- Riot Platform Inc. sells Bitcoin mining computers and hopes to gain from BTC nearing 30K.

- The crypto industry’s market cap also raised slightly, giving strong signals.

With Bitcoin rising from crypto winter slumber, can the BTC mining company Riot Platform Inc. stock also rise? Currently, BTC is trading at $28,635.16, and the crypto industry’s global market cap is around $1.18 trillion after gaining 2.8% recently. All these create positive sentiments and might fuel the rally.

Riot Platforms Inc. and Bitcoin mining

Riot Platforms Inc. offers special cryptocurrency mining computers and data center hosting services. It was founded in 2000, and is headquartered in Castle Rock, Colorado, US. The BTC mining industry was marred with problems, rising energy costs, increasing difficulty levels, and dropping prices. With BTC rising, one of the problems is solved for now.

When writing, BTC was trading at $28, 635.16 gaining 1.12%, the market cap raised by 1.13% to $553 billion, and its volume suffered by 0.11% to $20.9 billion in the last 24 hours. Ranked number 1, Bitcoin enjoys a market dominance of 46.54%, with an ROI of 21,042.49%.

Riot Platforms Inc. (RIOT) – The Number Game

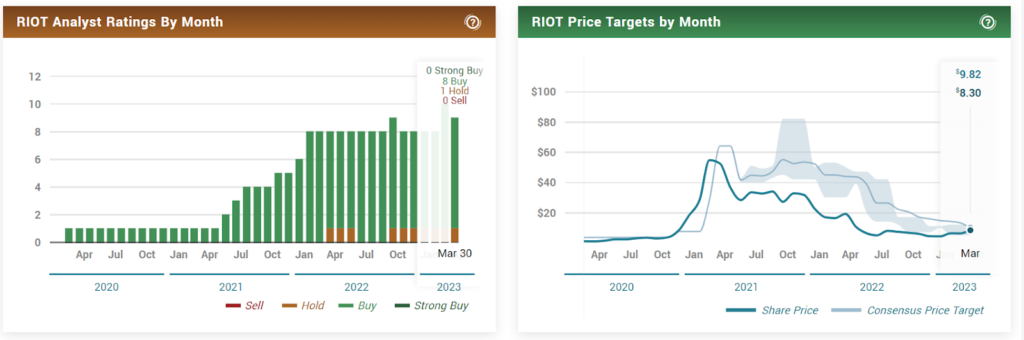

When trading, Riot Platforms Inc. (NASDAQ: RIOT) was changing hands at $9.32 and jumped by 13.81%. Previous close and open were at $8.11 and $8.54, respectively. The 52-week change dropped 56.40%, with an average volume of 17.79 million shares and a market cap of $1.541 billion. The analysts have placed the target at $9.82 with an upside of 6.4%.

With a 2.9 rating for moderate buy and a bearish short interest with 19.69% shares sold short, RIOT seems to be in neutral territory. Concerning data from December 2022, the revenue dropped by 33.82% from $60.15 million, with revenue per share at $1.86. Revenue on assets and equity dropped by 11.32% and 40.77%, respectively. In comparison, the quarterly revenue growth suffered by 33.80%.

Operating expenses gained 28.43% from $91.78 million, while net income dropped by 477.79% from negative $155.78 million. Net profit margin suffered massively after a drop of 773.23% from negative $259.00. EBITDA fell by 285.44% from negative $42.08 million, while the earnings per share (EPS) tumbled by 2,098.82% from negative $0.34.

The last earnings were reported on March 2, 2023, with an estimated revenue of $55.501 million, while the reported revenue was $60.147 million. This came with a surprise of $4.646 million or a gain of 8.37%. The next earnings are scheduled on May 9, 2023, with an estimated revenue of $74,152 million.

Riot Platforms Inc. (RIOT) – The Candle Exploration

Both the crypto industry and RIOT stock prices have been slowly rising since the start of 2023. There is a visible short-term rise in the price, supported by a rising moving average and positive signals from MACD. If all goes as estimated, the price might go cross R1 to reach R2, but before that price, the immediate resistance present at the $10.41 mark must be broken.

If RIOT drops below the immediate support at $7.78, it shall bounce from S1 while consolidating its way to touch R2. S2 acts as a strong solid support. The price might come near it, but breakthrough chances are slim.

Disclaimer:

The views and opinions stated by the author, or any people named in this article, are for informational purposes only and do not establish financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Andrew is a blockchain developer who developed his interest in cryptocurrencies while pursuing his post-graduation major in blockchain development. He is a keen observer of details and shares his passion for writing, along with coding. His backend knowledge about blockchain helps him give a unique perspective to his writing skills, and a reliable craft at explaining the concepts such as blockchain programming, languages and token minting. He also frequently shares technical details and performance indicators of ICOs and IDOs.

Home

Home News

News