- Bitcoin hash rate back to 100 million TH/s

- Trade continued on Peer-to-peer (p2p) markets

- The hegemony of Asia-based exchanges continue

China and its communist regime had come down heavily on Bitcoin, from banning Crypto sites on social media to asking Banks not to deal in the crypto trade and finally stopping all Bitcoin mining activities. The move was intended to destroy Bitcoin but has failed in its objective.

Bitcoin (BTC) endured one of its most vicious and coordinated attacks in the past couple of months. However, investors did not lose faith. China had abruptly banned all bitcoin mining activities which were thriving in its northern regions. At its peak, 90% of new Bitcoin mining activities were accomplished in China. The outright banning gave the miners only two weeks to shift the mining rigs out of the country. Furthermore, it caused the most significant mining difficulty adjustment after the network hash rate dropped 50%.

Bitcoin was also enduring a riff-raff from one of its most ardent supporters Elon Musk. Elon Musk announced that Tesla would no longer accept Bitcoin payments due to the environmental impact of the mining process. It is not clear if China’s decision was linked to Musk’s remarks. Tesla, however, said that it would start accepting Bitcoin as payment when 50% of BTC mining was done using eco-friendly energy sources. However, the damage was done, and it hurt BTC prices.

On June 16, China cryptocurrency exchanges from web search results. Meanwhile, derivatives exchange Huobi started to restrict leverage trading and blocked new users from China. On June 21, the People’s Bank of China asked all banks to shut down the bank accounts of over-the-counter desks, and even their social networks accounts were banned. The OTC desk served as a conduit for fiat currency in the region. Without them, it would not be easy to exchange from Bitcoin to stablecoins.

Some analysts termed the events as meaningless, but it appears that China had launched a very well-planned and executed attack on the Bitcoin network and mining industry. The stated goals of China were to destroy Bitcoin, and it looked as if the stated goals were being achieved in the short term. Nevertheless, it managed to halve the value of Bitcoin and the rising concerns that a 51% hash rate attack could occur.

Despite all efforts, China failed to realize its goals, and here are the reasons why

The hash rate back to 100 million TH/s

The peak in mining was achieved on May 12 when the Bitcoin network hash rate touched 186 million TH/s. Subsequently, it started to fall. It is because China first restricted mining activity in areas that received electricity from coal-based power plants. It constituted 25% of the mining capacity. Soon the ban was extended to other regions as well and the indicator bottomed at 85 million TH/s, its lowest level in two years.

Bitcoin estimated hash rate. Source: Blockchain.com

The data above reveals that the Bitcoin network’s processing power recovered to 100 million TH/s in less than three weeks. By then, most miners had relocated their heavy mining rigs to crypto-friendly locations. Some miners relocated to Kazakhstan, others moved on to the U.S and Canada.

