- $Roku stock is up 32.82% year-to-date so far this year.

- Roku is all set to release its fourth quarter earnings report on February 15th, 2023.

Roku, Inc. (NASDAQ:ROKU) is an American publicly traded company headquartered in San Jose, CA. The company engages in the provision of a streaming platform for television as it operates through the following business segments: Platform and Player. The Platform segment added digital advertising and related services which include the OneView ad platform, content distribution, and licensing arrangements with service operators and TV brands.

On the other hand, the Player segment added the sale of streaming players and audio products. The majority of streaming players, audio products and Roku TV models are sold via traditional brick and mortar retailers, like Best Buy, Target, and Walmart, including their online sales platforms, and online retailers such as Amazon, and to a lesser extent, Roku’s website.

$Roku Stock Overview

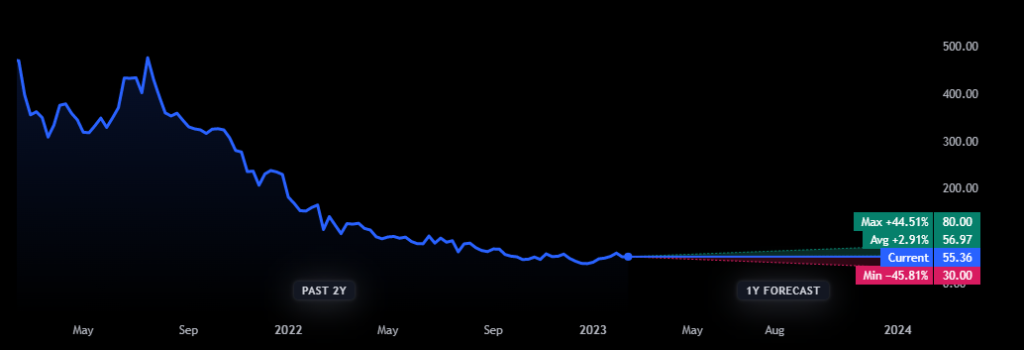

Roku stock noted an increase of 14.07% in one month. However it is down by 9.79% in the last one-week. Yesterday, Roku stock opened at $55.87, touched its one-day high at $56.20 and closed at $56.16 with an increase of 0.84%.

At present, the market cap of Roku is $7.646 Billion. And the next Roku, Inc earnings date is February 15th, the estimation is -$1.72. The total revenue of Roku for the last quarter is $761.37 Million, and it’s 0.40% lower compared to the previous quarter. The net income of Q3 22 is -$122.18 Million.

Roku earnings for the last quarter are -$0.88 whereas the estimation was -$1.29 which accounts for 31.94% surprise. Its revenue for the same period amounts to $761.37 Million despite the estimated figure of $696.13 Million. Estimated earnings for the next quarter are -$1.72, and revenue is expected to reach $801.81 Million.

The technical analysis summary for Roku that is based on the most popular technical indicators, such as moving averages, oscillators, and pivots, is currently neutral. While out of 25 analysts offering 1 year price forecasts for Roku have a max estimate of $80.00 and a min estimate of $30.00.

Roku’s Rocking Performance

The recent performance of Roku stock stunned the investors as it is outperforming the S&P 500 since its January lows. The company reported active accounts growth of 16.5% Year-over-Year, reaching 70M, as Roku silences skeptics predicting a structural slowdown in growth. While Google’s battle against Microsoft in search advertising is heating up. This intensifies the competition for Roku as YouTube sharpens its competitive edge to capture market share in streaming. However, Roku might faces some challenges due to an ad market slowdown

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational ideas only, and they do not establish the financial, investment, or other advice. Investing in or trading stocks comes with a risk of financial loss.

With a background in journalism, Ritika Sharma has worked with many reputed media firms focusing on general news such as politics and crime. She joined The Coin Republic as a reporter for crypto, and found a great passion for cryptocurrency, Web3, NFTs and other digital assets. She spends a lot of time researching and delving deeper into these concepts around the clock, and is a strong advocate for women in STEM.

Home

Home News

News