- Reporting crypto in tax filing could be beneficial.

- Tax loss harvesting can offset losses.

- Crypto donations and IRAs are also beneficial.

The crypto industry lost nearly $3.9 billion in 2022. Such inimical losses were of the crypto investors worldwide, somehow managing to stay afloat. If they report crypto in their taxes, there could be a silver lining in the dark clouds.

2022 was a tough year for the crypto market. A recent report found that the crypto industry lost a total of $3 in 2022. There may be a silver lining to decreasing assets for investors reporting crypto on their taxes.

— Halley Wight (@wight_halley) February 5, 2023

Speaking to the media, a certified public accountant with Turbo Tax, Lisa Green-Lewis, said that even though inverters made profits in 2021, the same story could not be repeated in 2022. “We have seen a crypto winter occur, and Turbo Tax wants to help investors cope with their losses.” Further, referring to tax loss harvesting as a tool for saving money while filing taxes.

Was tax loss harvesting the cause of the recent Crypto and stock market rally? Maybe it was. People who sold in December of 2022 are passing the 30 day mark in order to avoid the wash sale rule. That means they can buy their assets back. pic.twitter.com/sJ8yqDpbxf

— Zac's Money FAQs (@ZacsMoneyFAQs) January 31, 2023

Tax Loss Harvesting

Further explaining the point, she said that to offset gains with losses in crypto, any leftover losses which are upto $3,000 against ordinary income can be offset. While losses that are more than $3,000 can be carried forward for the next year. Further hinting at the new and young investors who are entering the crypto market, if they know about this, could be very helpful in the long run.

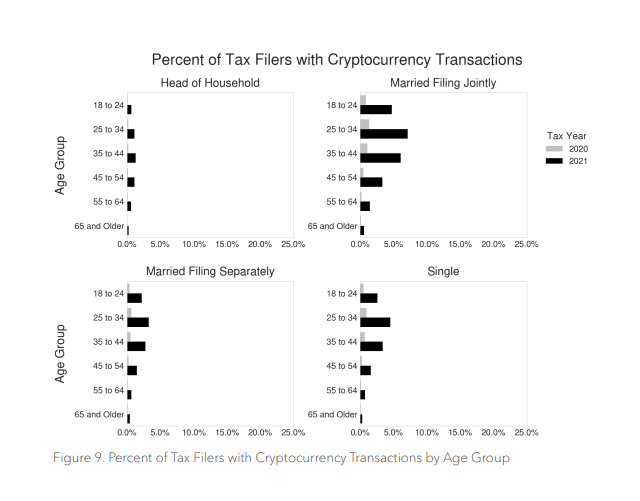

Studies show that 16% of Americans have invested or traded in crypto, with the majority being in the age bracket of 25 to 35, with a majority ignorant about tax-loss harvesting. Although the last date for the tax-loss filing for 2022 was on December 30, 2023, the CPA hinted that investors can still do that action as the losses roll forward.

Vice president at Swan Global Wealth, Steven Lubka, says this option could be beneficial as no “wash sale rule” applies to crypto. The rule would prevent tax breaks for an investor buying the same assets 30 calendar days before or after the sale.

Can Crypto donation be an Option?

Donating crypto to charity could reduce taxable income, a decent strategy in the bull market. Co-founder of a crypto donation platform, Giving Block, Alex Wilson, says that donating cryptocurrency is tax efficient, also allowing investors to avoid capital gains tax. Further explaining the point, he said that buying BTC at $1 and selling at the current rate would invite taxes. But if it was to be donated to a non-profit, it makes it tax deductible. And when donated under 501(c)(3) charity, it is even higher.

IRA could also be an option

Individual retirement accounts (IRAs) also allow crypto investors to lower their taxable income. Akin to 401(k), crypto assets held in a traditional IRA will also be tax-deferred, allowing investors to not be asked for taxes as long as the asset is in the account. Surrounding the latest controversy with IRAs, Swan Bitcoin is about to launch Bitcoin IRA.

Should cryptocurrency be reported while Tax filing?

Although it seems beneficial to report crypto while tax filings, there is still a lack of awareness among investors, according to reports, 31% of investors did not report their crypto, half of the people did not make any profit to book, and 18% not even knew that crypto was taxable.

The IRS and other government agencies must work on providing guidance and educating crypto investors about taxes, as upcoming infrastructure bills or crypto bills could affect the crypto reporting landscape.

Andrew is a blockchain developer who developed his interest in cryptocurrencies while pursuing his post-graduation major in blockchain development. He is a keen observer of details and shares his passion for writing, along with coding. His backend knowledge about blockchain helps him give a unique perspective to his writing skills, and a reliable craft at explaining the concepts such as blockchain programming, languages and token minting. He also frequently shares technical details and performance indicators of ICOs and IDOs.

Home

Home News

News