- The Defi market is under an existential crisis during Q2.

- Inverse Finance and Rari have witnessed crypto hacks worth $1.2 million and $11 million respectively.

- Q2 also brought a decline in the Defi market capitalization by 74.6%.

The Defi Existential Crisis

It’s old news that the Defi market is amidst an existential crisis. Crypto trading volume went down to reach its lowest in 12 months. The crashing of NFT trading volume 26% below its peak was also witnessed in June this year. This refers to the fact that the volume has fallen to $7.6 billion as of this writing. It got supplemented by the NFT floor price collapsing in the Defi market.

Q2 also initiated a decline in the Defi market capitalization by a whopping 74.6%! Once booming with $142 million, the market is now on its knees with just $36 million worth of market cap. And that’s not all. The on-chain crypto activities are slowed down drastically. A major reason for this market condition is the collapse of prominent stablecoins such as TerraUSD Classic, commonly referred Terra USTC. Despite the existential crisis, the Defi market has few urgent problems, the most important being the sudden uprise in Defi exploits. Inverse Finance and Rari have witnessed crypto hacks worth $1.2 million and $11 million, respectively.

The Dawn of Hope

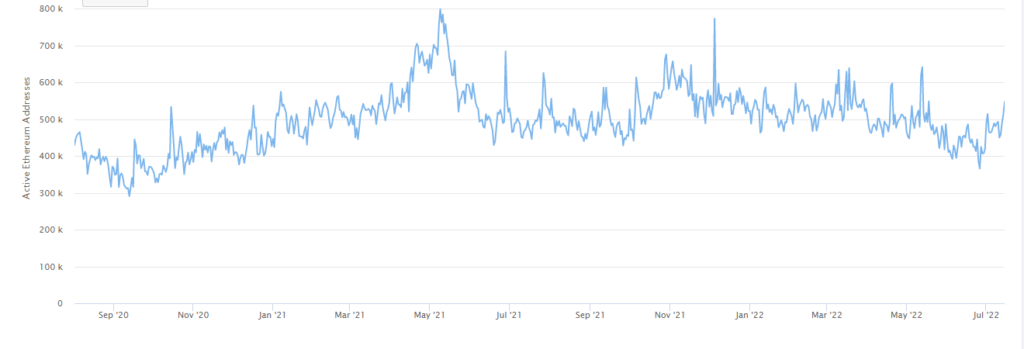

Even after that, the user activity still, is pretty resilient. The daily Defi market user count has only decreased by 34.5%, from 50,000 to 30,000 this quarter. There are instances when sudden spikes appear in the Defi activity chart, leading to an instantaneous surge in the user activity.

An important spike occurred in May 2022. This is when Terra, along with its USTC, collapsed. The reason is that whenever there is a massive decrease in the demand for a coin, most users sell their crypto in markets like Uniswap and Curve Finance. This accounts for the increased user activity. Another hike was shown in June 2022 around the time of Celsius’s bankruptcy filing.

This sends us a message: “When Centralized entities fail, Users capitalize on Defi’s permissionless ecosystem.”

Andrew is a blockchain developer who developed his interest in cryptocurrencies while pursuing his post-graduation major in blockchain development. He is a keen observer of details and shares his passion for writing, along with coding. His backend knowledge about blockchain helps him give a unique perspective to his writing skills, and a reliable craft at explaining the concepts such as blockchain programming, languages and token minting. He also frequently shares technical details and performance indicators of ICOs and IDOs.

Home

Home News

News