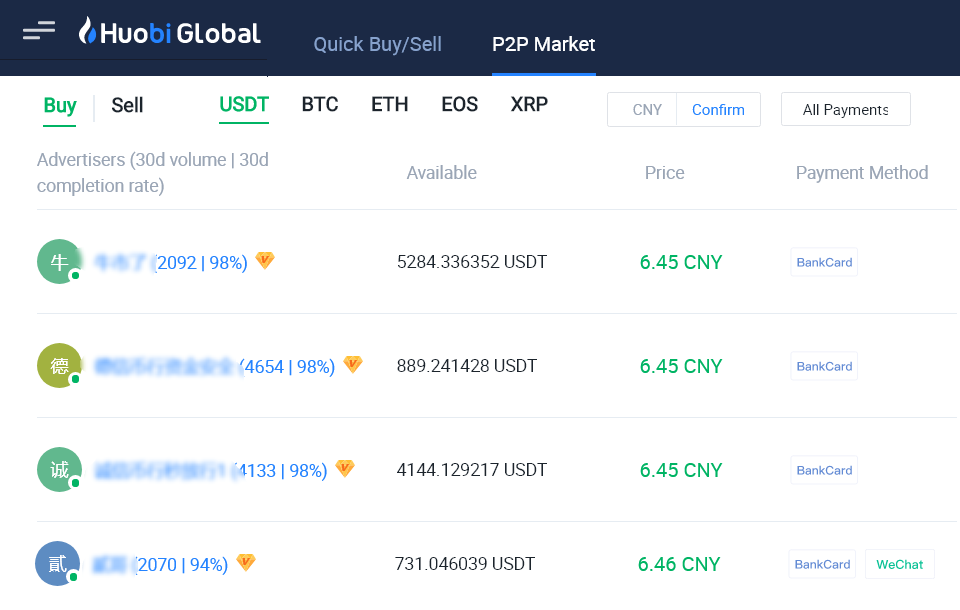

Peer-to-peer (p2p) markets continue trade

China had banned companies involved in crypto transactions from the country; individuals acted as conduits —some of these recorded over 10,000 successful peer-to-peer transactions according to data from the exchange’s ranking system.

Huobi Global peer-to-peer market advertisement. Source: Huobi

Huobi and Binance enable users to trade multiple cryptocurrencies, including USD Tether (USDT). Once the fiat currency has been converted to stablecoin, transacting on a regular or derivatives exchange becomes possible.

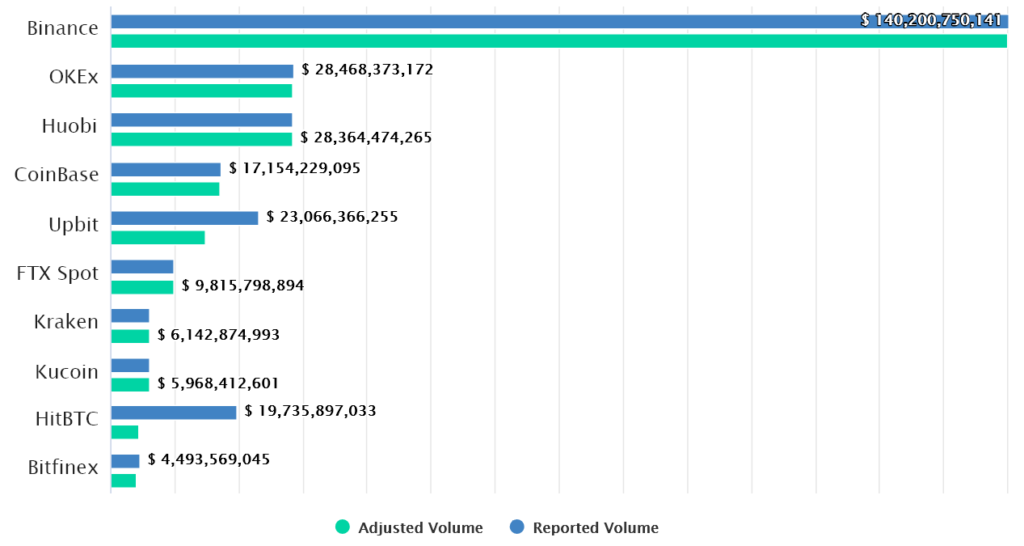

Asia-based exchanges still control spot volume.

If China hoped its crackdown would curtain cryptocurrency trade, it was mistaken. A fall in cryptocurrency trade would have been reflected in the exchanges previously based on the region, like Binance, OKEx, and Huobi. However, looking at the recent volume data, there hadn’t been a meaningful impact.

Weekly spot volume, USD. Source: Cryptorank.io

The chart above shows that ‘Asia-based’ exchanges remain dominant, while Coinbase, Kraken, and Bitfinex come nowhere near their trading activities.

Steve Anderson is an Australian crypto enthusiast. He is a specialist in management and trading for over 5 years. Steve has worked as a crypto trader, he loves learning about decentralisation, understanding the true potential of the blockchain.

Home

Home News

News