- Crypto whales are actively acquiring the crowned crypto asset.

- 159 new whales have entered the market.

- Bitcoin was trading at the market price of $17,402.

Despite the declining cryptocurrency market, Bitcoin and stablecoins have maintained their shine to attract the investors. Recently, a blockchain data aggregator, Santiment, revealed that crypto whales are continuously acquiring BTC, and stablecons like DAI, Tether USDT and more. They have accumulated around $726 Million worth of the crowned asset in the last 9 days.

🤯 Breaking: #Bitcoin's addresses holding between 100 to 10,000 $BTC have bought $726m in $BTC the past 9 days. Meanwhile, #stablecoin assets like $USDT, $BUSD, & $DAI are also being bought quickly. This is a recipe for good things. Read all about it. 👉 https://t.co/H0G6oJhWFp pic.twitter.com/lOKPAfzZNO

— Santiment (@santimentfeed) December 15, 2022

More Addresses Join The Whale List

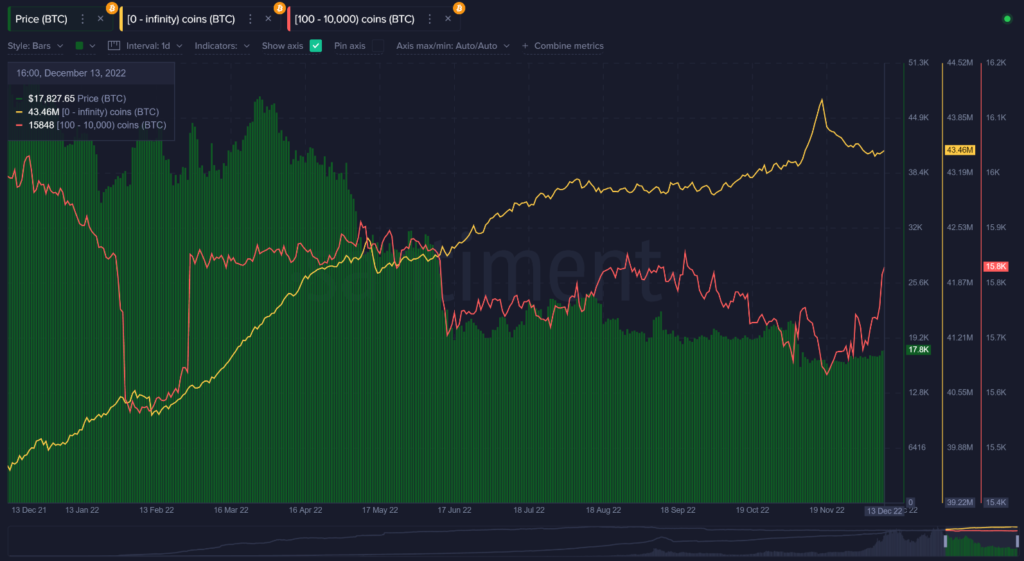

According to the Santiment blog post, the firm keeps track of addresses holding between 100 to 10,000 Bitcoins. There are currently 15,848 addresses according to the data aggregator. In contrast to this, there are a total 43.46 Million Bitcoin addresses. This means that the price momentum is defined by just 0.0364% of them.

Moreover, 159 addresses joined the Bitcoin whales list in the last 3 weeks. The blog says this is the fastest growth in the numbers in 10 months. It also mentioned that the Bitcoin whales are continuously lowering their supply after the market peaked in 2021. The crypto market has experienced a serious decline since the flagship asset reached nearly $70,000.

The firm is bullish on the market in future due to the asset acquisition by the whales instead of dumping it. The data aggregator has tracked the biggest streak by new Bitcoin whales in the past 10 months. Recently, the whales have added 40,747 more BTC to their crypto portfolio.

In the stablecoin scenario, key Tether addresses have purchased $817.5 Million worth of the asset in the last 3 days, an over 7% increase since December 10, 2022. This shows a huge uptrend in the market and points towards a positive momentum in the digital asset sector. However, the space recently saw the fall of the FTX exchange which caused a lot of panic among the investors. A major event in Russia Ukraine war, covid update, or more can cause heavy turbulence in the market.

According to the crypto analytics firm, Glassnode, Bitcoin and Ethereum are less likely to see a major uptrend by the year’s end. Low market liquidity and uncertainty contributes to the fact that the sector may remain under the control of bears. Currently, the dominant crypto currency was trading at a market price of $17,402 at the publication time.

Majority of virtual currencies still haven’t seen any major movement recently. Solana (SOL) and Tron (TRX) gained 2.14% and 1.86% in a week. Toncoin (TON), native crypto asset of the Ton Network, remains the top gainer, gaining over 25% in the past 7 days.

Anurag is working as a fundamental writer for The Coin Republic since 2021. He likes to exercise his curious muscles and research deep into a topic. Though he covers various aspects of the crypto industry, he is quite passionate about the Web3, NFTs, Gaming, and Metaverse, and envisions them as the future of the (digital) economy. A reader & writer at heart, he calls himself an “average guitar player” and a fun footballer.

Home

Home News

News