- Wealthy individuals in Asia think highly of cryptocurrency, with a research showing that 52% of the investors in Asia have invested in crypto.

- The website accountable for research said that this study was organized with over 3,200 customers across different Asian nations.

- Though half of the Asian investors were holding digital assets during the first quarter of 2022, the percentage is expected to grow by the end of this year.

Asians Love Investing In Crypto

Affluent investors are ahead and are abundant about investing in crypto, with an analysis by Accenture showing that 52% of them include crypto in their portfolios during the initial quarter of 2022.

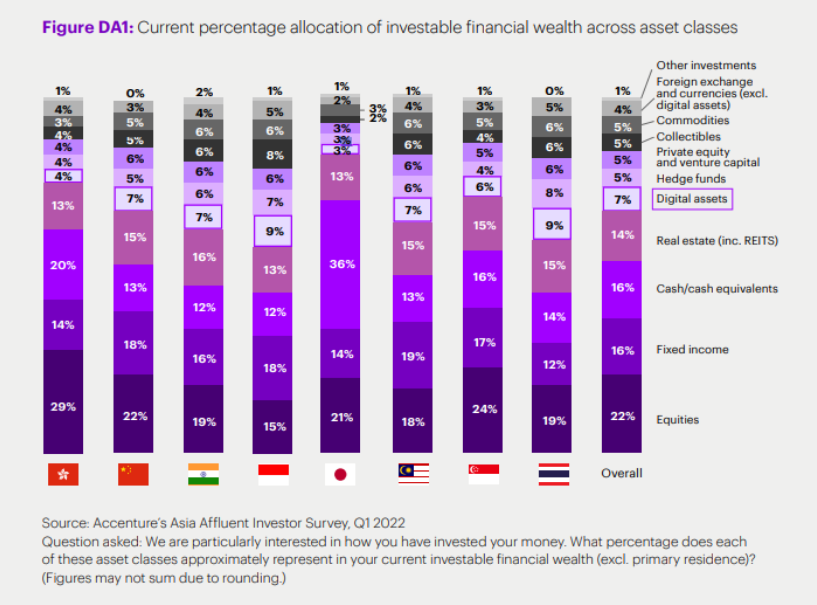

As per the research, virtual assets including crypto funds, digital assets and stablecoins, made up 7% on average of the surveyed investor portfolios, rendering it the 5th largest asset class for Asian investors.

Accenture stated that this survey was carried out with over 3,200 clients across Thailand, Singapore, Malaysia, Japan, Indonesia, India, Hong Kong and China. The organization defines an affluent investor as the one having invested between $100,000 to $1 Million.

Investors in Indonesia and Thailand contain the largest percentage of virtual assets in their portfolios in contrast to their peers.

Hesitant Wealth Managers

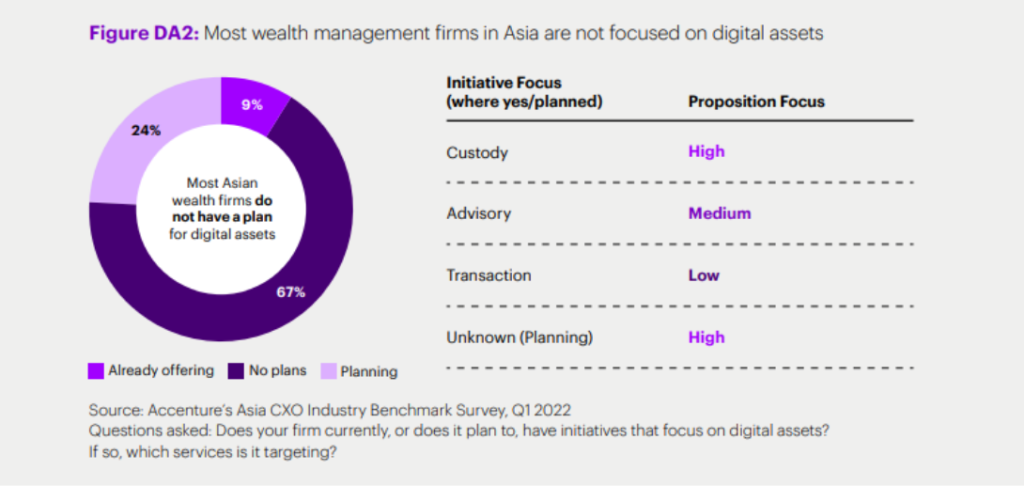

However, the organization discovered in the study that wealth management organizations, the ones offering estate planning, investment counsel, tax, monetary planning to their clients are slow to onboard crypto flight.

67% of the wealth management organizations made it clear that they do not have any strategies to offer digital asset services or products.

Wealth management organizations cited a scarce belief and knowledge of crypto assets, a wait and watch mindset, and the operational complication of releasing a digital asset offering as a prime cause for retaining, making them turn towards other initiatives instead.

Accenture stated that scarce engagement by the organization means they have to rely on unreliable sources in terms of cryptocurrency counseling.

It said in the report that the scarce engagement by the organizations means that several clients are getting counseled from unregulated forums, including P2P advice on social media.

However, Accenture emphasized that importance of wealth management organizations to drive ahead into the digital asset sector, or risk being left behind.

Back in April, a report issued by Winklevoss Twins’ Gemini exchange discovered that cryptocurrency adoption boomed back in 2021, specifically in nations such as India and Hong Kong.

Nancy J. Allen is a crypto enthusiast, with a major in macroeconomics and minor in business statistics. She believes that cryptocurrencies inspire people to be their own banks, and step aside from traditional monetary exchange systems. She is also intrigued by blockchain technology and its functioning. She frequently researches, and posts content on the top altcoins, their theoretical working principles and technical price predictions.

Home

Home News

News