As our company, Creative Tim, made the transition in 2022 from Web 2.0 to Web 3.0 by launching our very own NFT collection for Developers, Designers, Creators, and NFTs Fans – NF-Tim by Creative Tim – we noticed that there are still many people, even in the tech industry, who are unfamiliar with NFTs and the differences between them and cryptocurrency.

This realization prompted us to write this article, with the aim of shedding light on the subject and educating our readers on the unique characteristics and potential of NFTs in comparison to traditional cryptocurrency.

So, whether you’re a tech enthusiast or just curious about this new frontier, read on to learn more about NFTs and how they differ from crypto.

What are NFTs?

NFT stands for a non-fungible token, and it is understandable why the full form of the term still does not explain everything at once. Non-fungible simply means unique and irreplaceable while fungible means replaceable. For example, one dollar is fungible. You can exchange it for another dollar whose value will remain the same.

However, if you are an avid collector of Pokemon cards, and have a unique Pokemon card, then it is a non-fungible card. If you trade it with something else, you don’t get the same value.

So how does this make sense in the aspect of an NFT?

NFTs are mostly tokenized versions of real-world artistic/or not objects. They can be art, music, or other virtual assets like real estate. NFTs can also represent the identity of owners, property rights, and more.

For example, NF-Tim Collection includes different types of NFTs, each one granting access to different utilities like the access to web development premium tools developed by Creative Tim(Utility NFTs).

While the current market for NFTs is centered around collectibles, its importance is also growing in new markets.

Each NFT is singular or unique, and cannot be traded for the same thing of the same value. Compare it with Leonardo Da Vinci’s Mona Lisa. Though there are multiple variations of the same image, there is only one unique Mona Lisa painting, and it cannot be exchanged with the same thing of the same value.

NFTs, at a high level, are mostly based on the Ethereum blockchain. However, many blockchains have recently implemented their own version of NFTs.

What is Crypto?

Crypto, also called cryptocurrencies, are digital currencies based on blockchains. The term crypto is used primarily because these currencies are secured using cryptography. Cryptocurrencies are protected, impossible to counterfeit, and secured using encryption algorithms, and private/public key pairs.

Cryptos can be sold and bought on decentralized exchanges like OpenSea and Binance, and you have to set up a crypto wallet to buy and store your crypto.

In the battle of NFTs vs. crypto, crypto is a fungible token and is replaceable. They are just like physical currencies where you can exchange one for another, and still get the same thing with the same value. One Ethereum is as good as any other Ethereum, and that is the main difference between NFT and crypto.

What do NFTs and crypto have in common?

While NFTs and crypto are different in terms of their fungibility, they are still based on the same underlying technology.

The common aspects related to NFTs and crypto are:

- Blockchain and fungibility

Both cryptos and NFTs exist in a blockchain. Cryptos are created using blockchain but are fungible. However, there is a certain characteristic of blockchain which allows its transaction history to be stored and communicated publicly. Hence, even if the value of the cryptos created on a blockchain is the same, the identifier associated with it is different and irreplaceable. For example, a crypto owned by Elon Musk has a unique identifier that identifies it as being owned by him. This crypto has also been sold as an NFT.

NFT utilizes this uniqueness of blockchains to tokenize assets and create non-fungibility. NFTs make each token unique and irreplaceable,e making it impossible for one non-fungible token to be equal to another. Just like cryptos, NFTs also have unique ownership details for identification and transfer between different token holders.

- Advantages of blockchain

NFTs and cryptos both benefit from the advantages of being based on the blockchain. Both of these tokens and their trading is ideal when it comes to removing intermediaries. Both of them can be used to connect artists with audiences directly. Security and immutability are also benefits that both share. Both of them also benefit from the ability to easily transfer assets digitally.

- Minting

NFTs are also created using a process called minting, much like cryptos. In both crypto and NFTs, minting creates a new block, and the information of the newly created block is validated by the validator. The information is recorded and spread across the peer-to-peer network. Similar to crypto, the NFT creation process also includes creating smart contracts to assign ownership and transferability.

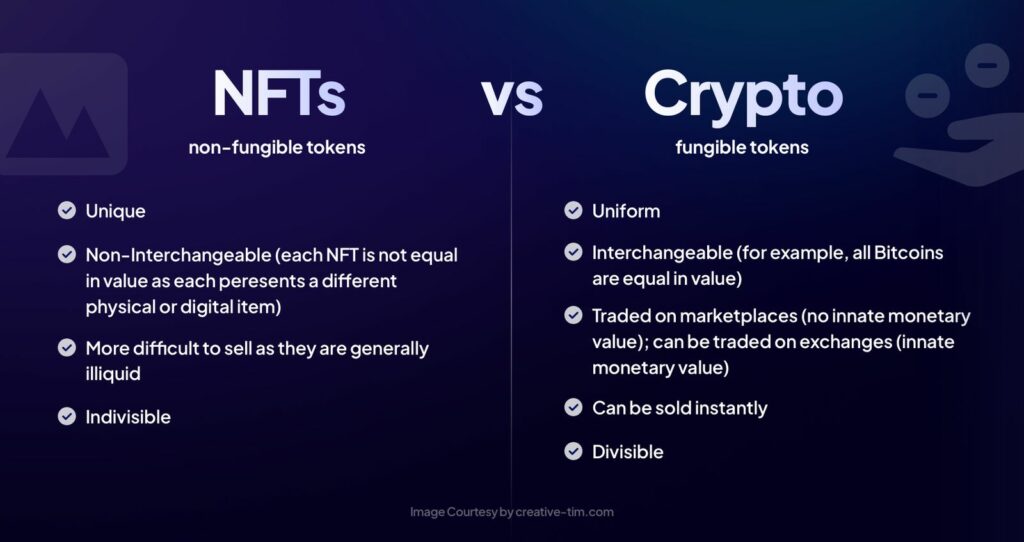

NFT vs Crypto – What are the differences?

