- In November 2020, the Eth 2.0 launch process began. Because of the network’s transition to proof-of-stake, ETH is likely to become a deflationary asset

- The concentration of block manufacturing is an evident trade-off for this level of scalability

- They obtain a chain where block production is still centralized, but block validation is trustless and highly decentralized, Buterin added, and specific anti-censorship magic stops the block producers from filtering

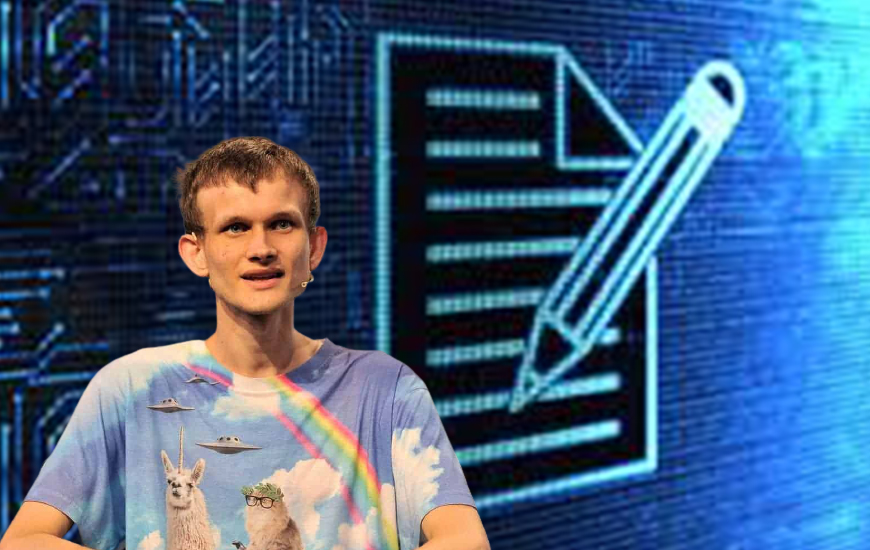

In November 2020, the Eth 2.0 launch process began. Because of the network’s transition to proof-of-stake, ETH is likely to become a deflationary asset. Vitalik Buterin, the co-founder of Ethereum, has articulated his vision for Eth 2.0’s plausible trajectory, presenting a future in which the world’s largest smart-contract platform may scale while maintaining high standards of trustlessness and censorship resistance. Buterin proposed a thought experiment for how the average huge blockchain defined by very high block frequency, high block size, and thousands of transactions per second may still be considered adequately trustless and censorship-resistant in a Monday article titled Endgame.

ALSO READ: CRYPTO MARKET SWOOP TENDS MEME-COINS LOSE BILLIONS

The concentration of block manufacturing is an evident trade-off for this level of scalability. Buterin’s proposals, as outlined in the blog post, do not address the issue of centralization, but they do provide a roadmap for implementation. Buterin proposed the second tier of staking, with low resource requirements, to perform distributed block validation; introduce either fraud-proof or ZK-SNARKS to let users directly check block validity, and introduce data availability sampling to let users check block availability add secondary transaction channels to prevent censorship.

They obtain a chain where block production is still centralized, but block validation is trustless and highly decentralized, Buterin added, and specific anti-censorship magic stops the block producers from filtering. Even with the adoption of so-called rollups, which are layer-two solutions that process transactions outside of the main Ethereum chain, Buterin stated that block production will remain centralized. No single rollup comes close to capturing the majority of Ethereum activity. Instead, they’re all limited to a few hundred transactions per second, he explained. While rollups may appear to help with distributed block creation, decentralization may not be sustainable due to the possibility of cross-domain maximal extractable revenue, or MEV.

The maximum amount of value that can be generated via block production in addition to ordinary block rewards and gas taxes is referred to as MEV. Regardless of the network’s path to scalability, the Ethereum co-founder came to the conclusion that block production will most likely become centralized.

According to him, the advantage of Ethereum’s rollup-centric roadmap is that it is open to all futures. Since November 2020, when the protocol first began its gradual shift to proof-of-stake, there has been a lot of buzz around Ethereum. In August of this year, the much anticipated London hard fork was implemented, putting ETH on pace to become a deflationary asset. EIP-1559, a hard fork that intends to improve the network’s fee market, was implemented as part of the hard fork. Since the EIP-1559 went into force, approximately 1 million ETH has been burned.

Steve Anderson is an Australian crypto enthusiast. He is a specialist in management and trading for over 5 years. Steve has worked as a crypto trader, he loves learning about decentralisation, understanding the true potential of the blockchain.

Home

Home News

News