Looking at the Netflix Inc (NASDAQ: NFLX) stock price growth in the past months, it would be hard to say that it’s the same that was falling during the start of the year. Netflix stock has witnessed an impressive growth recently and also started experiencing the optimism from Wall Street. Several significant changes made within the strategies of the prominent video streaming company brought it to the present stage.

Netflix Earnings and Ad Plan Brought Optimism

Netflix released its Q3 2022 earnings report in October. The report consisted of impressive numbers showcasing the growth of the company in recent months. Earnings per share for the company remained 3.10 USD, evidently up from estimated 2.13 USD. Revenue of the company also remained high from its estimate of 7.83 billion USD to actual 7.93 billion USD.

In addition, Netflix also reported adding about 2.41 million subscribers during the quarter. The company also showcased a positive outlook for the upcoming quarter suggesting adding more than 4 million users and over 7 billion USD in revenue. At the time of earnings release, NFLX stock price witnessed a jump of over 14% in a day.

Netflix stock is consistently making higher highs since the earnings release. Several other instances also acted as catalysts for the stock price growth. One such was video-on-demand streaming service platform’s move to launch ad-support tier in November 2022.

The ad plan reported to cost 6.99 USD for a month in the United States. It would consist of 4 to 5 minutes ads on average for an hour long content.

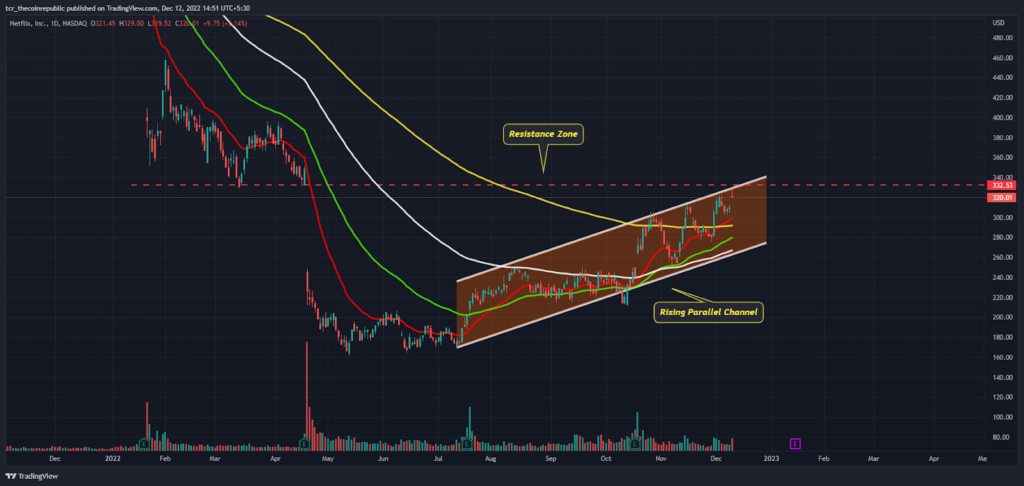

Netflix Stock Movement on Chart

Relative Strength Index (RSI) shows the stock price is in the buying range. Fib retracement shows the key support at 290 USD. Volume being higher than the average shows the buyers entry. The current price is expected to lead to resistance of 330 USD and once broken, it is likely to move forward 360 USD as per fib extension.

The stock is following a bullish pattern and currently trading at 320.01 USD with 3.14% growth in the last 24 hours. Showcasing a tremendous growth of more than 88% in the last six months attracted many analysts who ended up upgrading stock rating and price target for Netflix stock.

Well Fargo analysts reported upgrading NFLX stock rating from Equal Weight to Overweight. While the price target was increased from 300 USD to 400 USD. While Cowen analysts reported to rate stock Outperform and targeted for 420 USD.

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational ideas only, and they do not establish the financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Nancy J. Allen is a crypto enthusiast, with a major in macroeconomics and minor in business statistics. She believes that cryptocurrencies inspire people to be their own banks, and step aside from traditional monetary exchange systems. She is also intrigued by blockchain technology and its functioning. She frequently researches, and posts content on the top altcoins, their theoretical working principles and technical price predictions.

Home

Home News

News