- The data from Delphi Digital reveals that while many layer one ecosystems struggle to regain their momentum, Terra (LUNA), Avalanche (AVAX) and Ethereum (ETH) have witnessed a sharp increase in their prices.

- An integration with Wirex, Terra’s second lock drop event, the announcement of the Luna Foundation Guard, and DeFi Kingdoms to get launched on the Avalanche network, are some of the factors that contributed to the growth of Terra and Avalanche ecosystem.

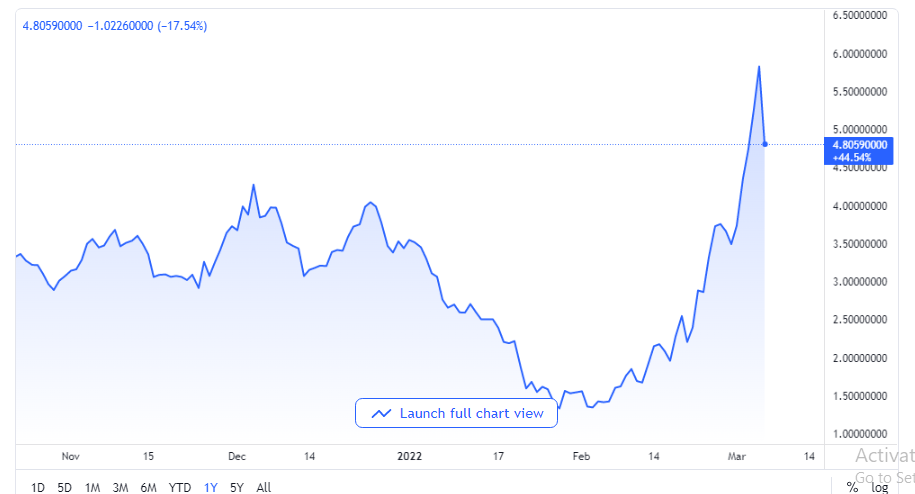

- While the release of interchain and superfluid staking on March 1 helped increase the price of Osmosis. According to data from Delphi Digital, Osmosis has outperformed its major counterparts.

As the investors search for new opportunities in the Cosmos(ATOM), Fantom(FTM), and NEAR, the layer-one (L1) ecosystem has come into the spotlight in the crypto sphere.

However, most of the L1 were found to be struggling to ride back on momentum following the market sell-off in January, as the price of Bitcoin dropped to below $34,000.

As per the data from Delphi Digital, Terra (LUNA), Avalanche (AVAX), and Ethereum (ETH) are the only L1 to experience a significant rise in their prices.

Factor Behind The Growth Of Terra Ecosystem

The announcement of the Luna Foundation Guard that helped raise funds worth $1 billion to form a Bitcoin reserve for the Terra USD (UST) stablecoin of the ecosystem, is being hailed as the biggest reason behind the price boost in LUNA.

Another factor that increased the demand for LUNA Token is the launch of Terra’s second lock drop event.

The Terra-based platform that is a major avenue for minting UST through pledging LUNA or Ether, Anchor Protocol (ANC) also benefited from the $1 billion in reserves for UST. Terra’s another announcement that its developers are working on integrating AVAX as a collateral option for creating UST, acted as an accelerator to Anchor’s price.

According to the data from TradingView, on March 2nd, the price of ANC rose by 268% and hit a daily high at $4.35, where it stopped at a major resistance level.

An integration with Wirex and the news of DeFi Kingdoms to get launched on the Avalanche network were other factors that contributed to the growth of the ecosystem since late January.

“AVAX seems to move with a higher correlation to BTC relative to other L1s,” stated Delphi Digital looking at its recent price performance.

ALSO READ: Digihost Aims to Triple Capitalization With $250M Share Offering

What’s Driving Osmosis Towards More High?

The data from Delphi Digital, a decentralized exchange in the Cosmos ecosystem, Osmosis has surpassed its fellow major counterparts and that too by a huge margin

Cosmos that had a great end to the year 2021, as the practical benefits of the thesis of interoperable app-chains have finally begun to appear, played a great role in the price rise of OSMO.

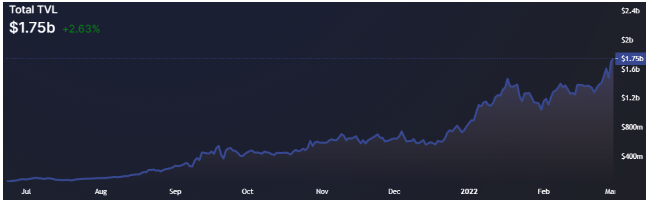

According to the data from DefiLlama, with $1.75 billion in total value locked, Osmosis is now the largest decentralized exchange in the Cosmos ecosystem and backs 37 separate IBC chains.

The release of interchain and superfluid staking on March 1 also contributed to the price increase of Osmosis. The interchain and superfluid staking enables liquidity providers (LP) on the Osmosis DEX to earn rewards for the assets through which they provided liquidity, hence allowing users to do both staking and LP at the same time for the first time.

Andrew is a blockchain developer who developed his interest in cryptocurrencies while pursuing his post-graduation major in blockchain development. He is a keen observer of details and shares his passion for writing, along with coding. His backend knowledge about blockchain helps him give a unique perspective to his writing skills, and a reliable craft at explaining the concepts such as blockchain programming, languages and token minting. He also frequently shares technical details and performance indicators of ICOs and IDOs.

Home

Home News

News