- Crypto derivatives exchange, GMX to deploy protocol on layer 2 blockchain, Base.

- Gets affirmation from the community.

GMX, a decentralized derivatives exchange, was supported by its community concerning deploying protocol on Coinbase’s Base. Brian Armstrong’s crypto exchange Coinbase has recently announced their layer-2 blockchain called Base. This step could be beneficial for the industry.

GMX, Coinbase and Base

Launched in September 2021, GMX is a perpetual contract trading platform for major cryptocurrencies. Unlike other decentralized spot exchanges, GMX allows endless trading. Meaning that instead of buying or selling tokens, the user deposit collateral on which long and short positions can be taken. After trade settlement, profits are paid in USDC for short positions and other tokens for long positions.

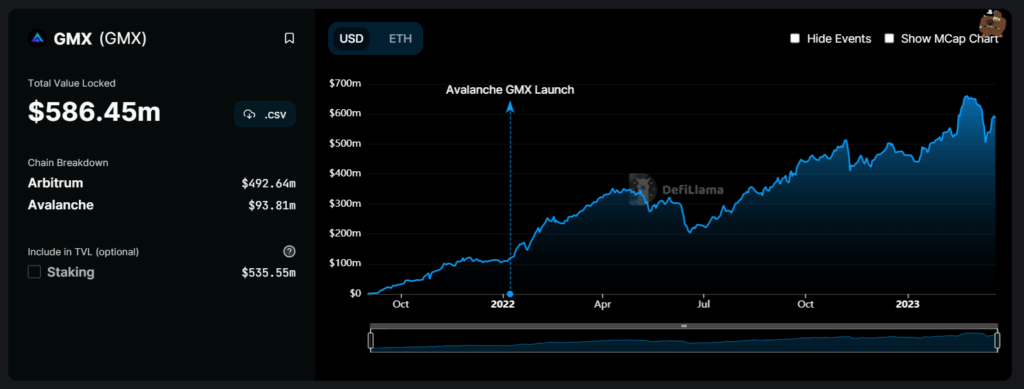

Total Value Locked (TVL) at GMX at press time was $586.45 million, with Arbitrum valued at $492.64 million and Avalanche at $93.81 million. These numbers make it the largest DeFi protocol on Arbitrum.

Coinbase’s Base is a layer 2 blockchain developed using Optimism’s OP stack. That would be fed into the Ethereum mainnet, not featuring a native token. It should be known that there were recent airdrops of Arbitrum tokens.

Should GMX be allowed on Base?

Most GMX forum users are supposed to favor the exchange being deployed on Base, as this would give them the “first mover” advantage. However this premise may sound lucrative, but other forum members have some reservations. Many members are concerned that the pseudonymous founders of the project had to submit their documentation at Coinbase. It must be done per the strict anti-money laundering (AML) regulations.

During a Bloomberg radio interview, Coinbase CEO Brian Armstrong argued that the KYC restrictions should be in place when the blockchain goes live.

COIN & GMX, Where Do They Stand?

This supposed amalgamation has boosted the price of both COIN and GMX; both are trading slightly higher.

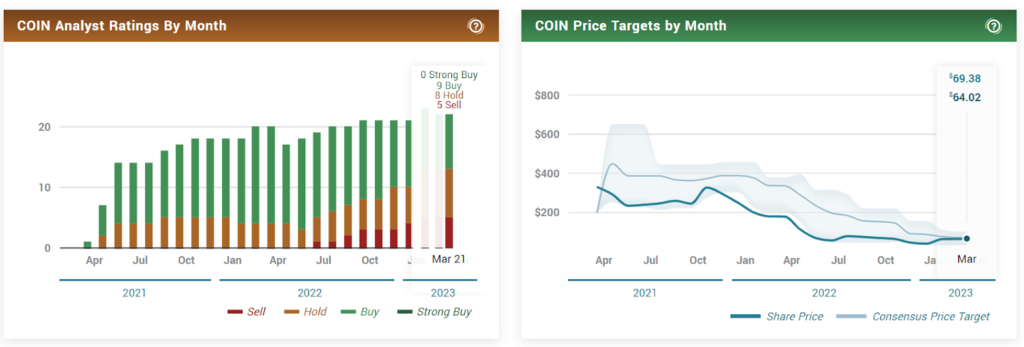

When writing, COIN was trading at $76.39 with a jump of 1.66%; previous close and open were at $75.14 and $76.76, respectively. The fifty-two-week change dropped by 59.62%. Short interest seemed bearish, with 22.65% float sold short. Price is targeted at $69.38 with a downside of 7.7%.

The following details have changed in COIN data concerning December 2022. Revenue dropped 75.78% from $604.95M; operating expenses hiked by 4.35% from $1.08 billion. Net income dropped by 166.29% from negative $557.0 million, and Earnings Per Share (EPS) massively dropped by 197.39% from negative $2.66.

Profit margins suffered by 83.35%, and operating margins were also corrected by 65.21%. Returns on assets and equity dropped by 2.31% and 44.35%, respectively. In comparison, the quarterly revenue growth suffered a loss of 75.80%.

GMX was trading at $84.38 with a gain of 2.47%; its Value against Bitcoin jumped by 2.29% to 0.002996 BTC. Market value hopped by 2.54% to $721 million, and its volume jumped by 10.03%, to $291 million, in the past 24 hours. Ranking at number 67, GMX enjoys a market dominance of 0.06%.

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational purposes only and do not establish financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Steve Anderson is an Australian crypto enthusiast. He is a specialist in management and trading for over 5 years. Steve has worked as a crypto trader, he loves learning about decentralisation, understanding the true potential of the blockchain.

Home

Home News

News