- Decentralized Finance (DeFi) is a notion which has gained a lot of traction since the so-called DeFi Summer of 2020 due to its utility.

- DeFi sets out to disintermediate methods conventionally operated by banks as well as monetary institutions such as market making, borrowing and lending.

- DeFi or Decentralized Finance is the framework, technology and process utilized for democratizing monetary transactions.

The Rising DeFi Sector

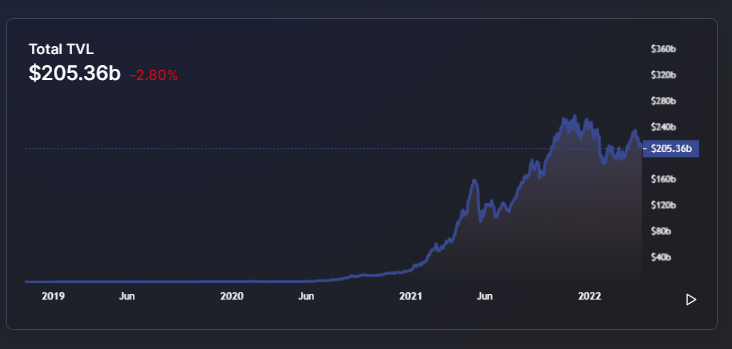

Decentralized finance (DeFi) is a notion which has gained a lot of traction since the so-called DeFi Summer of 2020 due to its usage, frequently measured in TVL, has soared considerably since that time.

During previous year alone, TVL increased by 240% to a present $205.36 Billion in value locked within DeFi projects, as per DeFi Llama. Not just has it become interesting with investors to enter into promising DeFi projects via their tokens, but also to utilize these platforms to produce a stable and regular income via several activities. And it remains more impressive in bearish markets.

TradeFi to DeFi

Simply putting, DeFi sets out to disintermediate methods conventionally operated by banks and monetary institutions such as borrowing, market making, and lending by eliminating intermediaries.

It enables investors to directly interact with each other on a P2P basis by offering loans or liquidity for trading and assume such functions in return for producing fees, albeit while also carrying threats.

Usual factors utilized to to classify TradeFi sector involves that it is based upon trust, as folks are required to trust their banks as a single counterparty, big obstacles remain for taking the system, as several surfacing countries still have population where 50% to 70% are still unbanked, and they are also slow, costly and not not very client friendly.

Components Of DeFi

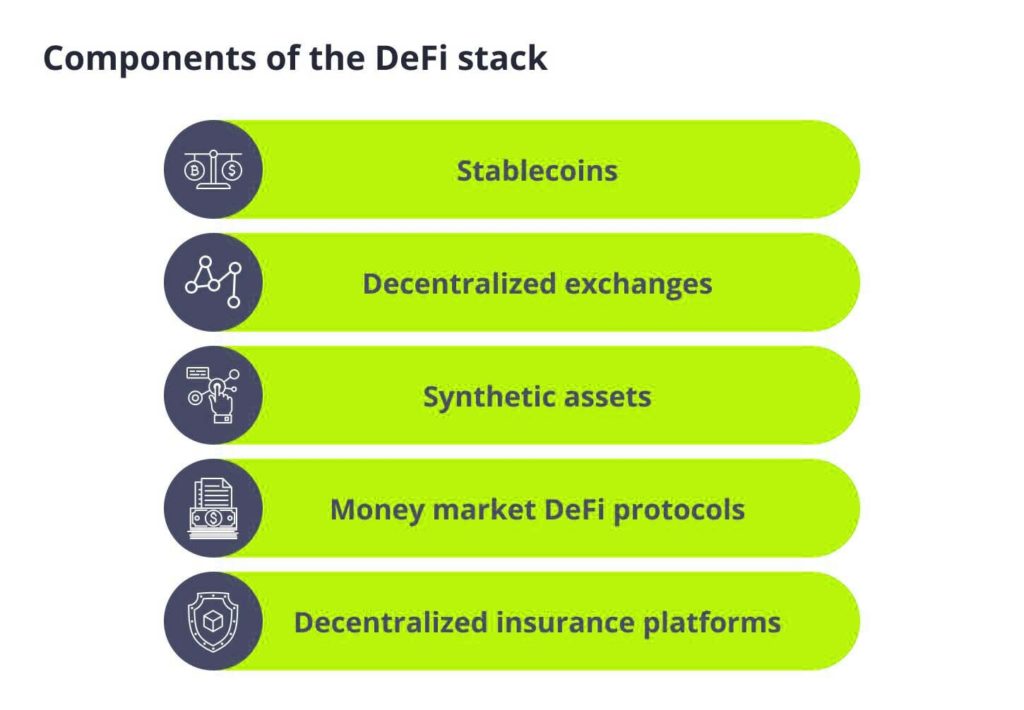

Watching towards DeFi as a whole, much like developing a house, folks have several layers which come together to create a latest virtual service offering.

Utilizing the house as an instance, initial layer, underpinning blockchain tech which might be Solana or Ethereum (L1 protocols,) is similar to a basement or cellar.

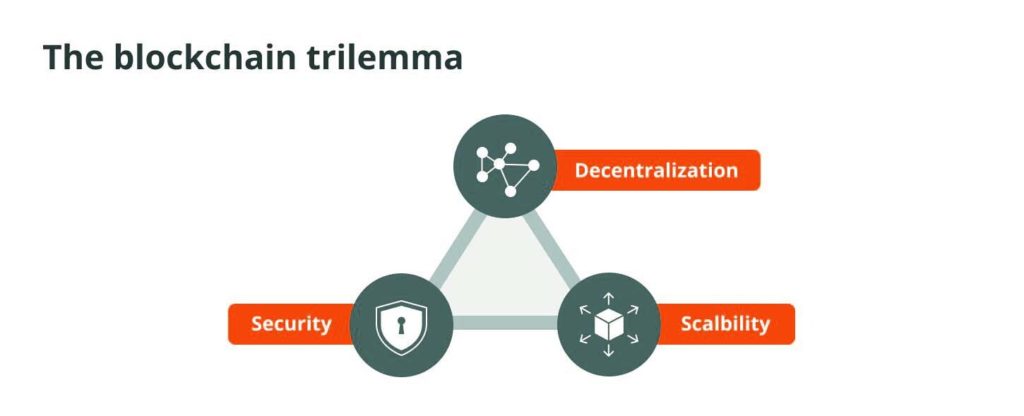

Depending on which blockchain is utilized, folks are required to make certain trade offs, which is the so-called blockchain trilemma, a phrase given by Vitalik Buterin, founder of Ethereum.

Imagine a triangle with decentralization, security, and scalability at all every edge. Folks can optimize a couple of corners while making a compromise on 3rd edge.

On top of basement, there are walls, that are respective protocols, called dApps which offer DEXs like UniSwap or Curve, lending protocols such as Maker or Aave, derivative liquidity protocols such as Synthetix and more. A sector which is continuously developing and growing.

Where Should We See?

First of all, we should ask if the team is anon or known, their practical and technical background.

Technically, we need to look for any hacks occurred previously, are there any 3rd party smart contract audits accessible.

We need to look for any rewarded governance tokens, what’s the present TVL and how are growth numbers associated with active users and assets.

Regarding pools, we should look for APYs, whether if they are insanely big, or are stable. Apart from this, folks need to check that how much trading liquidity is there i the pool, threat of impermanent loss, transaction fees or lockup periods.

Steve Anderson is an Australian crypto enthusiast. He is a specialist in management and trading for over 5 years. Steve has worked as a crypto trader, he loves learning about decentralisation, understanding the true potential of the blockchain.

Home

Home News

News