- VanEck claims that miners are critical to the growth of digital assets

- The ETF launch comes just a month after asset manager Valkyrie launched its Bitcoin Miners

- The fund is set to track the MVIS Digital Assets Mining Index

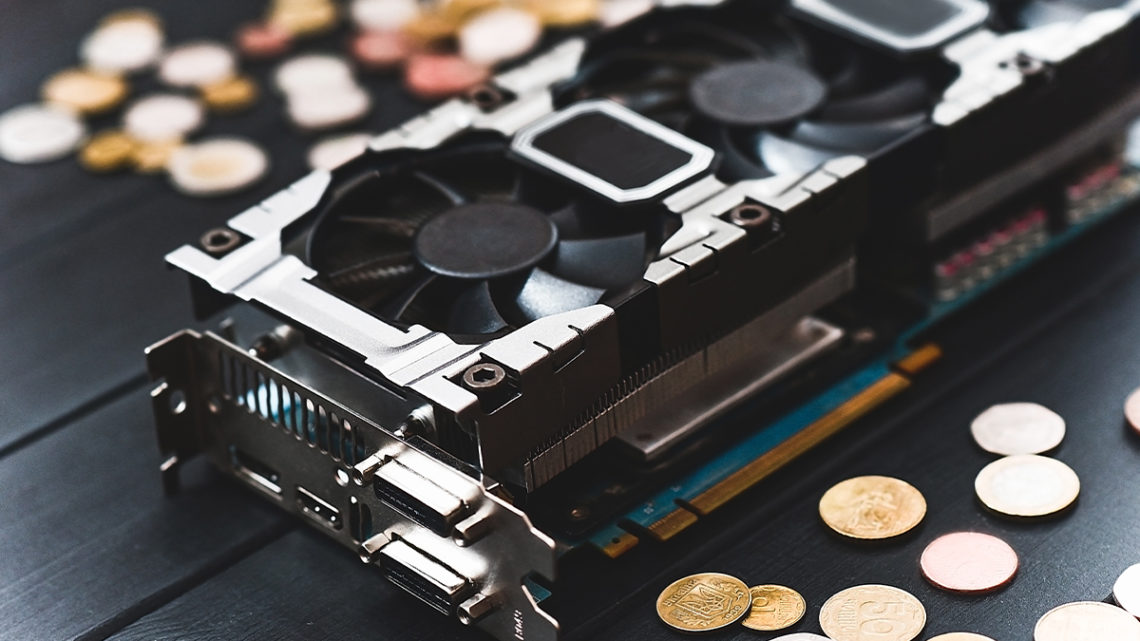

VanEck’s Digital Assets Mining ETF (DAM) really got started Wednesday, offering designated openness to those organizations in the crypto resource mining industry.

The trade exchanged asset will contribute somewhere around 80% of absolute resources in protections of crypto diggers create or can possibly acquire no less than half of their income from mining exercises or related advances. The asset will follow the MVIS Digital Assets Mining Index and will a have net cost proportion of 0.5%

Crypto mining sector is still in the early stages of growth

Blockchains present straightforwardness, effectiveness and lower costs contrasted with customary concentrated data sets and cycles, yet without excavators, blockchain exchanges can’t be checked and reviewed, making their job significant, VanEck Head of Product Management Ed Lopez said in a proclamation on Wednesday.

The ETF send off comes simply a month after resource administrator Valkyrie sent off its Bitcoin Miners ETF (WGMI), zeroing in on excavators that principally depend on sustainable power. That asset fell over 10% since its commencement on Feb. 8, generally in accordance with decreases in different diggers and the cost of bitcoin (BTC).

It’s a convincing time for VanEck to send off the asset, said Lopez, as the crypto mining area is as yet in the beginning phases of development, and he anticipates undeniable degrees of interest from financial backers for a wide range of advanced resources.

ALSO READ: Louisiana Bill Seeks to Lay Rules for Cryptocurrency Political Donations

VanEck has a futures-based bitcoin ETF product

The top possessions of the asset incorporate excavators, mining producing organizations, hopeful mining makers and a blockchain-centered bank.

The biggest weighting is Riot Blockchain (RIOT) at around 11%, trailed by Hut 8 Mining (HUT) at 9.1%, Marathon Digital (MARA) at 8.3%, Iris Energy (IREN) at 7% and Canaan (CAN) at 6.5%.

Balancing the main 10 property are Hive Blockchain (HIVE) at 6.3%, Northern Data (NB2.GR) at 5.8%, Block (SQ) at 5.7%, Bitfarms (BITF) at 5.6%, and moneylender Silvergate Capital (SI) at 4.8%.

VanEck additionally has a prospects based bitcoin ETF item it sent off in mid-November, the Bitcoin Strategy ETF (XBTF), as well as its Digital Transformation ETF (DAPP). The organization’s spot bitcoin ETF was one of a few dismissed by the Securities and Exchange Commission.

Andrew is a blockchain developer who developed his interest in cryptocurrencies while pursuing his post-graduation major in blockchain development. He is a keen observer of details and shares his passion for writing, along with coding. His backend knowledge about blockchain helps him give a unique perspective to his writing skills, and a reliable craft at explaining the concepts such as blockchain programming, languages and token minting. He also frequently shares technical details and performance indicators of ICOs and IDOs.

Home

Home News

News