Collateral Network (COLT) is an up-and-coming player in the world of decentralized finance (DeFi), currently in the presale phase. Along with established DeFi giants like Aave (AAVE) and PancakeSwap (CAKE), Collateral Network (COLT) technology. Let’s review the different protocols and their solutions to the future of lending.

Collateral Network (COLT)

Collateral Network (COLT) is a decentralized finance (DeFi) lending platform that is designed to bring real-world assets onto the blockchain. Collateral Network (COLT) allows users to use their assets as collateral for loans, without the need for traditional financial intermediaries.

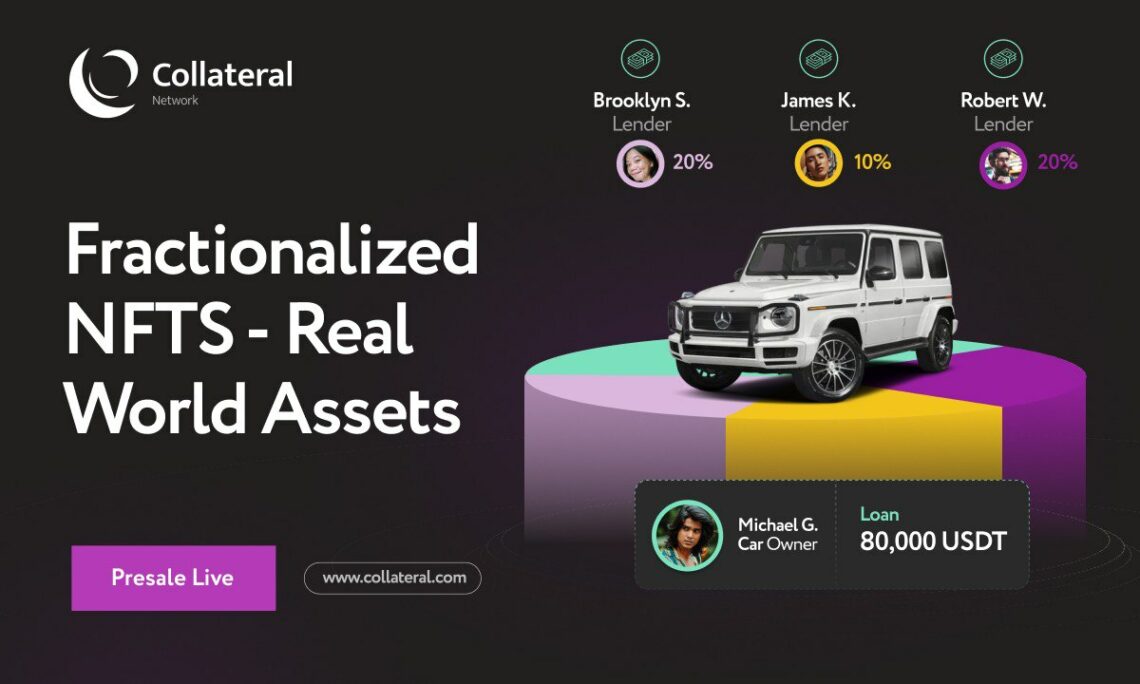

Collateral Network (COLT) does this by tokenizing real-world assets — like artwork, diamonds, and gold — and then listing them on the blockchain. By tokenizing these assets into fractionalized NFTs, Collateral Network (COLT) opens the lending market up to a wider range of borrowers and lenders.

With Collateral Network (COLT), multiple lenders can provide funds for a single loan, spreading the risk and enabling smaller lenders to participate in the market. This benefit passes onto borrowers, who can draw upon increased liquidity on Collateral Network (COLT).

Collateral Network (COLT) has opened its presale, and holders of the COLT token will receive reduced platform fees, be able to partake in governance, and stake for passive income. It’s no wonder why the Collateral Network (COLT) presale is selling out so fast.

Aave (AAVE)

Aave (AAVE) is a DeFi protocol that allows any user to borrow or lend cryptocurrency – all without the need for a middleman. Aave (AAVE) supports a wide range of cryptocurrency assets, including BTC, ETH, DAI, and USDT.

Automated Market Makers (AMMs) are at the core of Aave (AAVE)’s protocol. The Aave (AAVE) AMMs hold a pool of funds that users can borrow or lend against — and pay interest accordingly. This provides liquidity to borrowers and a yield for lenders, as well as decentralizing the lending process free from any central authority.

The governance token Aave (AAVE) allows users to vote on platform parameters, and token holders pay reduced interest rates on loans. Aave (AAVE) also has plans to release GHO, its own decentralized stablecoin, soon.

In terms of price, Aave (AAVE) has experienced a 50% increase since the beginning of January 2023. Currently trading at $70, Aave (AAVE) is anticipated to test the $100 mark by Q3 2023, with a move to $200 by the end of 2023.

PancakeSwap (CAKE)

PancakeSwap (CAKE) is a decentralized exchange (DEX) that is built on top of the Binance Smart Chain (BSC). PancakeSwap (CAKE) allows users to swap tokens and yield farm to earn rewards.

What makes PancakeSwap (CAKE) unique is its liquidity pools, which allow users to provide liquidity for a pool and earn transaction fees in return. These fees are then shared amongst all participants in the pool — allowing everyone to benefit from PancakeSwap (CAKE)’s success.

In terms of price, PancakeSwap (CAKE) has seen incredible growth since its inception, and its token is now one of the most popular in the DeFi space. However, PancakeSwap (CAKE) is down more than 80% from an all-time high, leaving holders worried about the future.

Market analysts expect PancakeSwap (CAKE) to hit $10 by the end of 2023, with a shift towards decentralized finance (DeFi) protocols driving the increase in value. PancakeSwap (CAKE)’s future depends on the wider adoption of DeFi protocols, but it’s looking bright.

Find out more about the Collateral Network presale here:

Website: https://www.collateralnetwork.io/

Presale: https://app.collateralnetwork.io/register

Telegram: https://t.me/collateralnwk

Twitter: https://twitter.com/Collateralnwk

Disclaimer: Any information written in this press release or sponsored post does not constitute investment advice. Thecoinrepublic.com does not, and will not endorse any information on any company or individual on this page. Readers are encouraged to make their own research and make any actions based on their own findings and not from any content written in this press release or sponsored post. Thecoinrepublic.com is and will not be responsible for any damage or loss caused directly or indirectly by the use of any content, product, or service mentioned in this press release or sponsored post.

For publishing articles on our website get in touch with us over email or one of the accounts mentioned below.

Home

Home News

News