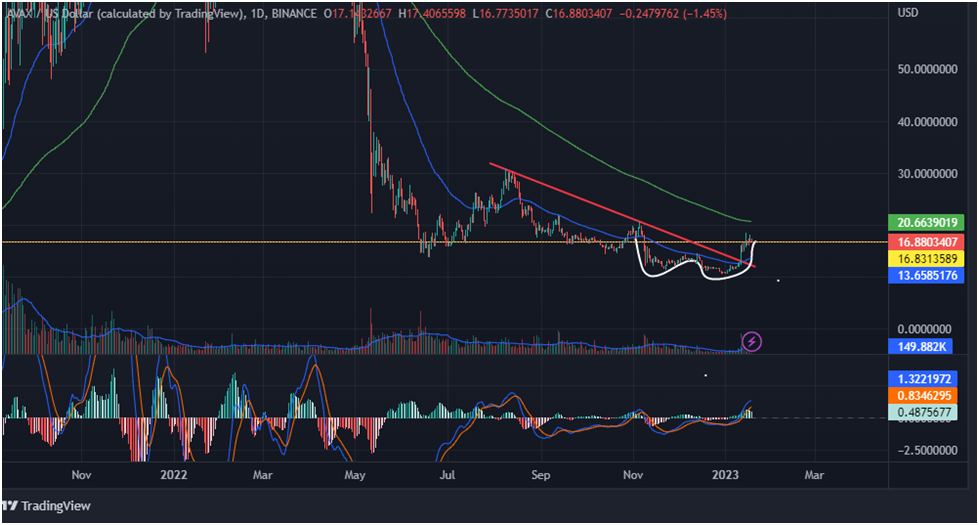

- A double bottom pattern is visible on daily chart

- The coin has recently given a trendline breakout

AVAX is currently near its resistance level, and the coin has been trending upward for the last few days. The coin’s price is close to its 50 EMA (the blue line).

AVAX on daily chart

On the daily chart we can see a double bottom pattern being formed after which a great bullish move is expected up to $23.102779. Moreover the trendline breakout can also be considered as an additional bullish breakout. Overall, the daily chart of AVAX looks good and short-term investors can look forward for investing in the coin.

MACD – A bullish cross has been made by the MACD. The MACD’s bullish crossover indicates a rising trend on the AVAX daily chart.

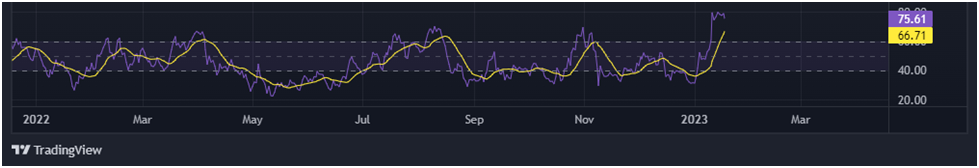

Relative Strength Index (RSI) – The RSI curve has surpassed the 50-point barrier at 75.61, according to the relative strength indicator (RSI). The value of the RSI curve has increased due to the increase in coin values. The RSI curve may rise dramatically if the price rises even further.

Analyst view and Expectations

We might witness a bullish rise in the days ahead, but there is still a chance that the price will first consolidate for a while at its current levels before making a bullish move. If this occurs, it would be very satisfying because if the price makes a breakout after such consolidation, there will be a strong upward movement.

According to a short-term avalanche price forecast from CoinCodex for 2023, the coin might fall to $14.11 by January 17 before rising to $17.48 by February 12. Technical analysis on the website was indecisive, with 16 indicators producing bullish indications and 13 producing bearish ones.

In its long-term cryptocurrency price forecast for AVAX, DigitalCoinPrice was more optimistic. The website forecasted the AVAX price for 2025 to be $53.13, with the average price of the coin. According to DigitalCoinPrice’s AVAX price forecast for 2030, the coin would increase even more, reaching an average price of $157.92.

Technical Levels

Major resistance -$30.2705646

Major support -$10.6424605

Conclusion

For short-term investors, the chart is favorable, but it is not favorable at the moment for long-term investors. It is therefore advised that long-term investors wait until there is a Golden Crossover.

Disclaimer: The views represented in this article, as well as any other views mentioned, are offered for informative reasons only and shouldn’t be interpreted as financial advice. When purchasing or trading cryptocurrencies, there is a chance that you could lose money.

Nancy J. Allen is a crypto enthusiast, with a major in macroeconomics and minor in business statistics. She believes that cryptocurrencies inspire people to be their own banks, and step aside from traditional monetary exchange systems. She is also intrigued by blockchain technology and its functioning. She frequently researches, and posts content on the top altcoins, their theoretical working principles and technical price predictions.

Home

Home News

News