Central bank digital currency (CBDC) received popularity and adoption across the countries around the world. Seeking its utilities over traditional fiat currencies, financial authorities in many countries are looking for opportunities to develop such systems to boost the economy. Recently the Central Bank of England reported taking steps towards developing digital currency.

As reported by the Times, the Bank of England (BOE) is hiring people to form a CBDC developers team of up to 30 members.

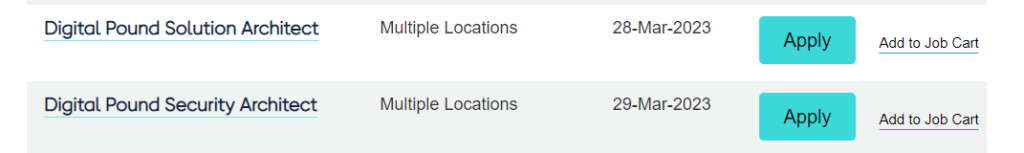

The official website mentions job postings seeking team members to develop Digital Pound CBDC. The two jobs, i.e. “Digital Pound Solution Architect” and Digital Pound Security Architect,” were posted at the end of March 2023.

An adviser to the CryptoUK trade association, Ian Taylor, stated “A team of 30 seems like quite a significant resource to focus on the digital pound. “It shows the impact it would have and that the bank is serious about it.

The Bank of England will issue the Digital Pound, or Digital Sterling, also often dubbed “Britcoin.” This would have the backing of the British Government. It was also reported that BOE and United Kingdom Treasure were looking for the possibility of the CBDC being released by the end of this decade.

CBDC Aces While Crypto Struggles

The UK government is trying to place the country as a “crypto hub.” However, despite the government initiatives to bolster the growth of the burgeoning asset-class industry in the region, the regional banks fail it.

Earlier TheCoinRepublic reported that banking institutions create hindrances for crypto companies to operate. Several crypto executives reportedly raised concerns regarding crypto companies’ challenges because of banks in England. The issues were limiting banking services like transactions, asking for excessive paperwork, straight away rejecting applications and several other bureaucratic hurdles which limit the industry from growth.

The British government is keen to provide crypto firms with a suitable environment, but the banks do not seem to resemble the vision.

On the contrary, the European Union has a relatively softer take towards cryptocurrencies and crypto firms. Though efforts are made towards crypto regulations, Markets in Crypto-Assets (MiCA) like regulations being prominent ones, the overall perception towards crypto is optimistic.

US Federal Reserves Taking Shot on FedNow

Chasing the growing CBDC development worldwide, the United States Federal Reserve is also not far behind and will soon launch its inter-banking payment system, FedNow. The government payment initiative was reported to transfer US dollars funds across banks like financial institutions.

Unlike traditional payment systems, FedNow will operate at ultra-low costs and much faster speed. Peer-to-peer (P2P), business-to-business (B2B) and business-to-consumer (B2C) transactions will have a better alternative to the existing payment system. FedNow is said to launch by July this year.

With a background in journalism, Ritika Sharma has worked with many reputed media firms focusing on general news such as politics and crime. She joined The Coin Republic as a reporter for crypto, and found a great passion for cryptocurrency, Web3, NFTs and other digital assets. She spends a lot of time researching and delving deeper into these concepts around the clock, and is a strong advocate for women in STEM.

Home

Home News

News