- 1 FUBO stock price is down nearly 80% in one year, and 75% in 6 months.

- 2 FUBO stock price is performing in bearish trend thus the stock sees no hopes for the future.

FUBO stock has shown an all-time decline in its share price by almost 99%, so it can be said that it is not performing well. FuboTV Inc (NYSE:FUBO) is a sports-first, live TV streaming service company. The company offers subscribers access to tens of thousands of live sporting events annually along with news and entertainment content.

FUBO Stock Price Analysis

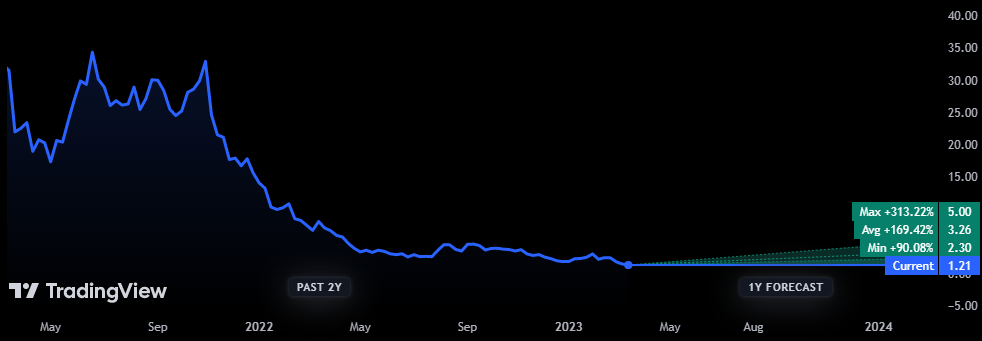

FuboTV Inc (FUBO) stock closed at $1.21 on March 16 with no change. Yesterday, FUBO stock was trading between $1.16 and $1.25. FUBO stock’s 52-week range is between $1.16 and $8.23. Overall, FUBO stock is forming a bearish pattern, as it is down nearly 41% in just one month. And year-to-date (YTD) drop is around 31%, according to data sourced from Tradingview.

As shown in the above chart, FUBO stock price is forming a bearish pattern as it jumped off from $1.68 to $1.21 in recent weeks. And noted a nearly 28% decline this week. FUBO stock’s 24 hour volume is nearly 518k.

As of March 17, 2023, the average one-year price target for FuboTV is $3.26. Its forecasts range from a low of $2.30 to a high of $5.00. The average price target represents an increase of 169.42% from its latest reported closing price of $1.21.

FuboTV Inc. currently has a market cap of $253.731 million. The next FuboTV Inc earnings release date is June 30, the estimation is -$0.43. And the estimated earnings for the Q1 ‘23 are -$0.43, while revenue is expected to reach $303.40 million. FUBO earnings for the Q4 ‘22 are -$0.76 whereas the estimation was -$0.71 which accounts for -7.64% surprise.

The total revenue of FUBO for Q4 ‘22 is $319.31 million, and it is 42.04% higher than the previous quarter. The net income of Q4 22 is -$95.81 million. FuboTV revenue for the same period amounts to $319.31 million despite the estimated figure of $285.57 million.

Furthermore, according to Fintel, Vanguard group has filed a 13G/A form with the Securities and Exchange Commision (SEC) disclosing ownership of 21.02 million shares of FuboTV, representing 10.02% of the company.

However, in their previous filing dated February 9, Vanguard group reported 18.53 million shares and 9.49% of FuboTV, an increase in shares of 13.40% and an increase in total ownership of 0.53%.

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational ideas only and do not establish financial, investment, or other advice. Investing in or trading crypto or stock comes with a risk of financial loss.

Steve Anderson is an Australian crypto enthusiast. He is a specialist in management and trading for over 5 years. Steve has worked as a crypto trader, he loves learning about decentralisation, understanding the true potential of the blockchain.

Home

Home News

News