- Crypto scams have spiked 81% this year to an all-time high of $7.7 billion

- Rug pulls have efficiently been able to scam investors of their crypto

- DeFi in go-to scam has increased multifold over the last few years

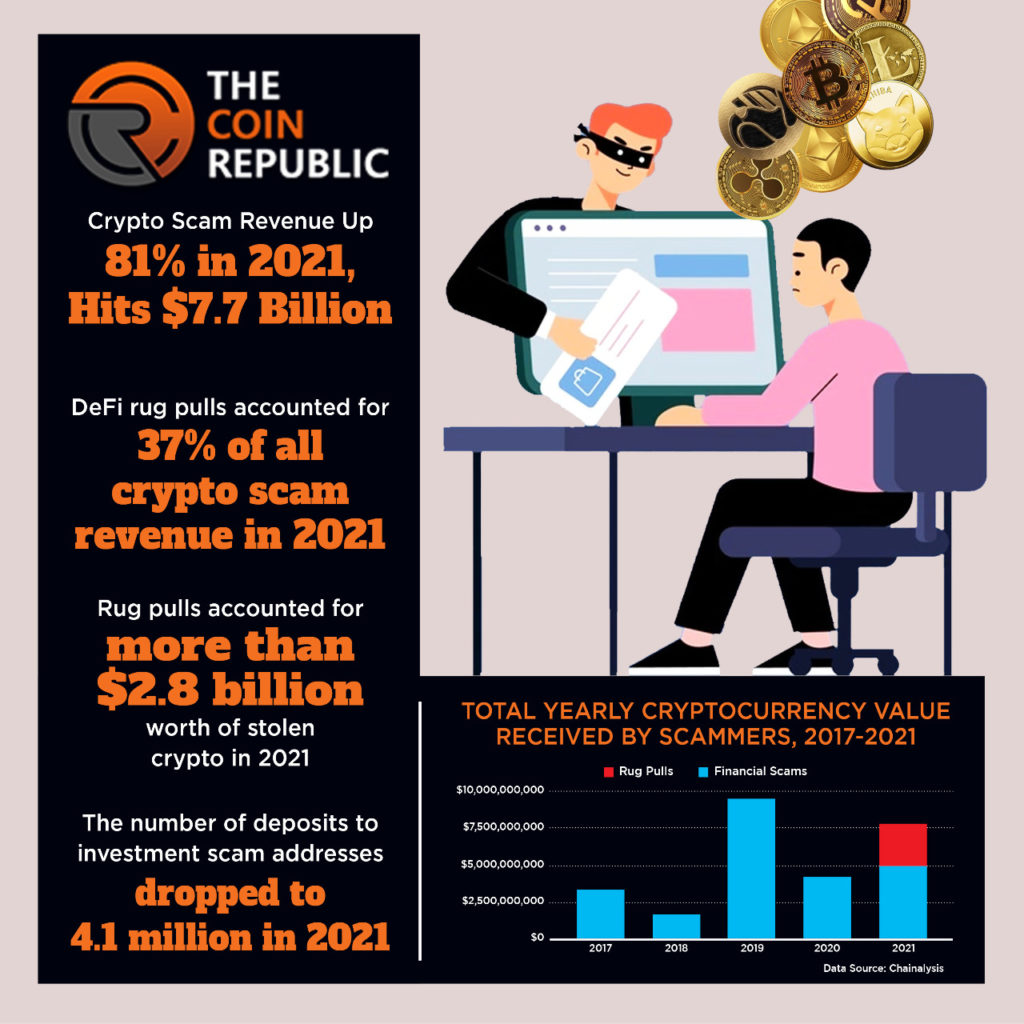

Digital money tricksters overall pulled in almost $8 billion in income in 2021, driven by a moderately new strategy called mat pulls, as per Chainalysis. Income from tricks bounced by 81% from a year prior to $7.7 billion in digital currency, the blockchain information stage said Thursday in a blog entry that will be essential for its bigger Crypto Crime report coming in 2022.

As the biggest type of cryptographic money-based wrongdoing and one interestingly designated toward new clients, defrauding presents probably the greatest danger to digital currencies proceeding with reception, said Chainalysis.

Crypto biological system

The current year’s income flood was pushed to some degree by the rise of mat fittings that leave financial backers in crypto-projects with basically nothing.

They have turned into the go-to trick in the decentralized money, or DeFi, biological system, Chainalysis said. In those plans, engineers of a cryptographic money project — normally another token — out of the blue forsake it and take clients’ assets with them.

Floor covering pulls represented 37% of all cryptographic money trick income this year contrasted and 1% in 2020 and left casualties without $2.8 billion worth of their digital currency.

Rug pulls are common in DeFi on the grounds that with the right specialized ability, it’s modest and simple to make new tokens on the Ethereum blockchain or others and get them recorded on decentralized trades (DEXes) without a code review, said Chainalysis.

Scammers increase in numbers

While code reviews that would get these weaknesses are normal in the space, they’re not needed to list on most DEXes, consequently why we see so many mat pulls.

The current year’s biggest floor covering pull, nonetheless, didn’t begin as a DeFi project, it said. Thodex was an enormous Turkish unified trade whose CEO vanished not long after the trade ended asset withdrawals by clients, the report said. Clients lost more than $2 billion worth of cryptographic money or almost 90% of all worth taken in Rug pulls.

The second-biggest Rug pull of 2021 was AnubisDAO, at more than $58 million worth of cryptographic money taken. While absolute trick income expanded essentially in 2021, it remained level in the event that we eliminate Rug pulls and break point our examination to venture tricks — even with the rise of Finiko.

Simultaneously however, the quantity of stores to trick tends to tumble from just shy of 10.7 million to 4.1 million, which we can expect implies there were less individual trick casualties.This likewise lets us know that the normal sum taken from every casualty expanded.

Also read: Sotheby rakes $100 million profit from NFT auctions

Tricksters’ tax evasion procedures, nonetheless, haven’t changed too a lot. Like earlier years, most digital currency sent from trick addresses wound up at standard trades.

The normal monetary trick was dynamic for only 70 days in 2021, down from 192 of every 2020. Thinking back further, the normal digital currency trick was dynamic for 2,369 days, and the figure has moved consistently downwards from that point forward. One justification for this could be that agents are improving at examining and arraigning tricks.

For example, in September 2021, the CFTC recorded charges against 14 venture tricks promoting themselves as giving consistent cryptographic money subsidiary exchanging administrations — a typical trick typology in the space — though truly they had neglected to enlist with the CFTC as prospects commission dealers.

Beforehand, these tricks might have had the option to keep working for longer. As con artists become mindful of these activities, they might feel more strain to quit for the day prior to drawing the consideration of controllers and law implementation.

Steve Anderson is an Australian crypto enthusiast. He is a specialist in management and trading for over 5 years. Steve has worked as a crypto trader, he loves learning about decentralisation, understanding the true potential of the blockchain.

Home

Home News

News