The famous crypto analyst put some facts regarding the recent upwards movement in bitcoin instead of tightened economic situations

Nicholas Merten, a crypto analyst and YouTuber, claimed that the recent upside rip in the market involved big crypto players. While streaming a new strategy session on his youtube channel DataDash, Nicholas told his 514K subscribers that giant institutional investors and whales are not selling their bitcoin. No matter how the uncertain geopolitical situations affect the macroeconomic and financial situations, holding the asset instead of selling it resulted in a sudden rise in BTC price.

The analysts continued to state that the macro environment has faced several scares over the past few months, including the interest rate hikes by the Federal Reserve to initiate economic tightening in order to curb inflation. Same time, a few cases of the Covid-19 pandemic were encountered again, and on top of that, the latest hit was the Russia-Ukraine War and the subsequent sanctions on the country by western and European countries.

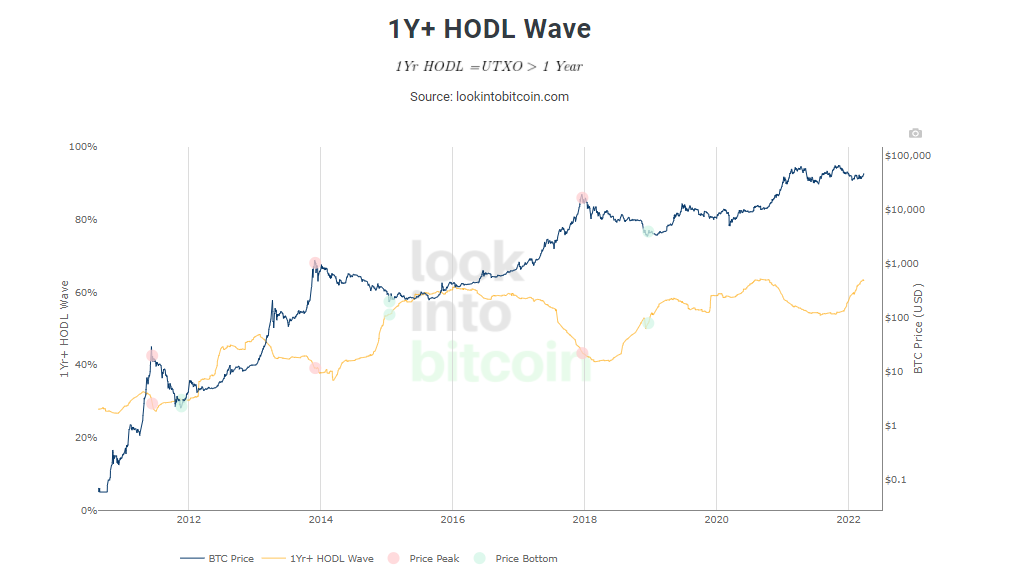

These different issues combined made many retail investors and general people pessimistic and made them think that the prominent investor, whales, and institutions would be selling their positions. But on the contrary, to their surprise, no whale has been noticed or reported dumped. Instead, the market continued accumulation to either hold or buy more, which was proven throughout the HODL wave past year. The wave has been in a sleepy state for the last year.

The Analyst explained that whales had been consistently adding crypto to their profile over the last six months. On the other hand, leveraged and short-term traders turned out to be responsible for price fluctuations. A return of almost 10% from September and October last year came towards where it is at the March-end. For a time, there was nothing, and then for a couple of months, whales bought more and held their positions. The volatility in the market seemed likely to get short-term traders and leveraged traders in the liquidation direction.

In the conclusion of his analysis, asserting again his opinion, which he has held for a long now, that BTC is still not in the bear market even though the flagship cryptocurrency is down by almost 50% from its all time high of $69K.

He said that supply contradictions usually drive these trends regarding the price drop. Whenever there are higher lows in price seen over last year and a fall, that is the indication that the trend is still not and that it’s not a bear market.

Steve Anderson is an Australian crypto enthusiast. He is a specialist in management and trading for over 5 years. Steve has worked as a crypto trader, he loves learning about decentralisation, understanding the true potential of the blockchain.

Home

Home News

News