- Lido is constantly surging in spite of a plunging cru\yptocurrency market, and have witnessed a surge in its Total Value Locked (TVL) since March.

- The dApp (Decentralized Application) has a Total Value Locked of around $16.35 Billion as this article was being written.

- Chains with majority of value locked in Lido Finance are Solana, Ethereum, and Terra, where Three Arrows Capital injected a sum recently.

Lido’s New Peak

In spite of a dive in Total Value Locked in DeFi during 2022, Lido Finance is constantly witnessing a surge in its TVL since the commencement of March this year.

Lido Finance remains a vital element in the DeFi sector this year, as per the latest research, the protocol has attained 18% in Total Value Locked since the very first day of March.

On March 1, Lido Finance had a Total Value Locked of $13.83 Billion, and this surged to a roundabout of $16.43 Billion on 23rd March.

Lido Finance is a liquidity staking protocol with the objective of escalating the staking economy. It operates by enabling users to stake their assets for receiving staking rewards on a daily basis.

There is no minimum limit regarding how much an individual can stake, and they are allowed to stake any number of tokens they desire to.

With Lido Finance, numerous users are utilizing their tokens as collateral for yield farming as well as lending, amongst others. Some of the apps and facilities which were blended with Lido involve but are not restricted to StakeEther, Curve, MakerDAO, Ledger, Anchor Protocol, SushiSwap Onsen, and 1Inch.

What’s The Reason Behind This Surge?

Chains with the majority of shares in TVL are Terra, Solana, and Ethereum.

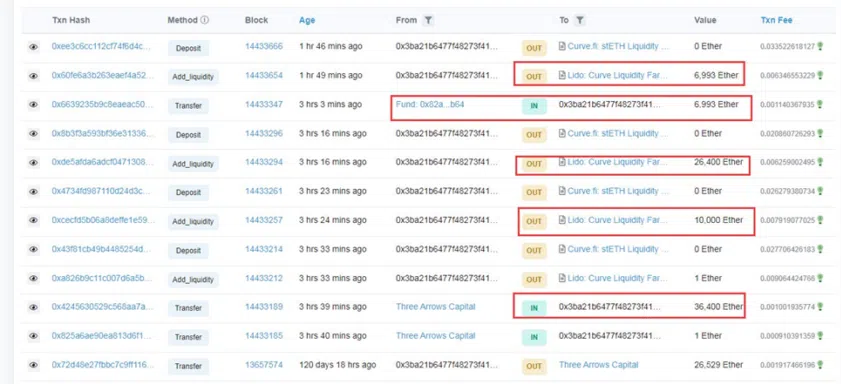

For Ethereum, a data tracker exhibited that Three Arrows Capital has injected around $22.43 Million, which is equal to 7,500 ETH from Deribit and FTX.

The Three Arrows Capital address (0x4862733B5FdDFd35f35ea8CCf08F5045e57388B3) has inflowed 7,500 ETH in the past seven hours, with a total value of about $22.43m; of which 5,500 ETH was withdrawn from FTX and 2,000 ETH was withdrawn from Deribit. https://t.co/27A1u6o4su

— Wu Blockchain (@WuBlockchain) March 22, 2022

On a similar day, via a 3rd party Ethereum wallet, “Curve stETH Pool” on Lido got a minimum of 36,401 ETH worth around $110 Million from Three Arrows Capital.

This automatically qualified the hedge fund manager based in Singapore to get a minimum of 36,401 staked Ether from Lido Finance.

As this article was being written, Ethereum had the major command over TVL, having an $8.48 Billion Total Value Locked.

In the case of Terra, total stakers have escalated 223,733 on 13th March to 230,159 on 24th March.

Terra is second after Ethereum in terms of command over TVL, having $7.77 Billion in Total Value Locked.

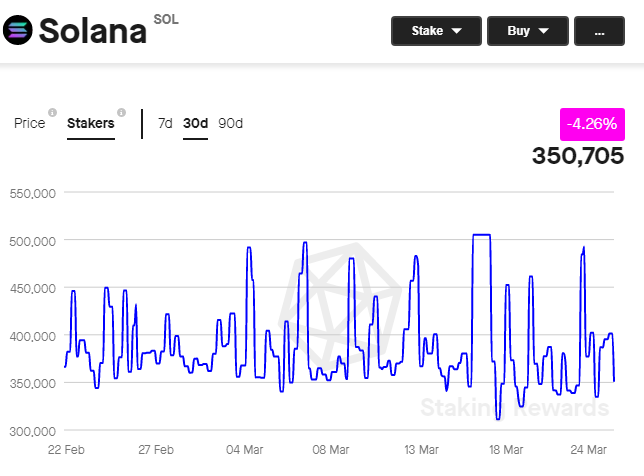

In the case of Solana, total stakers escalated from 311,419 on March 18 to 350,705 on March 24. Solana has command on $318.82 Million in overall Total Value Locked on Lido Finance.

Activities on the above-mentioned chains are majorly accountable for a surge in TVL in Lido Finance.

As this article was being written, LDO was trading at a market price of $3.62, bullish by 1.19% in the past 24 hours.

ALSO READ: Krafton, PUBG Developer, Collaborates With Solana For NFT and Blockchain Games

Steve Anderson is an Australian crypto enthusiast. He is a specialist in management and trading for over 5 years. Steve has worked as a crypto trader, he loves learning about decentralisation, understanding the true potential of the blockchain.

Home

Home News

News