- 65% of Ford dealers agree to sell electric vehicles.

- The company introduced its own EV division called Model e.

- F stock was trading at a market value of $13.58 at the publication time.

Ford Can Easily Take Advantage of EV Sector

Global automotive industry has maintained its crown in the global manufacturing industry to this date, meanwhile supporting 3 vital pillars including mobility, people development and industrial development. Recently, one of the leading automotive industries, Ford Motor Company (NYSE: F), revealed that 65% of their dealers have agreed to sell electric vehicles according to CNBC. Company share, F stock, saw a declining interest from the investors on December 5, 2022.

Though it is not mandatory for the dealers to agree to sell the EVs. They may opt out and choose to stick with the traditional car business. They can choose to enter the deal in 2027 when the company reintroduces the certification process in 2027. The organization introduced their separate electric vehicles division titles Model e which instantly became a debating point for the people. Currently, Ford’s EV lineup includes F-150 Lightning truck, Mustang Mach-E and e-Transit van.

Ford Stock Price Analysis

Source: TradingView

Ford Motor Company share shows bearish trend since the beginning of the year, where it maintained a support around $11 and $12. The price soared to above $16.5 during August 2022, thanks to the profitable Q2 2022 earnings. Ford stock again ricocheted off the support, again thanks to the next quarter earnings.

Now the current levels show a consolidation phase where the sellers are active at around $15 and buyers at around $12. Ford stock was trading at $13.58 at the publication time, experiencing a 3.46% decrease in the past 24 hours. If the company’s Model e division becomes a success, the future global automotive industry could be a gold mine for the organization.

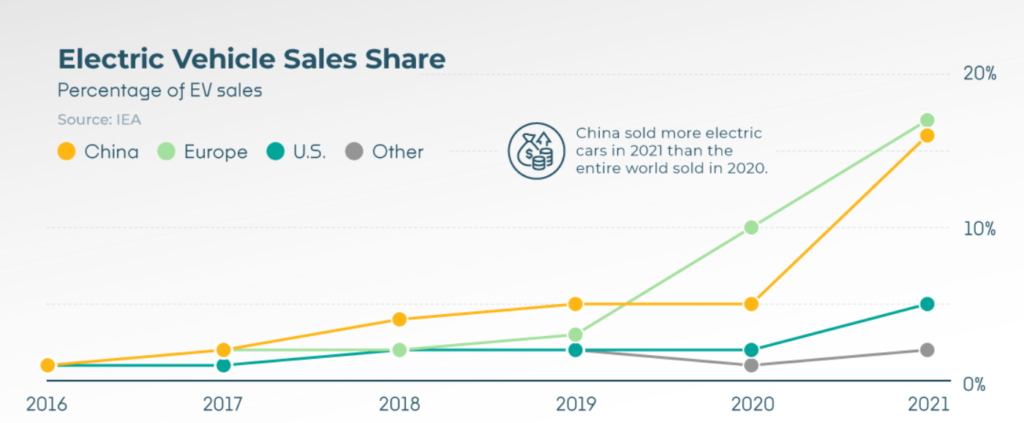

According to the International Energy Agency (IEA) data, electric vehicle sales have doubled in recent times. China, Europe and the US currently make 2/3rd of the entire EV market and accounted for 95% sales in 2021. 100 stakeholders have already signed the declaration to boost 100% zero emissions automobiles by 2035-40.

All this points to an increasing interest and demand in electric vehicles although the company may face challenges next year, which can directly impact Ford share price. This includes rising conflicts concerning the Russia Ukraine war, high inflation, hike rates and more.

The global automotive industry is slowly shifting their focus on connected cars concerning the increasing IoT structure across the world. The market is currently growing at a Compound Annual Growth Rate of 3.1%. If the sector continues at this rate, then there will be around 122 Million units by 2030.

Anurag is working as a fundamental writer for The Coin Republic since 2021. He likes to exercise his curious muscles and research deep into a topic. Though he covers various aspects of the crypto industry, he is quite passionate about the Web3, NFTs, Gaming, and Metaverse, and envisions them as the future of the (digital) economy. A reader & writer at heart, he calls himself an “average guitar player” and a fun footballer.

Home

Home News

News