Bestselling author puts up warning Bonds market could crash and also anticipated to buy Bitcoin once price go down.

Author of ‘Rich Dad, Poor Dad’ —Robert Kiyosaki—often seen to show his concern about economic situations in the United States and all over the world, while also criticizing the US government policies for creating such circumstances. On friday, Kiyosaki tookon Twitter and showed his concerns about the US bond market crash.

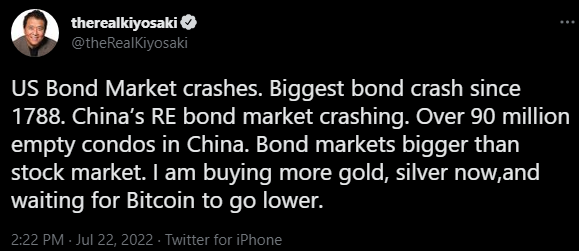

On 22nd July, Robert Kiyosaki, in his tweet stated that the United States Bond market is crashing. He compared his anticipated crash with the bond crash of 1788 and said that the recent bond crash would be the biggest since then. He emphasized that bond market in the United States is far bigger than their stock market.

Kiyosaki said that he is upto buying more assets like gold and silver. Further he also wished to buy bitcoin (BTC) if its price gets lower. The bestselling author also outlined the crashing real estate market in China. Currently, more than 90 million apartments are empty in China, he added.

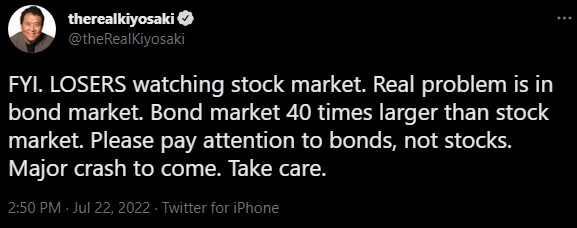

Robert Kiyosaki did not just stop there, he went on to continue criticizing the situations and problems with the bond markets. In the following Tweets, Kiyosaki said that losers are kept their eyes on the stock market while bond markets are in real big problem.

Also Read: BTC Is Sustainable, Says Bitcoin Mining Council

This is due to the US bond market being forty times the size of the regular stock market, he added. He asked to pay attention and shift focus towards bonds, rather than stocks, while anticipating an upcoming major crash in bond markets.

From time to time, Kiyosaki went on to Twitter and shared his harsh views on ongoing economic situations. He has been seen many times putting warnings about depression and hyperinflation. Many times, he said the current macroeconomic situation was the biggest financial bubble.

Nancy J. Allen is a crypto enthusiast, with a major in macroeconomics and minor in business statistics. She believes that cryptocurrencies inspire people to be their own banks, and step aside from traditional monetary exchange systems. She is also intrigued by blockchain technology and its functioning. She frequently researches, and posts content on the top altcoins, their theoretical working principles and technical price predictions.

Home

Home News

News