- AMC Entertainment Holdings Inc. is not performing well per rivals.

- A slow economy, Fed’ aggressive stance, and fear of recession is slowing AMC.

AMC Stock is hovering slightly above its yearly low, and its performance as compared to its competitors is not positive. Could it survive? AMC Entertainment Holdings enjoys a 30% global market share with just 5% screens. The uncertain global financial situation, a steep decline in movie-goers due to OTT platforms, and record high fed rates and are major challenges ahead for the stock.

AMC Stock vs. Competitors

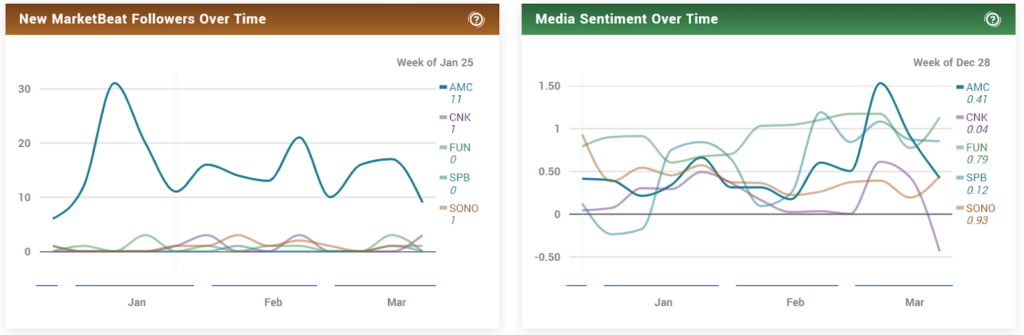

AMC Entertainment Holdings Inc. (NASDAQ: AMC), trading at $4.55, with a rise of 1.79%, is performing subpar compared to its competitors like Cinemark (CNK), which is at $13.42 and is up by 1.4%, Cedar Fair (FUN) at $44.27, gaining 1.2%. Spectrum Brands (SPB) at $58.50, jumping by 1.7%, while Sonos (SONO) gained 0.3% to $19.29.

AMC Entertainment Inc. (AMC Stock) – The Number Game

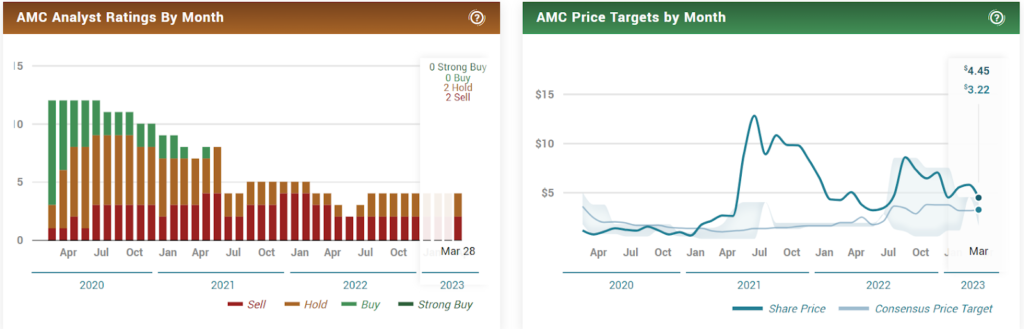

The previous close and open for AMC stock were at $4.47 and $4.51 respectively, and while writing, it gained 1.79% to $4.55. The market cap is $2.336 billion, with a volume of 20.09 million and the average volume of 35.24 million shares. Uncertainty of the market made analysts place the price target at $3.90 with a downside of 29.2%.

Short interest for the AMC stock seems bearish, with 24.61% shares sold short and a 1.20 rating for Reduce. Regarding the data from December 2022, Revenue dropped from $990.90 million by 15.43%, while revenue per share was $3.37, and the quarterly revenue growth suffered a fall of 15.40%. The operating expense was curtailed by 19.72% from $166.90 million.

The net income for AMC registered a drop of 114.06% from negative $287.70 million, while the net profit margin in December 2022 was negative $29.03, dropping by 153.10%. EBITDA was curtailed by 88.63% from $13.60 million, and the Earnings Per Share was negative $ 0.14 and fell by 27.27%.

The last earnings were reported on February 28, 2023, where estimated revenue was $977.645 million, and it was reported to be $1.026 billion, with a surprise of $48.155 million after gaining 4.93%. The next earnings are scheduled on May 8, 2023, with an estimated revenue of $964.78 million.

AMC Entertainment Holdings Inc. (AMC) – Candle Exploration

Since December 2022, AMC stock has oscillated between $9.15 and $3.75; although the movement seems huge, the upper and lower limits remain unchanged. The current price is inches above its fifty-two-week low and is rising. But for clarity, a few supporting candles will be required.

Before touching R1, it must cross the immediate resistance (I_R) present at $5.48; till then, it is expected to consolidate between I_R and the yearly-low. A downward-sloping EMA and indecisive MACD makes it difficult to decipher further movements.

Disclaimer:

The views and opinions stated by the author, or any people named in this article, are for informational purposes only and do not establish financial, investment, or other advice. Investing in or trading crypto or stock comes with a risk of financial loss.

Nancy J. Allen is a crypto enthusiast, with a major in macroeconomics and minor in business statistics. She believes that cryptocurrencies inspire people to be their own banks, and step aside from traditional monetary exchange systems. She is also intrigued by blockchain technology and its functioning. She frequently researches, and posts content on the top altcoins, their theoretical working principles and technical price predictions.

Home

Home News

News