Genesis Global Capital reportedly seeking the possible ways to avoid the looming potential bankruptcy. The firm got severely affected following the bankruptcy filing of Sam Bankman-Fried’s FTX. The Bahamian crypto exchange halted withdrawals and the funds of the US crypto broker stuck over the platform.

Genesis Seeking Restructuring Firms

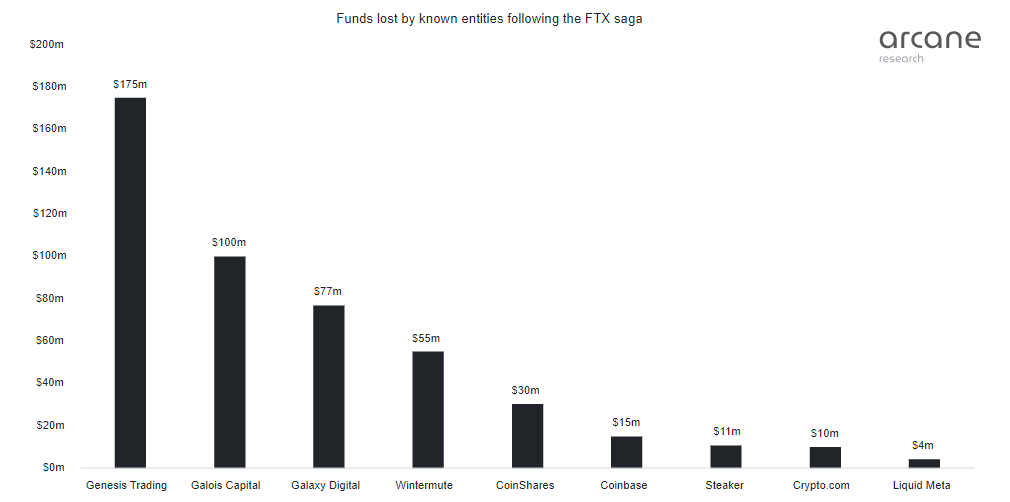

Over 175 million USD belong to Genesis out of its reach in the wake of FTX collapse. The amount is enough to create trembles within the firm and creditors are looking for potential ways to resolve the issue. Several efforts came in the wake of efforts to save Genesis from leading to bankruptcy.

Recently Bloomberg reported that Genesis creditors hired restructuring lawyers in order to explore potential ways to dodge the possibility of bankruptcy. The creditors consult prominent law firms like Proskauer Rose and Kirkland & Ellis.

Such actions showcase the firm is trying its best to fund a way out of the situation and possibly other than bankruptcy. A spokesperson from Genesis also stated that the company intends to resolve the ongoing situation hovering over the lending business space and it would not need to file for bankruptcy.

FTX Bankruptcy After-effects on Genesis

Once a top crypto exchange FTX fell so quickly and the abrupt fall led its users and investors—both individual and institutional—suffering the repercussions.

Prominent crypto lending platform of Genesis Global Capital is one of these adversely affected firms following the abrupt FTX collapse. The firm is a subsidiary of digital asset broker Genesis Trading and later reported to have its 175 million USD worth funds stuck with the crypto exchange platform.

The parent company of Genesis, venture capital firm Digital Currency Group also had to face the heat of ongoing wildfire. Sibling company and one of the biggest bitcoin (BTC) funds, Grayscale Bitcoin Trust (GBTC) Fund, also went through similar consequences.

Earlier it was reported that the lending firm is seeking about 1 billion USD from investors. However, it failed to secure the funding and is now looking for restructuring to avoid potential bankruptcy.

Global Economy Taking Worst Hits

The global markets had already had a hit following the post-pandemic recovery getting damaged for a number of reasons. From Fed’s interest rate hikes to Russia-Ukraine war broke out to potential looming recession, amalgamation of all the odds resulted in a global economic slowdown. Crypto market being sensitive to such situations has been suffering since the start of this year.

More specifically in crypto space, the devastation turned out to be relatively worse. This year has witnessed several prominent names in the crypto industry vanish. A huge capital also disappeared leaving investors empty-handed. Terra (LUNA) network collapse is one of the instances that started a ripple effect leading many other crypto firms to fall.

Nancy J. Allen is a crypto enthusiast, with a major in macroeconomics and minor in business statistics. She believes that cryptocurrencies inspire people to be their own banks, and step aside from traditional monetary exchange systems. She is also intrigued by blockchain technology and its functioning. She frequently researches, and posts content on the top altcoins, their theoretical working principles and technical price predictions.

Home

Home News

News