The differences between NFTs and crypto are outlined below:

- Fungibility

As mentioned before, fungibility is one of the defining differences between NFTs and crypto. Exchanging a piece of art with another piece of art never yields the same value in the case of NFTs. But, in the case of crypto, the value of one Ethereum crypto will always be equal to another.

- Purpose

The main purpose of using NFTs is simply to create a proof of ownership of an asset. NFTs have been used to designate the ownership of audio files, videos, and any form of digital content. They have also been used to tokenize and represent physical objects like collectibles, real estate, or works of art.

Since NFTs are irreplaceable and unique, it makes them an ideal token for establishing ownership and authenticity. When saved on a blockchain and distributed in a secure database, NFTs cannot be tampered with, thus making them perfect for establishing ownership.

Cryptos, on the other hand, are simply the means of exchanging digital information or dealing with the current shortcomings of physical currencies. Cryptos are used to buy and sell stuff in a safe, centralized, and secure manner.

- Divisibility

NFTs are not divisible. They represent a unique, distinct token that identifies ownership and authenticity. Since their division would make it impossible to validate ownership, they are indivisible.

On the other hand, cryptos are divisible. One Ethereum can be divided into several smaller parts to indicate a certain value. Bitcoin can be divided into 8 decimal places, and the term used for the smallest division of bitcoin is called “Satoshi”. This divisibility of crypto makes it easier to carry out transactions. There is no limitation of paying in whole crypto tokens.

- Usage

Cryptos and their underlying mechanism make them useful for payments, anonymous spending, and money transfers. They are primarily used to pay for assets. They have extremely high transaction speeds and global outreach, making them preferred for international transactions.

NFTs on the other hand are used for digitalizing collectible items. They can be used to represent virtual real estate and cosmetics. If items can be converted to a digital version, NFTs can be used to secure them and identify ownership.

- Investment Cost

Investing in crypto tokens is comparatively easier. Since the tokens can be divided into several smaller fractions, you can choose to invest in the lowest form of the currency, and still have an investment in place. Owing to its popularity, there are a huge number of centralized and decentralized exchanges to choose from.

On the other hand, investing in NFT can be expensive due to its indivisibility. Each piece is unique and distinct, and it is difficult to trade NFTs freely. There are limited platforms that facilitate its trade, and prices of NFTs are usually known to cross thousands if not millions of dollars. The gas fees associated with trading NFTs are also very high, and since ownership cannot be shared, investing in them can be a very expensive deal.

- Trading

When trading crypto, a person is trading the underlying value of an asset. When trading an NFT, a person is trading an asset itself.

- Volatility

Cryptos are lauded for their volatility. Volatility is the measure of the asset’s growth or downfall over time. A volatile asset is a riskier investment but also can offer higher returns in a short period. The volatility of crypto hence is considered to be bad by some, and a boon by many. Crytpo has seen a huge number of twists and turns and is hugely dependent on the market and the ideology of people toward crypto.

NFTs on the other hand are not volatile. Their value arises from the price of the asset itself, which is less subject to change. Their prices do not depend on the crypto market but are instead based on their merit. Hence, they are deemed to be a safer investment, but might not yield the same amount of huge returns as crypto does.

What is the future of NFTs/Crypto?

The future of NFTs and crypto will mostly be based on their merits and drawbacks. NFTs offer the ability to create unique digital assets, thus having the potential to be more valuable than traditional digital assets. They provide the ability to track ownership, and it is easy to see who owns NFT and from where it comes. NFTs also can be bought, sold, and traded easily because of the presence of dedicated NFT marketplaces such as Rarible and Open Sea.

However, NFTs can also be potentially used to launder money, take part in illicit activities, purchase illegal goods, circumvent trade restrictions, or purchase weapons.

Cryptos also have the advantage of faster and safer money transfers, decentralized systems that remove intermediaries, and systems that do not collapse at a single point of failure. Their price volatility, high energy consumption, and potential use in criminal activities are also valid concerns.

Both crypto and NFTs are experiencing a surge in popularity and look like both are here to stay given their demerits do not pose a great concern, and their merits can be used for the benefit of mankind.

Conclusion

When comparing NFTs vs. crypto, one can find a lot of similarities as they are based on the same underlying technology but are also different when it comes to their fungibility, volatility, divisibility, use, purpose, and cost of investment. NFTs do have advantages over traditional crypto but are comparatively newer when compared to crypto.

NFTs fall short when it comes to acceptance. They are not widely supported by institutions as such at the moment. Another shortfall is the inability of NFTs to be converted to cash, thus lacking in terms of liquidification in comparison to crypto. NFTs are based on blockchain and can potentially have the same security risks as crypto, including identity theft and hacking.

Hence, it can be said for sure that while NFTs are an emerging trend, they still have a lot of potential for growth. While they offer unique advantages over crypto, they also pose potential risks that need to be mitigated. Being a very new idea has its risks and uncertainty associated with it. Just like with any investment, it is important to do due research before deciding to invest in NFT.

Disclaimer: Any information written in this press release or sponsored post does not constitute investment advice. Thecoinrepublic.com does not, and will not endorse any information on any company or individual on this page. Readers are encouraged to make their own research and make any actions based on their own findings and not from any content written in this press release or sponsored post. Thecoinrepublic.com is and will not be responsible for any damage or loss caused directly or indirectly by the use of any content, product, or service mentioned in this press release or sponsored post.

For publishing articles on our website get in touch with us over email or one of the accounts mentioned below.

Home

Home News

News