- Monero [XMR] present a position no different from other altcoins

- XMR lost 11% of its value in the past week

- The community is working on several development projects simultaneously that will increase the adoption

Monero [XMR], a prominent privacy coin, has been through a fair amount of ups and downs during the year. From January 2021 to May 2021, the altcoins have been on their rising spree and reached their zenith of glory when they touched a three year high on May 3. However, the downfall started soon after.

Monero [XMR] present position was identical to other altcoins

Monero [XMR] present position was identical to other altcoins, which have been trying to insulate themselves from the vagaries market where most of the big players are going through a phase of price correction. But, unfortunately, Bitcoin is still in the red, and it seems altcoins like XMR would have to be patient before they see the light at the end of the tunnel.

XMR lost 11% of its value in the past week

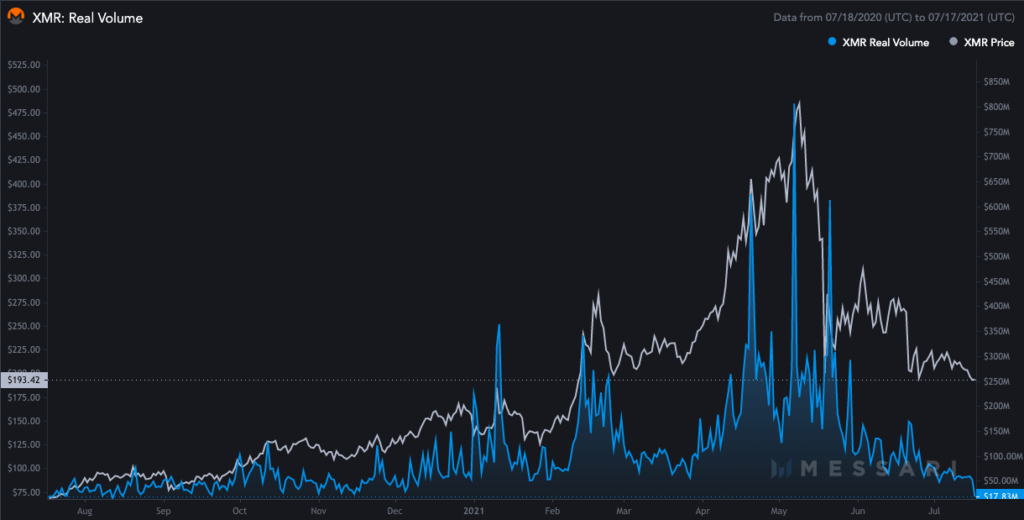

XMR is presently placed at the 27th position and has lost about 11% of its value in the past week. The drop in price was also well sustained by a fall in real volume too. An example can be seen On May 7; for instance, Monero real volume surged and cleared the $800 million mark. However, the same reflected a value of just $17.83 million.

Such a sheer drop can be analyzed by observing the chart attached below. Such low levels were witnessed only in August 2020.

Looking at the sheer drop, it is imperative to understand what caused this dramatic downfall of Monero’s downfall. Delving deeply, it is clear that a host of factors caused the collapse of Monero.

Consider the Sharpe Ratio. It is a metric that outlines the potential risk-adjusted returns of an asset. The drop in this metric ratio is noticeable in June. At press time, the ratio was 3.12.

Whenever this metric becomes negative, it is indicative that the portfolio’s proceeds are expected to be negative (Because the risk-free rate is larger than the portfolio’s returns). Hence when the ratio is negative, the returns are negative, there is no incentive to encourage the investor to buy. Ergo, MXR’s price will get the requisite support only when this ratio climbs back above zero.

Steve Anderson is an Australian crypto enthusiast. He is a specialist in management and trading for over 5 years. Steve has worked as a crypto trader, he loves learning about decentralisation, understanding the true potential of the blockchain.

Home

Home News

News