- 1 Carnival stock remained in the hands of bears in recent sessions.

- 2 Bears dominance leads stock price near crucial support.

Last week, Carnival Corporation (CCL) stock faced intense selling pressure. The share price of the leading cruise line slipped below its significant moving averages and is hovering near the support mark of $9. Bulls tried to sustain over the top in the past week, but failed. Moreover, the price action attained a reversal from the higher tops, forming a bearish “M” pattern. CCL stock slipped below $10, which makes indefinite cues to hold out or fizzle out from here.

CCL stock price was at $9.99 during Thursday’s market session with a drop of 5.03%, while its intraday high was at $10.59. Trading volume remained neutral with decent participation of buyers and sellers.

Carnival cruise line stock is seen with corrections nowadays with rulings accomplished by sellers. Last week, CCL stock was at $11.50, where an inverted hammer candlestick formed, indicating that bears were engulfing strength and bulls appeared to be fizzling out, getting rejected by 200 days EMA.

Will Carnival Rebounds or Slips Further ( NYSE: CCL)

Carnival stock price on the daily chart looked bearish, making fresh short positions. The price action indicates that if the stock sustains above $10, then a pullback could be seen. Whereas, if it slips below $9.50 it might retest the lows of $8.00 again in the near term. However, 4 consecutive days of selling indicates aggressive selling in the stock, which is a major concern for bulls to look out for. CCL share price is on the verge of slipping below the lower Bollinger band and is trying to hold. The price retracement over the top dampened bullish momentum.

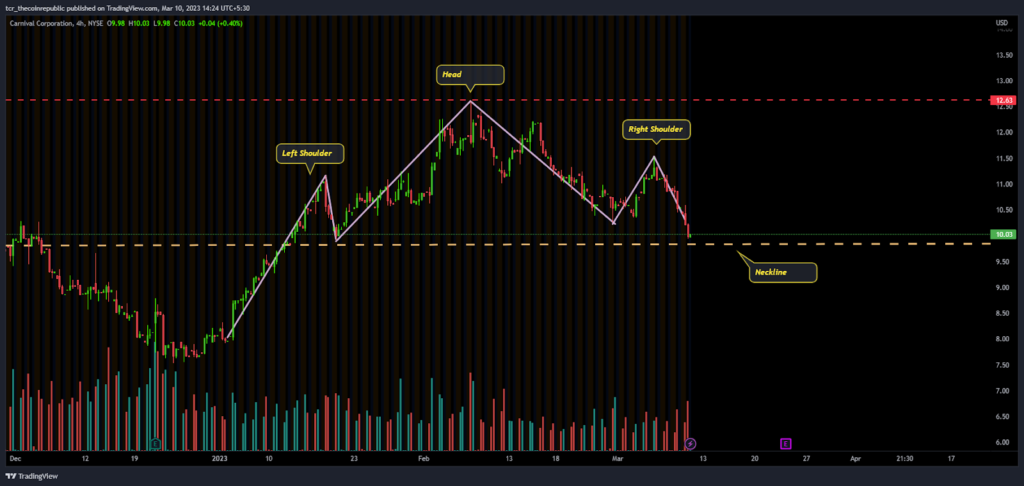

Cruise line CCL forms head and shoulders pattern

Carnival cruise line stock on a 4-hour chart forms a head and shoulder pattern, a sign of bearishness in the next sessions. The neckline was placed at $9.50, leading to a major price fall if it breaks. Moreover, the delivery volume in favor of bears showed a significant increase.

Last month, CCL stock pursued a transient high of $12 but could not hold on top and reverted by forming lower highs and lows. The stock barely manages the breadth and does not hold the gains.

The RSI curve floats in the oversold region near 24, indicating that a bounce is pending in the short term. Further, if the bounce does not sustain, further selling might be seen. Moreover, a negative crossover was seen in the past few days fuelling aggressive selling.

The MACD indicator continued to form red bars on the histogram and showed bearishness, leaving almost no hope for bullishness.

Support Levels: $9.00 and $7.50

Resistance Levels: $11 and $12.60

Conclusion

Carnival stock or CCL stock price witnessed selling pressure over the top and no signs of a pullback from bulls. However, successive falling was seen, and bulls must be paused for a return to retain above levels.

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational purposes only, and they do not establish financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Nancy J. Allen is a crypto enthusiast, with a major in macroeconomics and minor in business statistics. She believes that cryptocurrencies inspire people to be their own banks, and step aside from traditional monetary exchange systems. She is also intrigued by blockchain technology and its functioning. She frequently researches, and posts content on the top altcoins, their theoretical working principles and technical price predictions.

Home

Home News

News