- 1 The current banking crisis caused fintech stocks to boom, benefiting SoFi Technologies.

- 2 The company ended last year on a good note; can they repeat the success?

After gaining a customer hike of 51% in Q4 2022, can SoFi Technologies Inc. (NASDAQ: SOFI) fight the current banking scenarios? Ongoing banking crises have moved attention toward fintech stocks. The inclusion of SoFi Checking & Savings accounts with an APY of 3.75%. Their national banking license helps them provide the best rates and loans. These factors should fuel the rally.

Reasons to Invest in SoFi Technologies

In the fourth quarter of 2022, Sofi Technologies added 480,000 new members, totalling nearly 5.2 million, a year-over-year growth rate of 51%. They recently increased FDIC insurance coverage to $2 million. Their customer-centric product portfolio and surging growth trajectory make them a smart choice in fintech.

SoFi Technologies Inc. (SOFI) – The Number Game

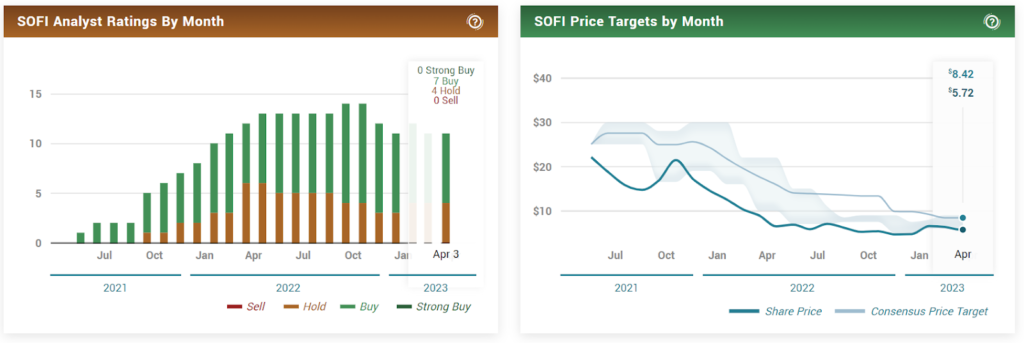

When writing, SOFI stock was changing hands at $6.07 with a hike of 6.12%. Previous close and open were at $5.72 and $5.75, respectively. With an average volume of 38.17 million shares, the market cap for SoFi Technologies is $4.854 billion. Analysts have placed the price target at $8.42, with an upside of 38.7%. With a 2.58 rating for moderate buy and bearish short interest with 10.81% float sold short, the fifty-two-week change dropped by 37.87%.

Concerning data for December 2022, the changes in some quantities were as follows; Revenue hiked by 57.24% from $441.73 million, while revenue per share was $1.69, and the quarterly revenue growth hiked by 57.20%. Operating expenses rose by 25.40% from $400.11 million, and net income hiked by 63.96% from negative $40.1 million. The net profit margin was negative $9.06 and jumped by 77.07%, and the earnings per share gained 65.47% from negative $0.04.

The last earnings were reported on January 30, where revenue was estimated to be $425.624 million and reported to be $4443.418 million, with a surprise of $17.794 million and a jump of 4.18%. The next earnings are scheduled on May 9, with an estimated revenue of $441.156 million.

SoFi Technologies Inc. (SOFI) – The Candle Exploration

A positive crossover at MACD and supposedly upward-moving EMA supports the short-term bullish movement. However, the volume was considerably high post earnings but dropped significantly. After bouncing off of immediate support present at the $5.09 mark, SOFI stock is gaining slightly.

Hereafter, if SoFi Technologies manages to retain the growth pace, the SoFi stock price could increase to the point of immediate resistance at $7.29. It may or may not rebound from there. If it moves ahead, it shall cross R1, but a further movement toward breaking R2 depends on many variables.

If the sentiments reverse and immediate support breaks, SoFi price may not break the Support S1 at the $4.28 mark. As S1 is close to its lows, it acts as strong support.

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational purposes only and do not establish financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Steve Anderson is an Australian crypto enthusiast. He is a specialist in management and trading for over 5 years. Steve has worked as a crypto trader, he loves learning about decentralisation, understanding the true potential of the blockchain.

Home

Home News

News