- Bitcoin (BTC) prices inching slowly towards $34,000

- The shift in the macro hodling behaviour of long term investors

- Long term holders are propping up the speculative coins

The latest Glassnode data reveals that investors willing to take long term risks had started accumulating Bitcoin when it was in its worst bearish phase.

Bitcoin (BTC) prices have remained steady over the weekend and are inching slowly towards $34,000 on July 11. However, comparing its price with an all-time high in mid-April, which was $65,000, BTC values have tumbled by more than 50%. However, this steep descent has not dissuaded investors betting on the digital coin.

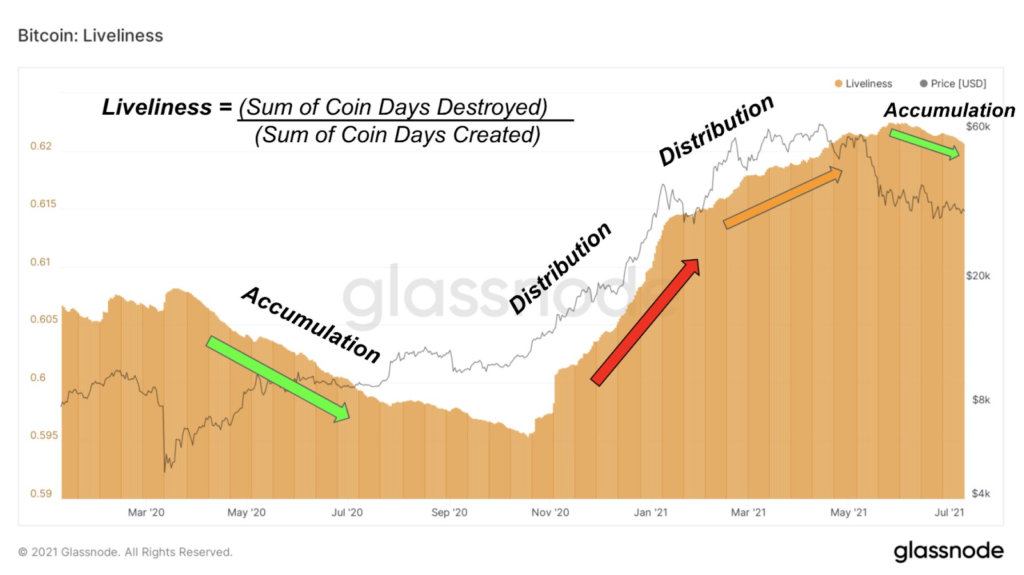

Glassnode metrics Liveliness reveals that the Bitcoin market has been seeing a strategic shift in the macro hodling behaviour of long term investors. The genesis of the word Holding is interesting. It first originated from a drunken forum post in 2013 and typo and has come to represent crypto investors’ response to market downtrends, a meme-driven investment strategy.

Liveliness is the cumulative coin days lost to the cumulative sum of all coin days ever accumulated by the network—the value of the ration swings between zero and one. Zero represents the most significant proportion of dormant Bitcoin supply or HODLing behaviour. It is a measure that revealed that the global coin day accumulation had been more than coin days destroyed in on-chain activity.

Bitcoin Liveliness ratio signals accumulation phase

However, a higher degree of distribution does not forecast a bearish cycle and an example is also there to prove this point. Between November 2020 and April 2021, the Liveliness Ratio surged besides the Bitcoin prices, suggesting that despite lower HODLing behaviour, the Bitcoin market did not enter a bearish phase.

One of the reasons for this phenomenon could be the massive surge in trade volumes at the beginning of 2021. Bitcoin trading activities surged to touch over $6 trillion compared to $1.4 trillion in the fourth quarter ofv2020 as per data obtained from Bitcoinity.

With a background in journalism, Ritika Sharma has worked with many reputed media firms focusing on general news such as politics and crime. She joined The Coin Republic as a reporter for crypto, and found a great passion for cryptocurrency, Web3, NFTs and other digital assets. She spends a lot of time researching and delving deeper into these concepts around the clock, and is a strong advocate for women in STEM.

Home

Home News

News