- 1 PACW stock dropped nearly 37% on its last day of trading, which brought the stock price near its 52-week low.

- 2 The SVB crisis supported the massive price drop in the PACW stock.

- 3 PacWest Bancorp recently issued updated financial figures, which clarify its capital and liquidity strategy.

PacWest Bancorp (NASDAQ:PACW) is a bank holding company that offers commercial banking services. The share price of PACW stock tumbled after the collapse of Silicon Valley Bank (SVB) on March 10th, Friday morning. The SVB collapse led to the second-largest failure of a financial institution in U.S. history.

PACW Stock Price Analysis

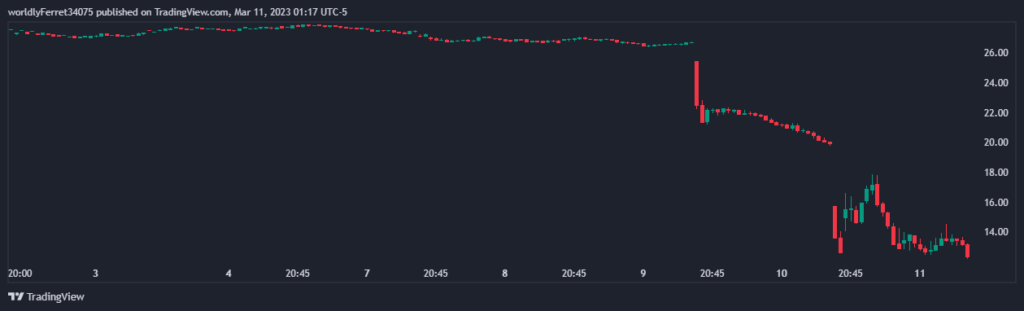

PACW stock price dropped more than 50% in the recent week. PacWest share price touched its 52-week low on its last day of trading on March 10th, when PACW closed at $12.35 with a 37.91% on a decline in the past 24 hours, according to the data sourced from Tradingview.

As the above chart shows, from Thursday March 9th, PACW stock price started declining. The stock on the same day opened at $26.58 reportedly, after the SVB crisis, it was dragged down nearly to its 52-week low at $12.21. PACW stock gave the new 52-week low yesterday, while the 52-week high was recorded at $46.84 last year in March. In one year from 2022, PacWest Bancorp (NASDAQ:PACW) shares fell nearly 71%, while its year-to-date (YTD) decline is 46.49%.

Furthermore, with $41 billion in assets, the bank holding company issued updated financial figures in light of recent industry events. As of March 9, 2023, PacWest Bancorp’s total deposits were $33.2 billion compared with $33.9 billion as of December 31st, 2022.

As PacWest Bancorp said, “its risk-based capital ratios, including CET1, also have been increasing for the past 3 quarters, including tier 1 risk-based capital ratio of 10.61%.” However, it is well in excess of regulatory requirements as of December 31st, 2022.

The company also mentioned its liquidity position as of March 9th, stating that PacWest Bancorp held approximately $1.9 billion cash on its balance sheet. It also has unpledged, liquid securities of approx. $5.3 billion and Federal Reserve Discount Window availability of $2 billion.

The SVB Crisis

On Wednesday, SVB announced that it had sold a bunch of securities at a loss and it would sell $2.25 billion in new shares to support its balance sheet. This announcement eventually triggered a panic among the top venture capital firms that reportedly advised companies to withdraw their money from the bank.

SVB stock price crashed on Thurday and also pulled other banks alongside. By Friday morning, the shares of SVB halted and had abandoned efforts to raise capital or find a buyer rapidly. Aftermath, many banking stocks also experienced temporary halting on Friday, including PacWest Bancorp, First Republic, and Signature Bank, according to a report by CNN.

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational ideas only and do not establish financial, investment, or other advice. Investing in or trading crypto or stock comes with a risk of financial loss.

Nancy J. Allen is a crypto enthusiast, with a major in macroeconomics and minor in business statistics. She believes that cryptocurrencies inspire people to be their own banks, and step aside from traditional monetary exchange systems. She is also intrigued by blockchain technology and its functioning. She frequently researches, and posts content on the top altcoins, their theoretical working principles and technical price predictions.

Home

Home News

News