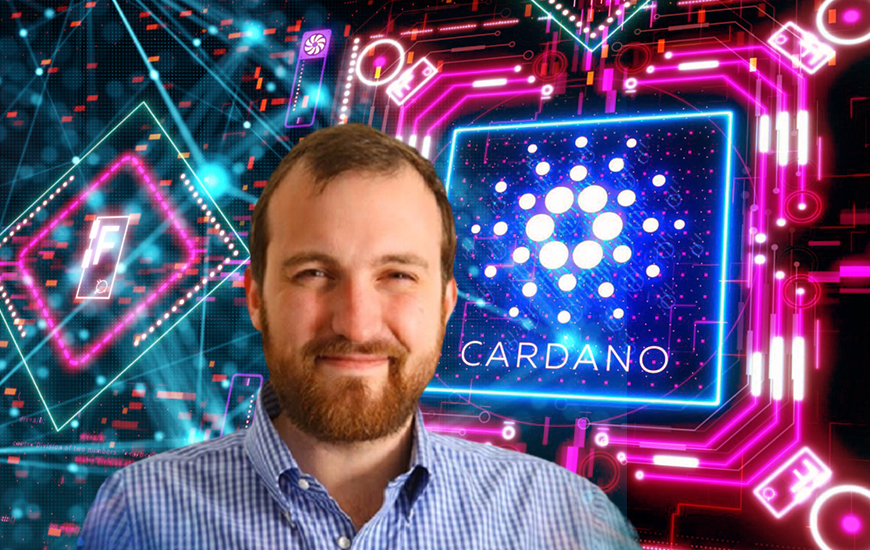

- Cardano chain founder Charles Hoskinson has proposed a clarification to the present breakdown of Terra’s stablecoin

- The organizer behind IOHK asserted that Cardano-based stablecoin Djed is all around shielded from losing its dollar stake

- Hoskinson accepts that LUNA’s accident was the aftereffect of cryptocurrencies looking out of the blue

In the interim, LUNA has figured out how to set up a battle. In the wake of falling underneath $1, the coin flooded to the $5 zone however at that point again went down. At press time, it is exchanging at $2.14, down 92.4%.

He expressed that an assault like that could be pulled off by anybody from programmers to dealers. A little adventure is sufficient to break it and succeed, Hosk tweeted. Whenever asked by a Twitter client how the Djed stablecoin in view of Cardano can try not to lose its USD stake, Hoskinson gave a short answer: Overcollateralization.

Djed is likewise an algorithmic stablecoin, as UST; in any case, its calculation depends on a 400%-800% security proportion for Djed and Shen (Djed’s hold coin). Through this, Djed’s collateralization instrument is decentralized and upheld by clients who mint Shen and put ADA into the liquidity pool.

Steady accumulation

In this way, the pace of collateralization stays pretty much steady. Conspicuous Bitcoin maxi Max Keiser accepts that Cardano’s ADA may before long continue in the strides of LUNA and crash, as indicated by his new tweet.

At the time that the tweet was distributed, ADA dropped 11.5%. While our primary objective is to issue stablecoin for ventures and vendors on COTI’s Trustchain, we additionally anticipate being associated with stablecoin gave on different chains.

Our involved acquaintance with Cardano, prompting a value speculation by their biological system reserve, has set out the freedom for COTI to turn into the authority guarantor for Djed, Cardano’s stablecoin.

Cardano stablecoin strategy

Being the guarantor of Djed, COTI takes on the obligation of distributing the shrewd agreements for the stablecoin and being the front end drawing in with reserves, ventures, designers and other people who wish to mint both the stablecoin and the hold coin utilized as a component of the fixing calculation.

As the supplier of this assistance, COTI gathers charges on both the stamping and consuming of Djed and of the hold coin.

Also read: Bitcoin Kimchi Premium served cold after heat up, drops 3%

We anticipate that the Djed Issuance collected expenses will be significant, as Cardano is the third biggest currency with regards to showcase capitalization and furthermore on the grounds that Djed will at last be utilized for all the exchange charges installment on Cardano.

Beating LiquidX and AUSD to the (testnet) punch is Djed, which portrays itself as a decentralized, algorithmic stablecoin that is based on Cardano.

Algorithmic stablecoins accomplish cost soundness and circling supply balance through fixing to a hold resource. For Djed’s situation, the hold resource is the Shen token. Through the Shen token, variances in the cost of ADA are counterbalanced by Shen covering shortages and ensuring the collateralization rate.

Andrew is a blockchain developer who developed his interest in cryptocurrencies while pursuing his post-graduation major in blockchain development. He is a keen observer of details and shares his passion for writing, along with coding. His backend knowledge about blockchain helps him give a unique perspective to his writing skills, and a reliable craft at explaining the concepts such as blockchain programming, languages and token minting. He also frequently shares technical details and performance indicators of ICOs and IDOs.

Home

Home News

News