- Long-term holders have no say in the Price

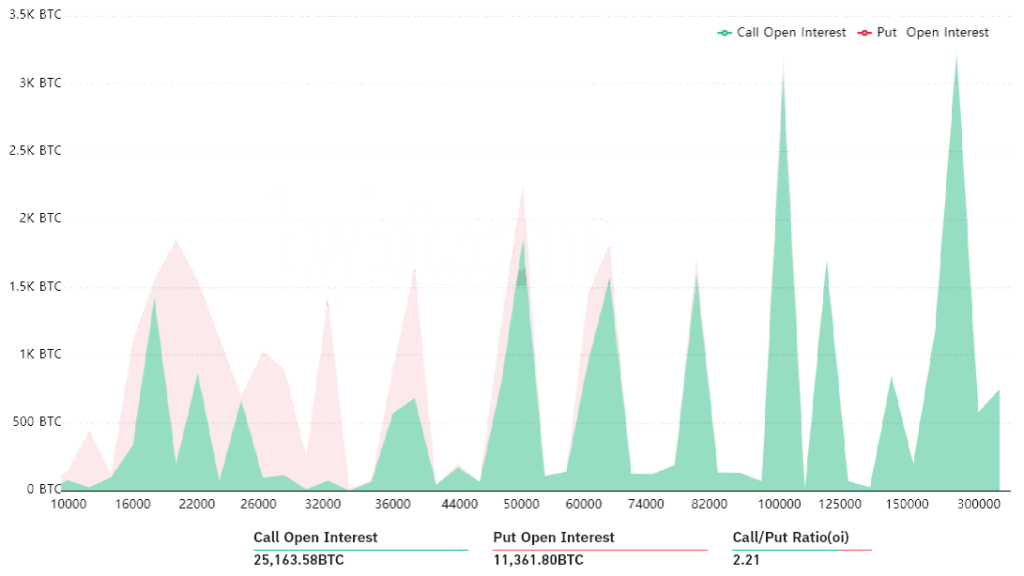

- $100,000 is still possible according to options markets

Bitcoin (BTC) is going through a period of price correction, and prices have tanked by more than 50%. However, despite taxing times, Bitcoin investors have remained bullish, and most analysts are optimistic that the worst is over. The optimism is not unfounded and is based on hard facts like BTC’s decreasing issuance and the 21 million coins fixed supply limit.

Economics of cryptocurrency unpredictable

However, the economics of cryptocurrency or even any fiat currency cannot be predicted by the most accurate models like the stock-to-flow (S2F) from analyst Plan B can forecast the dynamics of a bearish market or FOMO-precipitated (fear of missing out) pumps. Often, investors cannot gauge or decode these concepts, and values and prices are often mistaken.

Bitcoin is a virtual digital currency, but its existence is not a utopia, even if most skeptics dub it the number one crypto coin by the same. The Price of Bitcoin depends upon several external factors like volume of fiat currencies like dollars, euros, and yuans in circulation, interest rates, real estate market, shares, and commodity prices. In addition, the state of the global economy, inflation, and the value of local currency also have a bearing on the value of Bitcoin.

Factors driving Bitcoin current prices

Despite what different models predict based upon various parameters, any entity’s Price depends on the number of participants in the market at a particular time. Contrary to expectations, data from CryptoQuant shows only 2.5 million Bitcoin currently deposited on exchanges. Comparing this with 10.7 million that hasn’t been moved in the last 12 months according to ‘HODL wave’ data, one can safely assume that long-term holders have no say in the Price.

Value is subjective, and Price is objective.

It is essential to know the difference between the value and the Price of any entity. While the value is subjective, prices are calculated from a historical and objective perspective. Hence it is easy to perceive why investors expect $100,000 or higher targets for the end of 2021. However, to gauge the obstacles which stand in the way of these prices, one must analyze the calls (buy) existing in the options markets.

The buy sentiments are now dominating the markets compared to protective puts; it is not uncommon for asset class on longer-term expiries. However, a call for a $50,000 strike will be more believable than a $200,000 one because their prices will be noticeably different.

Steve Anderson is an Australian crypto enthusiast. He is a specialist in management and trading for over 5 years. Steve has worked as a crypto trader, he loves learning about decentralisation, understanding the true potential of the blockchain.

Home

Home News

News