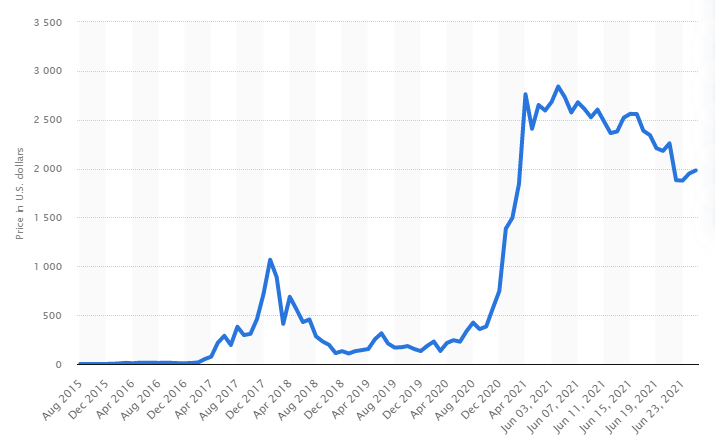

Ethereum (ETH) price history from 2015 to June 25, 2021

The Ethereum (ETH) price in USD kept growing in value over the course of April 2021, at one point reaching over 2,500 U.S. dollars. Much like Bitcoin (BTC), the price of ETH went up in 2021 but for different reasons altogether: Ethereum, for instance, hit the news when a digital art piece was sold as the world’s most expensive NFT for over 38,000 ETH – or 69.3 million U.S. dollars. Unlike Bitcoin – of which the price growth was fueled by the IPO of the U.S.’ biggest crypto trader Coinbase – the rally on Ethereum came from technological developments that caused much excitement among traders. First, the so-called “Berlin update” rolled out on the Ethereum network in April 2021, an update meant to pave the way for reduced ETH gas prices – or reduced transaction fees. Second, the arrival of Uniswap V3 in May 2021 – a smart contract protocol – is expected to further optimize Ethereum trading.

Ethereum’s future and the DeFi industry

Price developments on Ethereum are difficult to predict, but cannot be seen without the world of DeFi – or Decentralized Finance. This industry used technology to remove intermediaries between parties in a financial transaction. One example includes crypto wallets such as Coinbase Wallet that grew in popularity in recent years, with other examples including smart contractor Uniswap, Maker (responsible for stablecoin DAI), money lender Dharma and market protocol Compound. Ethereum’s future developments are tied with this industry: Unlike Bitcoin and Ripple, Ethereum is technically not a currency but an open-source software platform for blockchain applications – with Ether being the cryptocurrency that is used inside the Ethereum network. Essentially, Ethereum facilitates DeFi – meaning that if DeFi does well, so does Ethereum.

NFTs: the most well-known application of Ethereum

NFTs or non-fungible tokens grew nearly ten-fold between 2018 and 2020, as can be seen in the market cap of NFTs worldwide. These digital blockchain assets can essentially function as a unique code connected to a digital file, allowing to distinguish the original file from any potential copies. This application is especially prominent in crypto art, although there are other applications: gaming, sports and collectibles are other segments where NFT sales occur.

Daily Ethereum value from August 2015 to June 25, 2021

Paypal settled a trillion dollars

Lark Davis compared the statistics to prove his point. Paypal completed over 15 billion transactions in 2020. It amounted to $936 billion in transaction volume. It is a huge figure worth a trillion dollars settled by Paypal, and it is a payment platform of immense proportion.

ETH exchange did over $1.5 trillion worth of transactions

In comparison, classic ethereum ETH did a little over a trillion-dollar on-chain settlement in 2020. In the first quarter of 2021 ETH exchange did over $1.5 trillion worth of transactions. Compared to PayPal, Ethereum did 50 percent more transactional volume than what PayPal did in an entire financial year.

Lark added that the ethereum blockchain and other cryptocurrencies like bitcoin and Ethereum are increasingly becoming relevant in today’s world. The future is heading towards online payment. It is exactly why PayPal has started to allow its customers to pay for things online using bitcoin and Ethereum in their PayPal accounts.

Davis added that Ethereum is doing $35 billion of daily transactional value settled on the Ethereum blockchain. In other words, Ethereum does as many transactions on the Ethereum exchange in a month as PayPal does in a year. Furthermore, Ethereum blockchain is doing twelve times as much volume as PayPal is doing. Still, PayPal is labeled as the biggest online payment behemoth.

Ethereum is an exceptional asset

Lark Davis continues to compare PayPal to ETH. PayPal pays zero percent dividends while ethereum has just introduced its staking function in December and is paying 6 to 7 % as dividends per year. Lark added that it is better to have ethereum because if you have 100 ethereum, you get seven more ETH a year and earn more ethereum next year.

Ethereum blockchain in 2015 expanded the idea to create a peer-to-peer electronic payments system that eliminates the need for financial institutions like banks. In addition to storing transactions, the Ethereum blockchain can build smart contracts that power decentralized applications (apps).

PayPal had partnered with Paxos Trust to bring cryptocurrency to the PayPal and Venmo mobile apps. Today PayPal users can buy, sell, and hold Ethereum, Bitcoin, Bitcoin Cash, and Litecoin. However, the boldest move by PayPal was to introduce Checkout with Crypto. The service enables consumers to buy and sell wares using digital currencies. PayPal also intends to offer this service to all of its 31 million merchants sometime in the future.

PayPal active accounts surged by 21% in the first quarter of 2021. In the previous year, it was 17% growth. CEO Dan Schulman said that 50% of the crypto users open their app daily, which shows a high interest in cryptocurrency. It also suggests that these investors are also amenable to new apps like digital payments, QR Code payments, or the Venmo Credit Card.

Both Ethereum and PayPal have compelling qualities. PayPal could be labeled as a long-term investment option since Ether tokens were designed to power the Ethereum blockchain, not to increase in value over time. However, it does not mean that Ether value will not increase, but at some point in time in the future, it will reach a stage of equilibrium.

Steve Anderson is an Australian crypto enthusiast. He is a specialist in management and trading for over 5 years. Steve has worked as a crypto trader, he loves learning about decentralisation, understanding the true potential of the blockchain.

Home

Home News

News