- Rollout of Ethereum 2.0, includes a transition of proof of work algorithm to Proof of stake algorithm which will supposedly change Ether (ETH).

- Delays in Ethereum network updates are not new and so far, instant effect in Ether’s value following the reveal remains minimal.

- Here is what numerous researchers have stated regarding what this merger means for Ethereum and how this recent delay may influence ETH value going forward.

Short Term Blessing For Staking Rewards?

As per a data, there are at present over 10.9 million ETH staked on Beacon Chain, providing gross staking reward of 4.8%. As per a recent report, by a data provider, this staking level provides verifiers a window for net staking yield on 10.8%.

Current amount staked is equaling 9% of Ether’s circulating supply but many obstacles involving inability for withdrawal of staked Ether or any reward from Beacon Chain have restricted more broader involvement.

In post Merge world, Staking Rewards, a data provider, expects that total staked Ether will escalate between 20 to 30 Million Ether, which eventually would yield a net validator staked return of 4.2% to 6%.

Hayes Favors Ethereum Bonds

Arthur Hayes, previous BitMEX CEO says that, indigenous rewards issued to verifiers in form of ETH-based issuance as well as network fees for staking Ether in verifier nodes renders Ether a bond.

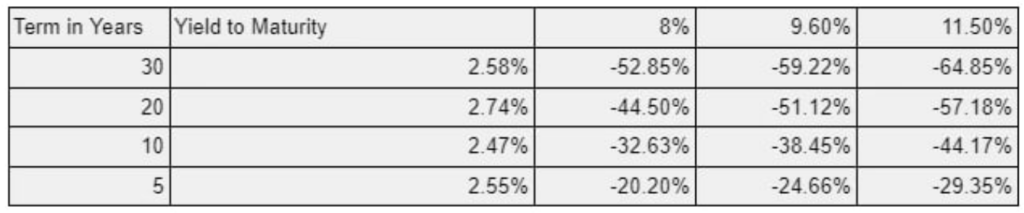

Hayes offered a chart, illustrating how much value Ether might lose while investors still break even Vs. US bond market.

As per this chart, if staking rate is 8%, Ether price could slip 32.6% and still remain equal to a 10 year 2.5% interest bond.

With several analysts making long term Ether price predictions of $10,000 and up, there is a potential for several US bond investors to initiate seeking yield from Ether staking instead of US bond market, assuming the institutional framework required to back these kinds of investments is present and approved.

Some Trade Routes For Merge

As per ABTestingAlpha, a pseudonymous Twitter user, this is likely to be a rushed trade on long side, meaning this would be a good piece of momentum traders bagging long Ethereum into Merge.

This will assist with incremental price gains, but it is vital to remember that these traders might not hold Ether in a long run, so it is crucial to try and determine when they will sell.

Also Read: What Is Ethereum 2.0?

With present delay pushing the release in 2022’s 2nd half, there is a chance which may inflict a damage of 75% to 80% gains made by Ether since mid March.

If the Merge is delayed to the next year, sentiments are more likely to get crushed, causing momentum traders selling with few opening short positions. This appears to be the worst case scenario and may lead Ether liquidity flowing into cash and other L1 and L2 protocols.

Steve Anderson is an Australian crypto enthusiast. He is a specialist in management and trading for over 5 years. Steve has worked as a crypto trader, he loves learning about decentralisation, understanding the true potential of the blockchain.

Home

Home News

News