- Bitcoin Bulls are calling the shots

- Bulls will be able to profit from the $40,000 call (buy) options

- Bitcoin has held on steadily even after the quashing of Amazon rumors

Bitcoin has breached the $40,000, boosting the bulls’ advantage in this month’s $1.7 billion options expiry. As a result, Bitcoin Bulls are in control of Friday’s $1.7B monthly options expiry.

On Friday, July 30, 42,850 Bitcoin (BTC) option contracts ($1.7 billion) are set to expire. As a result, it is for the first time since the May 21 weekly expiry that bulls will profit from the $40,000 call (buy) options.

Bitcoin’s recent surge can be attributed to the rumors that Amazon could accept payments in Bitcoins. However, Amazon has quashed these rumors, and thankfully, Bitcoin has held on steadily.

The options markets, regardless of the facts which led to the recent strength in the cryptocurrency market, have a few incentives which are sustaining the bullish trend in Bitcoin prices, and it is supporting at the $40,000 levels.

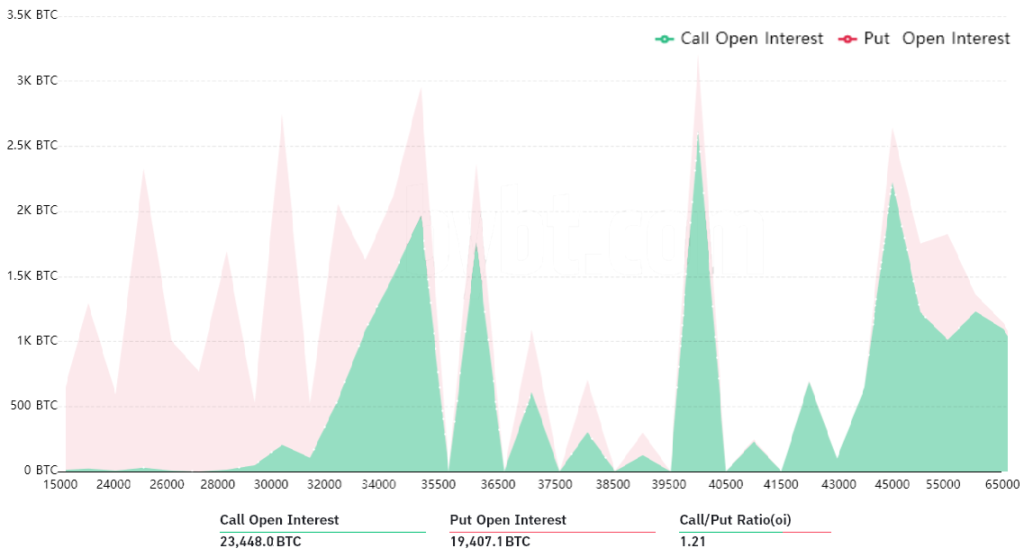

Aggregate July 30 Bitcoin option open interest by strike. Source: Bybt.com

Aggregate July 30 Bitcoin option open interest by strike. Source: Bybt.com

According to the call-to-put ratio, the primary analysis hints towards the neutral-to-bullish call options by 21%; a decent number of those bets were placed at $45,000 and higher strikes. However, these options become worthless with less than 14 hours until maturity.

Bulls are ruling the roost

The bears were smug in their belief that monthly expiry and 87% of the neutral-to-bearish put options have been placed at $39,000 or lower. If the bears were able to suppress the price below this level on July 30, a total of $105 million put options would be available.

Incidentally, the neutral-to-bullish call options below $39,000 amount to $320 million. The outcome is a $215 million advantage favoring the neutral-to-bullish call options.

If the price above $40,000 on July 30 stands firm, it will surge the bull’s lead by $140 million. The difference will validate a price push above that level until 8:00 am UTC when Deribit expiry occurs.

July futures contracts also have some bearing.

Bitcoin futures are set to expire at once, but unlike options, longs and shorts are evenly matched at all times. A total of $650 million in BTC futures is set to expire this Friday.

However, it will depend mainly upon CME’s $455 million. It is because the possibility of traders closing their position before the expiry is always there. The expiry will happen on Friday at 3:00 pm UTC. Presently the options market data largely favors bulls, at least for the short-term.

Steve Anderson is an Australian crypto enthusiast. He is a specialist in management and trading for over 5 years. Steve has worked as a crypto trader, he loves learning about decentralisation, understanding the true potential of the blockchain.

Home

Home News

News