- 1 Blackberry became the first company in the USA to gain OpenChain Security Assurance Certification.

- 2 Now solely focused on cybersecurity, it once held 43% of the smartphone market.

Blackberry, now a cybersecurity-focused company, is slowly trying to reach the high point of 2010. Formerly known as Research in Motion, it was founded on March 7, 1984, and is headquartered in Waterloo, Canada. The company was once known for its dominance in the smartphone arena and enjoyed 43% shares in 2010; then, its share price was around $59.88.

Currently, Blackberry provides intelligent security software and services to various businesses, car manufacturers, and government agencies for prevention against hacking and ransomware attacks. They leverage Artificial Intelligence (AI) and Machine Learning (ML) to deliver solutions for endpoint security, endpoint management, embedded systems and encryption.

Blackberry wins Openchain Security Assurance Certification

On January 24, 2023, Blackberry became the first business in America to receive the OpenChain Security Assurance Specification certification. This certificate validates the ability of the company to manage open-source vulnerabilities and risks. This could be an integral part of their software supply chain.

Blackberry (BB) – Price Analysis

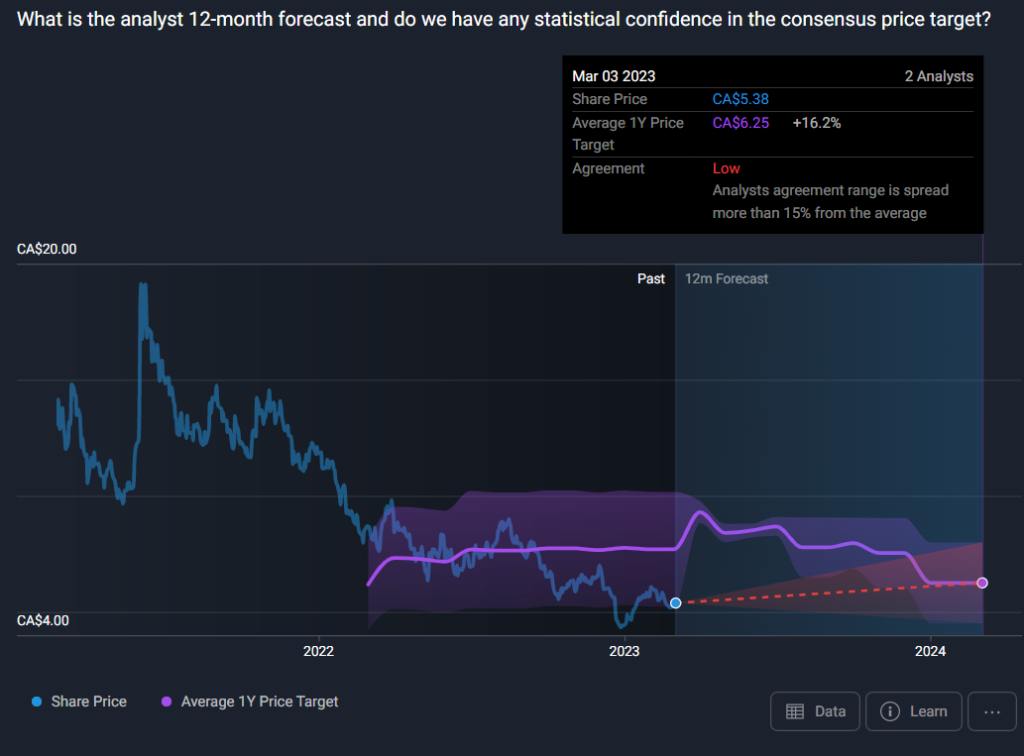

At the time of writing, it was trading at $3.95, with a jump of 3.13%. Previous close and open were at $3.83 and $3.81, respectively. An expected price target is $5.25 with a 32.9% upside; the highest it could touch is $7.00, while the lower limit is $3.75.the fifty-two-week change is negative, 40.90%.

The market cap of Blackberry is $2.298 billion, while the volume and average volume are 3.86 and 6.42 million shares, respectively. There is a 1.75 rating for hold by analysts, while the short interest is healthy with 3.91% float sold short. The profit margin is negative 13.77%; the operating margin is also negative 30.43%.

Projected earning growth is growing from $0.27 to $0.20 per share. The revenue of Blackberry is $169 million, with a year-on-year drop of 8.15%. At the same time, the Revenue per Share is $1.20, and the Quarterly Revenue Growth is negative 8.20%. The Net Profit Margin is negative $2.37, with a massive drop of 105.89%.

Blackberry (BB) – Chart Analysis

The chart shows that the price will either test or break the downward-sloping trend line. The moving average is also indicating a similar story. The price is gradually increasing northward.

It might consolidate upward if a positive environment continues, breaking the trendline and further consolidating before entering or breaking the supply zone. If the story reverses, it might touch the demand zone; however, a clean southward breakthrough is unlikely.

Disclaimer:

The views and opinions stated by the author, or any people named in this article, are for informational purposes only and do not establish financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Andrew is a blockchain developer who developed his interest in cryptocurrencies while pursuing his post-graduation major in blockchain development. He is a keen observer of details and shares his passion for writing, along with coding. His backend knowledge about blockchain helps him give a unique perspective to his writing skills, and a reliable craft at explaining the concepts such as blockchain programming, languages and token minting. He also frequently shares technical details and performance indicators of ICOs and IDOs.

Home

Home News

News