Tesla stock (NASDAQ: TSLA) is down by almost 61.71% in one year. That indicates the stock has experienced major challenges in 2022. On January 17th, 2023, CNBC’s Jim Cramer, also shared his thoughts on TSLA stock. He said in the current state of TSLA stock it might not be a good idea to bet against it.

Cramer said during CNBC’s ‘Squawk On The Street” that Tesla might very well be “immunized” from pessimistic coverage at its current levels. He further said that Tesla stock is a “sleeping giant now”. And he “don’t want to bet against Tesla…” as it is down too much.

Elon Musk, the co-founder of the electric vehicle company, Tesla Inc., has 13.4% of ownership and held 423 Million in his firm. According to Securities and Exchange Commision (SEC) filing, Musk sold almost 22 Million company shares that were worth $3.6 Billion, in 2022. Due to which its stock fell down.

At present, Musk is set to testify in a federal trial over his 2018 take private tweet, in which he noted ” It’s been, despite the selloff last year, a good couple of years for Tesla stock”. The lawyers are battling over whether Musk lied in his 2018 Tesla tweet.

Am considering taking Tesla private at $420. Funding secured.

— Elon Musk (@elonmusk) August 7, 2018

In the Tesla tweet trail, the shareholder’s attorney argues “we are here because Musk lied. His lies caused regular people… to lose millions and millions of dollars.” Countering that, Alex Spiro, Musk’s lawyer said, “This was not fraud. not even close… He decided in that rushed moment, imperfect or not, that disclosure was a better course.” Musk would take his stand tomorrow or maybe on Monday.

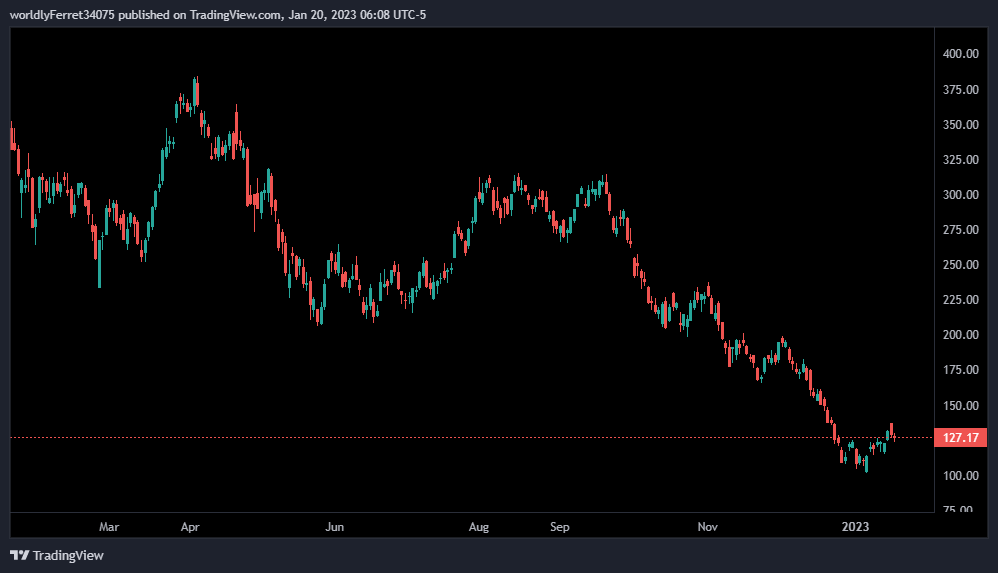

Tesla Stock Price Analysis

Since 2018, TSLA stock is up more than 450%. The current stock price of TSLA is $127.17, while its previous close was $128.78. The stock noted its 52-week high at $384.29 and low at $101.81. Tesla stock has a total market cap of around 398 Billion.

According to CNBC, Ark Invest’s Cathie Wood, said she is bullish in Tesla and remains strong as she kept buying the dip in Tesla. She sees that the stock is up fivefold in 5 years.

In a note to clients, Alexander E. Potter, a research analyst, said “Tesla took longer than expected to cut prices, but now that pricing adjustments have been made and now that the valuation has reset, we think investors should be proactively buying TSLA.”

Nancy J. Allen is a crypto enthusiast, with a major in macroeconomics and minor in business statistics. She believes that cryptocurrencies inspire people to be their own banks, and step aside from traditional monetary exchange systems. She is also intrigued by blockchain technology and its functioning. She frequently researches, and posts content on the top altcoins, their theoretical working principles and technical price predictions.

Home

Home News

News